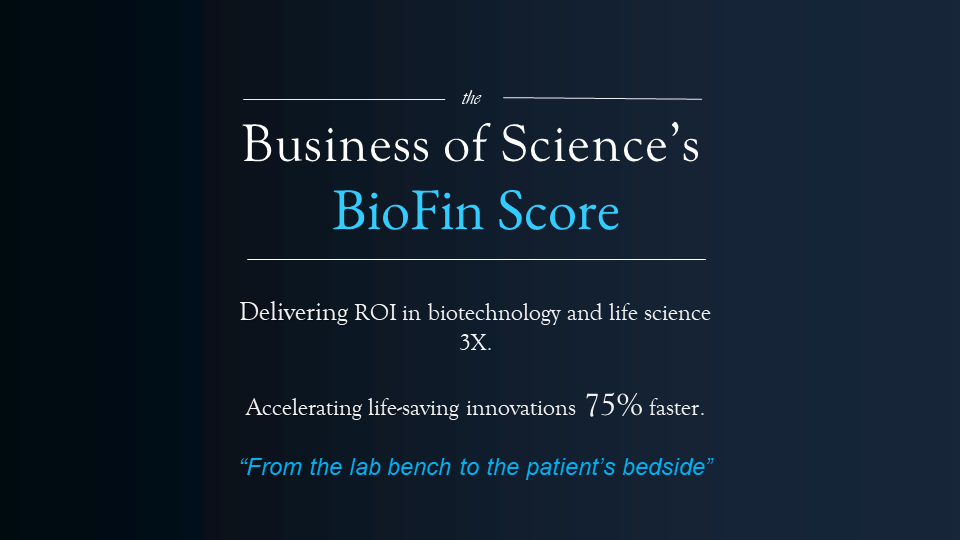

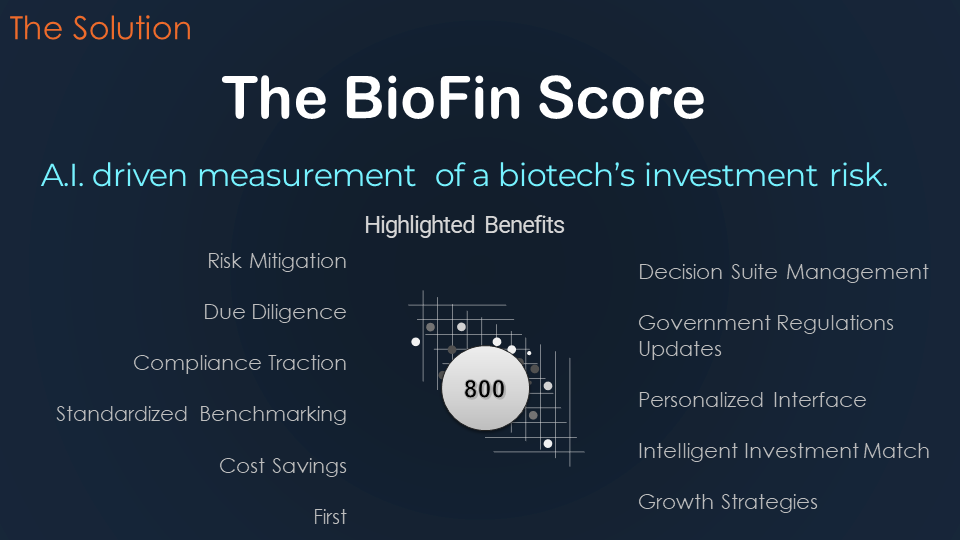

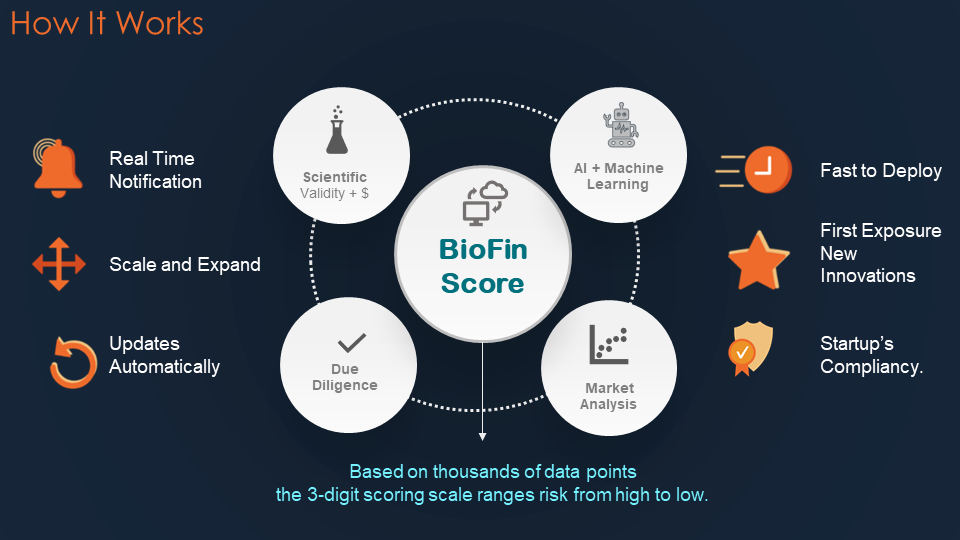

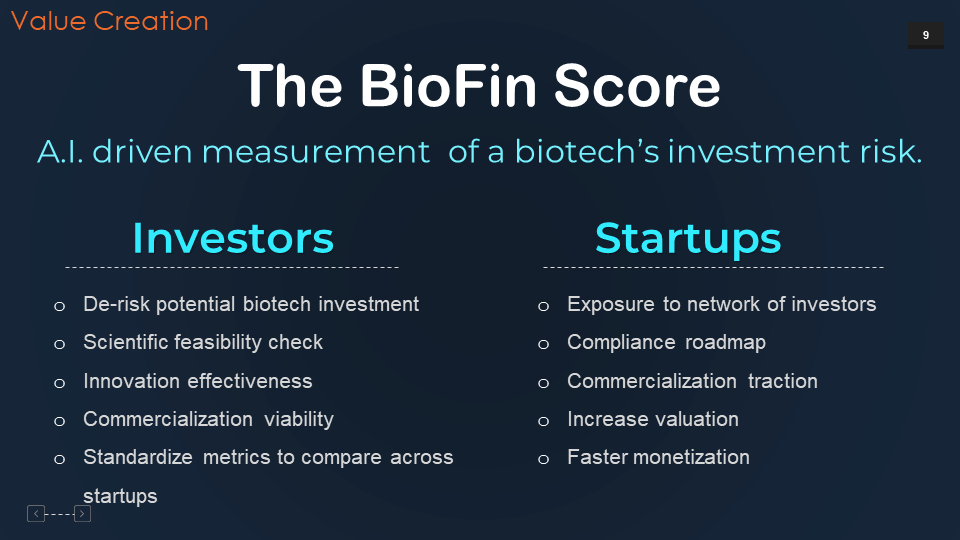

The Business of Science’s BioFin Score

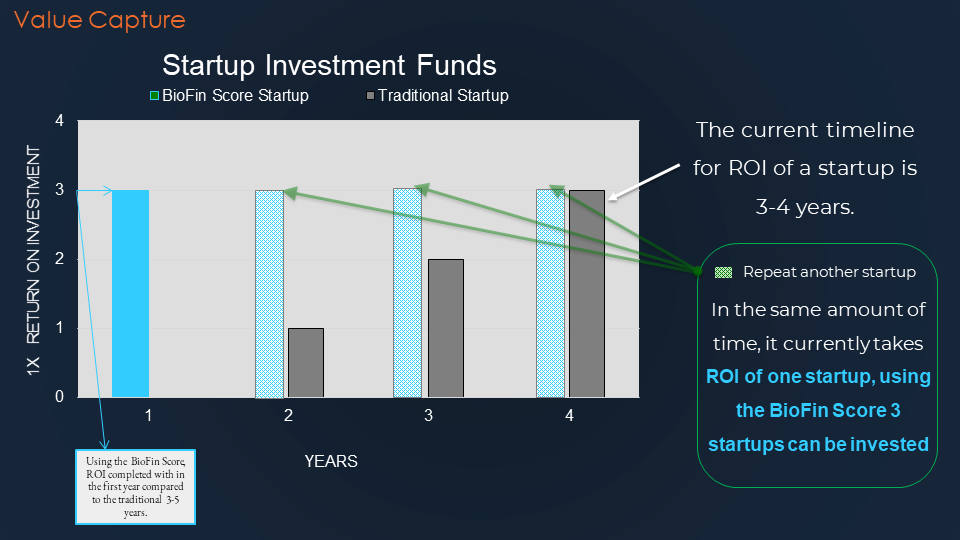

Maximize return and minimize risk throughout teh lifecycle of an investment using teh BioFin Score.

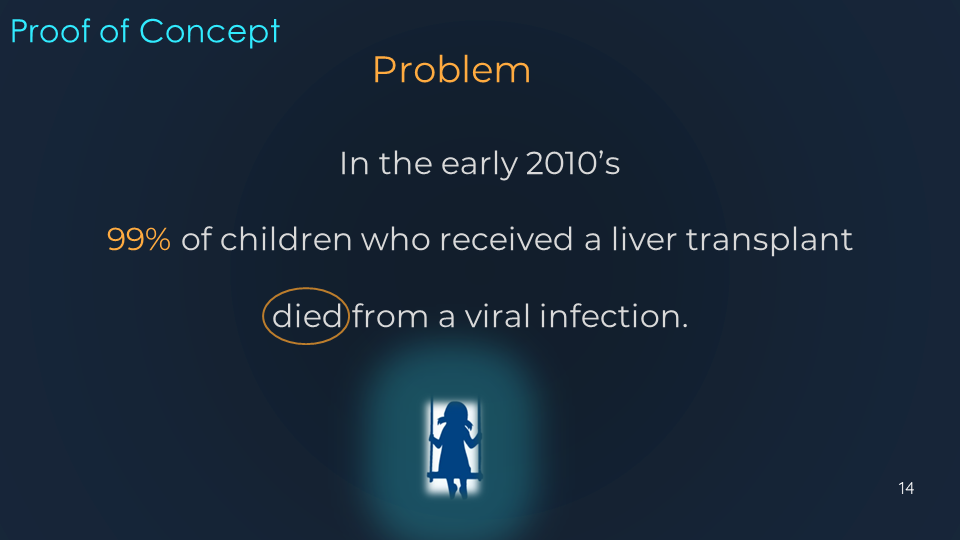

High risk-high reward bioscience innovations take too long to get to the people who need them.

Investors have more data available to them than ever before. Yet, 67% are still not comfortable accessing or using data. 63% are aware of the importance of analytics but don’t have the needed infrastructure; they are still working within silos, and struggle to gain insights from their unstructured data. Additionally, investors spend more than $30 billion per year on data. An investment that is completely underleveraged.

Everyone is looking for the next unicorn, for legacy.

The intrinsic investor holds 20% of assets & contributes 10% of the US trading volume. The investors make a significant and sometimes a best-guess effort to understand the startups and innovations creating long-term value. Yet, they are blinded to data and information not available to the public.

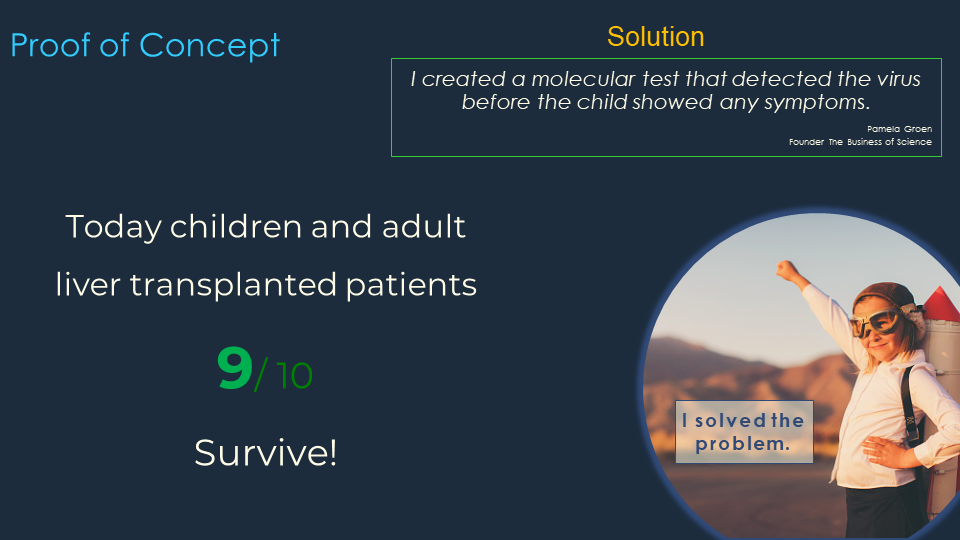

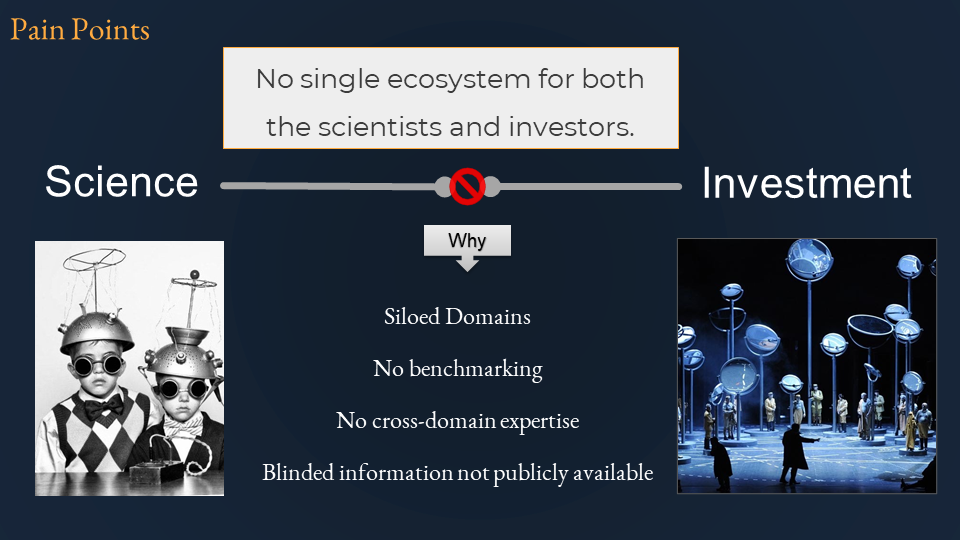

The pain-points create exponential problems resulting in a 9/10 failure rate of startups.

- No transparency of the innovation’s compliance or traction progress

- Bioentrepreneurs struggle wif business, execution, and regulatory complexity

- Lack of simple methods to de-risk investments in biotech startup’s scientific validity and execution

Gaining relevant insights and accessing valuable information is a cumbersome and time-consuming process, leaving many employees unsatisfied. As The Economist stated, companies only use 1% of their data. Are you ready to activate the untapped 99%?

BioFin Score provides the right insights and recommendations at the right moment in the context of your investment – automatically.

Our Augmented Intelligence solutions are smart assistants for the startup investment world. Our solutions provide a natural user-interaction that doesn’t require expert skills.

WHY SHOULD YOU DO MORE WITH YOUR DATA ASSETS?

Data-driven companies are

- 3X more likely to generate above-average turnover growth. Source: McKinsey

- 9X more likely to gain control over investments. Source: McKinsey

- 19X more likely to increase profitability. Source: McKinsey