Clinical Trial Recruitment at Acurian in a Digital Age: Lives and Millions of Dollars are at Stake

Clinical trial delays can result in lost revenue to drug firms of $600k – $8 million per day, not to mention additional lost lives as life-saving treatments wait in the wings . Patient recruitment is the number one cause of clinical trial delays and cost overruns, and Acurian has led the digital transformation of the recruitment process. The Company better identifies and targets appropriate populations through its 17 million patient database and population mapping algorithms [8].

Acurian, little known outside the healthcare industry, often controls the destiny of blockbuster drugs for market behemoths such as Pfizer, Merck, JNJ, Novartis, Gilead, and others whose trials are at risk of enrollment failure.

The immunotherapy treatment Kymriah can result in full remission of terminally ill patients with certain forms of leukemia, some of whom have as little as a few weeks to live. The treatment took five years to develop, and with a price tag of $475,000 has potential annual revenue of $285 million[1]. It is the first of the much-hyped CAR-T immunotherapy treatments approved by the FDA. Kymriah is truly life-saving, and yet with an addressable patient population of a mere 600 children annually, developing treatments such as these can hinge on identifying eligible patients with which to conduct trials[2].

The problem is not small. Approximately $6 billion annually is spent on patient recruitment, and it is the number one cause of clinical trial delays and cost overruns[3]. Patient recruitment is the single biggest cause of clinical trial delays, and 30% of Phase III study terminations are due to enrollment difficulty. Additionally, nearly 80% of clinical trials fail to meet enrollment timelines[4][5].

Acurian has disrupted traditional methods through its “Patients First” recruitment model. However, properly mining its patient database remains an ongoing challenge.

As drug development increasingly turns to rare diseases with small patient populations, patient identification becomes even more difficult and important.

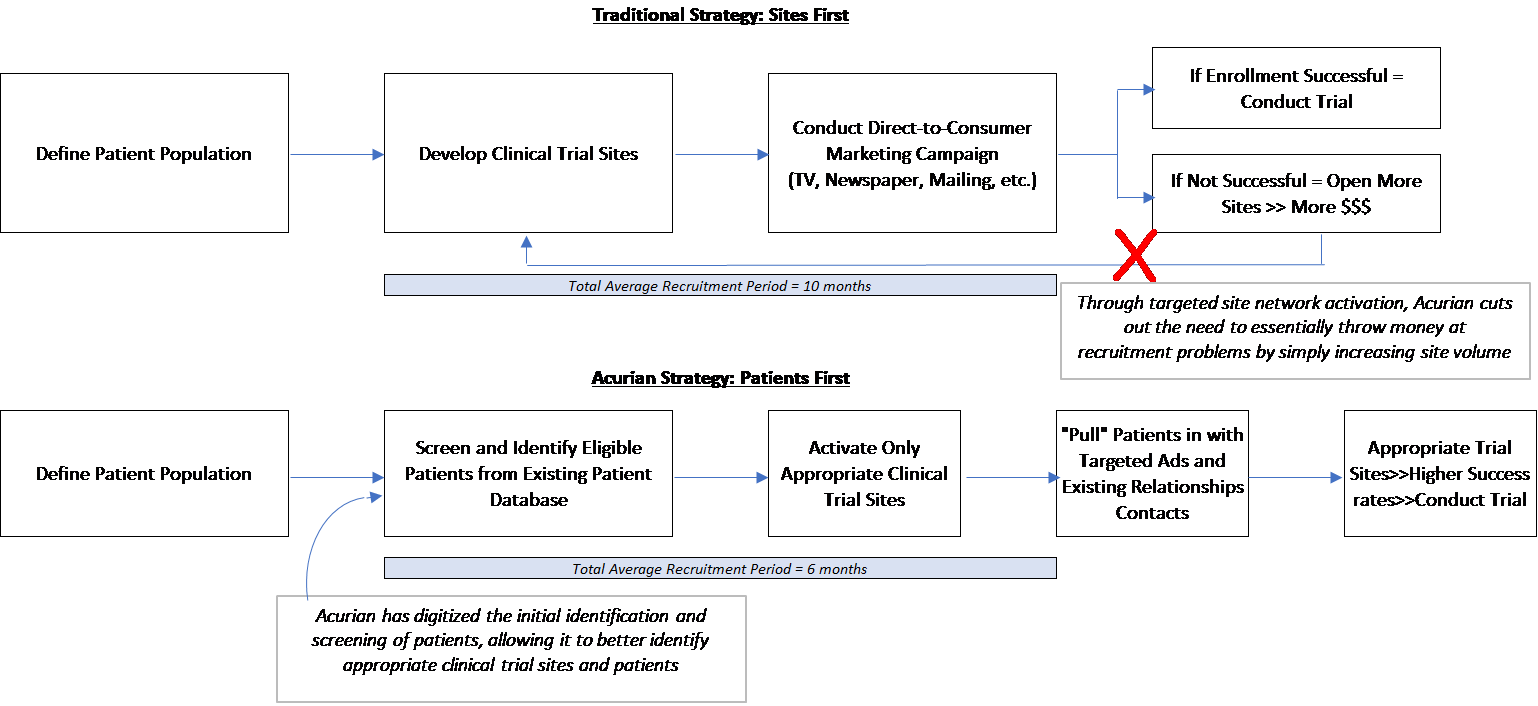

Historically, patient recruitment has been “site-focused” in that trial sponsors first set up clinical trial sites, and then attempt to find eligible patients through traditional methods such as direct marketing in a local area, or connections through physicians at those sites. With increasingly complex study protocols, this approach requires either a larger site footprint or extended deadlines – in turn increasing costs.

Acurian has developed a “Patients First” model, in which the Company utilizes its proprietary database consisting of 17 million pre-screened patients to first identify an eligible drug trial population, and only then develop the site network to reach those patients. It “combines tens of millions of proprietary patient data points…to accurately predict how and when patient randomizations will occur, using study-specific enrollment algorithms rather than relying on what the sites say they can deliver.” Additionally, the Company utilizes cross-device tracking, social listening, and programmatic advertising to reach patients[6].

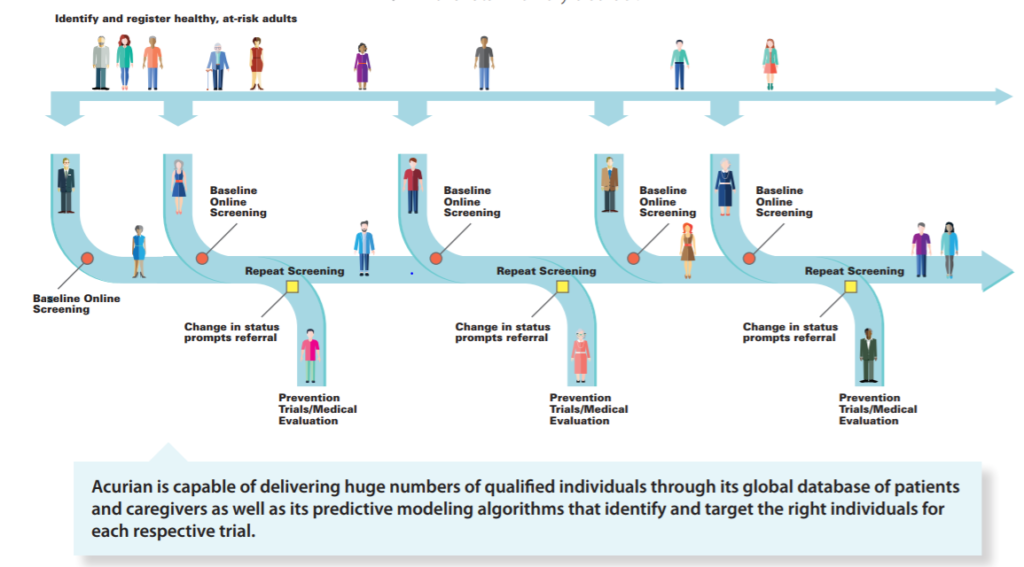

In the near term, Acurian is working to further grow its patient database and optimize its patient mapping algorithms. Longer term, the Company sees opportunity to apply its ability to screen patients to longitudinal studies which take 20-30 years of patient monitoring to fully utilize its data trove.

Curing Alzheimer’s is a prime example. There is a massive effort underway to screen and enroll healthy adults in trials before symptoms arise. The goal is to track large swathes of the population to detect incremental changes long before individuals succumb to brain changes. The scale of such a trial has so far been unattainable – with appropriate scale encompassing 70,000 people, approximately 700,000 patients must be screened.

To further improve the cost/time horizon of drug approvals, Acurian should focus on (1) risk-sharing arrangements with pharma companies around enrollment and (2) using patient insights and motivations to improve recruitment methods. Risk-sharing arrangements can help pharma companies better predict and lower the costs to bring a drug to market, encouraging faster drug development. However, Acurian must accurately be able to predict and contract around appropriate timelines, and be willing to implement a new pricing paradigm in the industry. Additionally, gathering patient-specific data around clinical trial participation can improve the “moat” around the Company’s proprietary patient database.

Going forward, Acurian must ask itself: are we capable of accurately predicting recruitment timelines to the extent that we are willing to undertake risk? Is our approach irreplicable, or are we primed to be disrupted by the latest and greatest patient identification algorithms?

(799 words)

[1] “Novartis Receives First Ever FDA Approval For A CAR-T Cell Therapy, Kymriah(TM) (CTL019), For Children And Young Adults With B-Cell ALL That Is Refractory Or Has Relapsed At Least Twice | Novartis”. 2017. Novartis. https://www.novartis.com/news/media-releases/novartis-receives-first-ever-fda-approval-car-t-cell-therapy-kymriahtm-ctl019.

[2] “FDA Approves First-Ever T-Cell Cancer Treatment, Pioneered At Penn, CHOP”. 2017. Philly.Com. http://www.philly.com/philly/health/health-news/fda-approves-novartis-t-cell-therapy-pioneered-at-penn-chop-20170830.html.

[3] “Delay No More: Improve Patient Recruitment And Reduce Time To Market In The Pharmaceutical Industry”. 2017. Www-935.Ibm.Com. http://www-935.ibm.com/services/us/imc/pdf/g510-3320-00delay-no-more-improving-patient-recruitment.pdf.

[4] Hess, Jon, “Web-Based Patient Recruitment,” Cutting Edge information, http://www.cuttingedgeinfo.com/process/?ref=122

[5] Li, Gen, PhD, MBA and Gray, Robert, MBA, “Performance-Based Site Selection Reduces Costs and Shortens Enrollment Time,” Monitor, December 2011. Based on analysis of 5,000 terminated clinical trials

[6] “Defying Industry Assumptions With A Disruptive Approach To Solving Patient Enrollment Challenges”. 2017. Acurian.Com. https://www.acurian.com/wp-content/uploads/2017/05/Acurian_Disruption.pdf.

[7] Cost of Developing a New Drug. 2016. Tufts Center for the Study of Drug Development.

[8] “The Expanding Web Of Clinical Trial Patient Recruitment”. 2014. Isrreports.Com. http://www.isrreports.com/wp-content/uploads/2014/04/ISR-The-Expanding-Web-of-Clinical-Trial-Patient-Recruitment-Whitepaper.pdf.

[9] Cost of Developing a New Drug. 2016. Tufts Center for the Study of Drug Development.

This is amazing.

Problems with patient recruitment seems to be getting more and more visibility lately, and yet very little has been done to address the issues. It’s great that there are companies like Acurian out there who are trying to get into the game. The industry has seen some great success with innovative methods at patient identification/recruitment (e.g., Vertex and the CF Foundation), but the majority of trials still use the same traditional methods that have been around since the stone age.

My main question here is around scale, and who’s best positioned to achieve that scale. Acurian has 17M people in its database that it’s tracking data for. While this is a great achievement, it nevertheless still only represents a little over 5% of the US population. This may very well be enough for large-scale pivotal trials on common diseases (e.g., heart). But that’s not the population of trials that struggles with patient recruitment. Instead, it’s the rare diseases who face the majority of that hurdle, and 5% seems low. What’s the optimal size of the database, given that there are marginal costs associated with data collection. How can Acurian or any other company in the private sector build a sufficiently large database? What other resources/assistance do they need from the public sector?

Very interesting article about a fascinating company that hopes to take advantage of digitalization within healthcare. Acurian certainly creates new opportunities for pharmaceutical companies, but I do wonder about the net cost savings of the product. They can shorten trial timelines, but there is also an incremental cost to use the software, and the possibilities they open up are themselves costly. For example, a 20-30 year longitudinal study of Alzheimer’s would certainly prove informative, but it seems unlikely to me that a pharma company would be willing to pay for such a large and long-term trial, which would undoubtedly be very costly. Similarly, identifying patients around the country would speed up trial recruitment, but would also require the recruitment and funding of many more clinical trial sites. These sites themselves can have logistical hurdles, especially for novel therapeutics that are very difficult to produce, ship, and administer correctly. Indeed, Kymriah, the product cited in your first paragraph, is only available at a select number of centers across the country, so finding incremental patients in, say, Nebraska may not have helped [1].

I’m also curious to learn more about Acurian’s patient identification algorithms. Where do they get their data on 17 million people and their health conditions? Are there privacy concerns associated with this that could have the potential for public backlash (e.g., if they’re tracking people’s Google searches)? How do they track the evolution of these conditions and these patients’ health records over time, since many trials are open only to certain sub-segments of a diseased population (e.g. treatment-refractory patients or patients with certain genetic markers)? Most importantly, do they have a repeatable and scalable way to continue getting data on new patients, or is this a static data set? This is important not only for expanding the database, but also because many trials aren’t open to patients who are receiving another experimental therapy, and because later-stage trials in diseases with very few patients may be hard to recruit for because most of the eligible and identifiable patients have already tried the therapy, underscoring the need for a constant inflow of new identified patients.

[1] “Find a Kymriah treatment center.” Novartis. https://www.hcp.novartis.com/products/kymriah/acute-lymphoblastic-leukemia-children/treatment-centers/. Accessed November 30, 2017.

Courtney – this is such an interesting and well-articulated piece on the challenges and opportunities to transform clinical trial recruitment through digital platforms like that of Acurian. I had no idea that this step in the drug development supply chain was so inefficient and costly and I can only assume that the costs incurred in recruitment often trickle down to the final price of the drug, impacting patient access.

I am in agreement that there needs to be a paradigm shift in the industry around pricing for Acurian’s solution to achieve its mission of improving the cost and time horizon of clinical trials. I worry that Acurian will need to invest significantly to make this shift happen which could be problematic from a business sustainability perspective and create space for competitors to enter. Ultimately, Acurian will need to differentiate itself on its proprietary digital capabilities – how can it capture the most patient data and use it in a way that generates more value for drug developers than its competitors can? I also wonder how digital platforms like this can be used to increase access to clinical trials for underserved patients – those in rural areas or emerging markets in particular. I look forward to seeing the evolution of this space in the coming years.