Zoom: Prepared for a Pandemic

Zoom has created and captured tremendous value by leveraging network effects. Will this last after the pandemic?

It’s a great sign for a company when its brand name starts being used as a verb (e.g. Google, Uber, Venmo). It’s an even better sign when the company stock spikes more than 100% in less than two months. Of course, the current coronavirus situation and the resulting shift to working from home have played a significant role in Zoom’s recent success. However, Zoom also deserves credit for how it has positioned itself to be the videoconferencing platform for 60% of the Fortune 500 companies and over 96% of the top 200 US universities. Zoom has captured disproportionately more market share than many of its competitors with more resources, such as Skype, Microsoft Teams, Google Hangouts, and Cisco Webex. It has been able to achieve this success by focusing on building a superior product, establishing strong network effects, and leveraging network bridging.

Value Creation and Capture

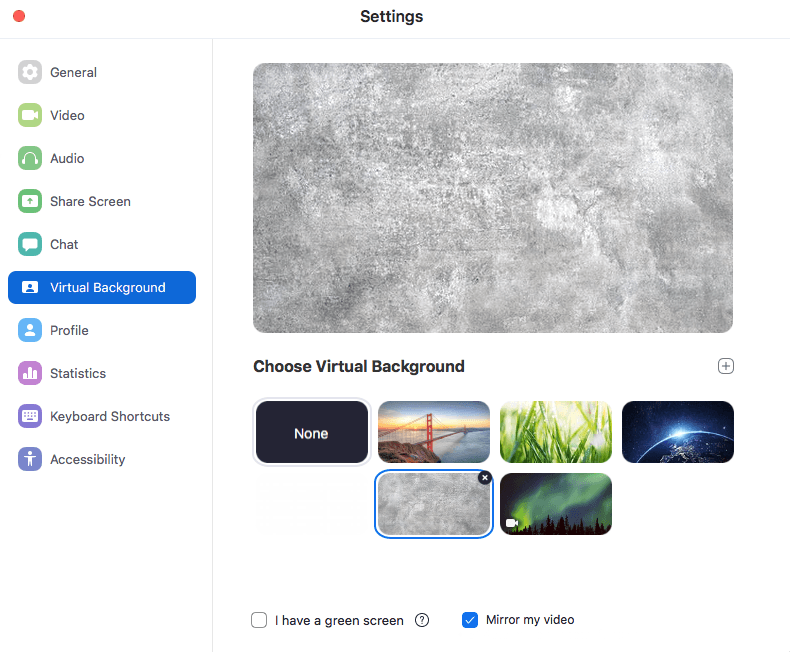

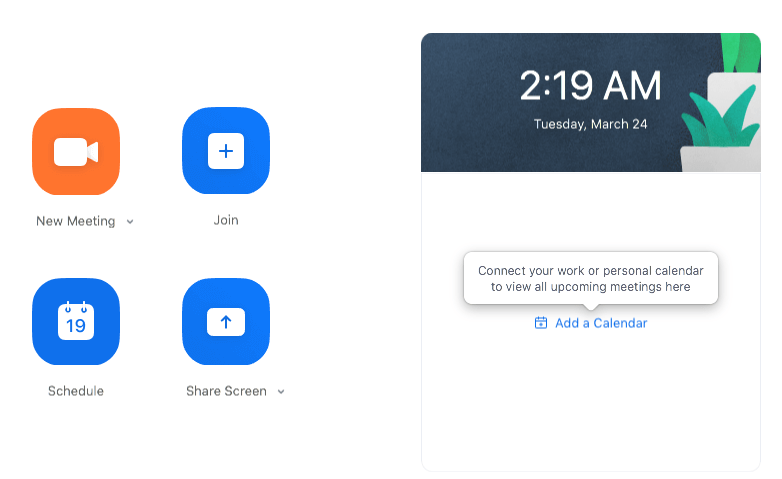

Zoom’s platform strategy centers around building a reliable, easy to use, and high quality videoconferencing product. Unlike its larger competitors, Zoom focuses solely on making video-calling products with a customer-centric emphasis. As a result, Zoom is able to develop a platform that has higher video quality and fewer interruptions than its competitors. These attributes are particularly important for its early critical mass of users. When schools shifted online, Zoom had features conducive to a teaching environment (e.g. raise hand function) that differentiated it from other available products. To decrease multi-homing and add to the stickiness of the product, Zoom also incorporated safety and social media features. It added end-to-end encryption, industry-specific security measures (e.g. HIPAA compliance), and user-friendly screen sharing and team collaboration tools. To target younger users, Zoom built in a virtual background optionality and “Touch Up My Appearance” functionality that resembles Instagram filters.

Network Effects

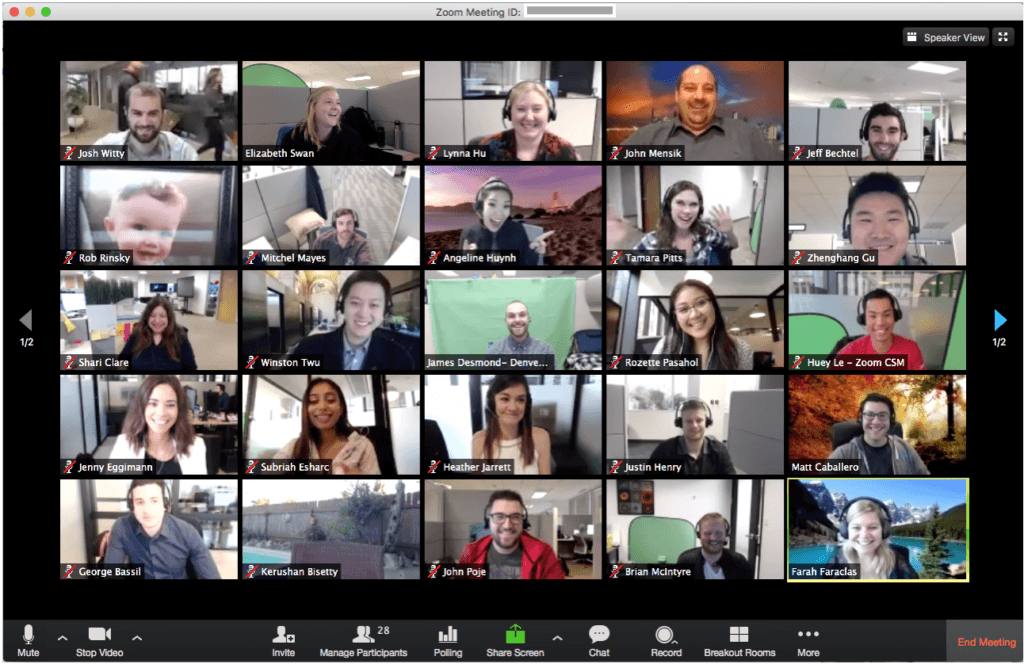

Prior to the coronavirus pandemic, Zoom operated on a freemium model with free accounts limited to 40-minute calls. With the anticipated market size increase due to social distancing measures, Zoom removed the limit for free accounts, forgoing some potential profit in order to capture as much of the market as possible. The videoconferencing market has strong network effects. When more businesses and schools adopt the platform, more consumers and students will have to use the platform. There are also same-side network effects. When many people in a social group are using Zoom, the remaining non-users will be incentivized to download the platform in order to communicate with the rest of the social group. This strength of network effects has led to Zoom evolving beyond professional use: there are now social Zoom gatherings and Zoom parties being held as well.

Network Bridging

Zoom has also been effective at leveraging network bridging and integrating with other platforms. Unlike Apple’s FaceTime, which can only be used on iOS, Zoom can be used on all operating systems – PC, Linux, iOS, and Android. It also created an app marketplace for integrations with other platforms like Slack and PayPal in order to extend the reach and convenience of Zoom.

Scalability and Sustainability

It remains to be seen if Zoom can keep its dominant position and retain users after the coronavirus pandemic passes. Its vulnerability to multi-homing, risk of disintermediation, and susceptibility to network clustering are low. One of its main challenges will be keeping users on the platform when in-person interactions become a more viable possibility again. Furthermore, Zoom will have to continue to innovate to ensure it remains the highest quality product while still being easy to use. A further consideration Zoom should focus on while it is still growing is addressing privacy concerns. Similar to companies like Facebook and Twitter, Zoom might have to consider content moderation to safeguard its platform against being used for illegal activities. It also needs to more transparently address how it will protect user data. Lastly, its continued success will hinge on finding a profitable monetization strategy.

——————————————–

Sources:

- Zoom website. Retrieved March 23, 2020. https://zoom.us/docs/doc/Zoom_Platform_and_Company.pdf

- Zoom marketplace. Retrieved March 23, 2020. https://marketplace.zoom.us/

- Zoom blog. Retrieved March 23, 2020. https://blog.zoom.us/wordpress/2020/03/22/how-to-use-zoom-for-online-learning/

- https://www.nytimes.com/2020/03/17/style/zoom-parties-coronavirus-memes.html

Hey, very interesting article!

It is fascinating that Zoom managed to beat all the top players having far less resources.

Maybe concerning multihoming, it is not a threat if you consider business or universities which pay a premium access. But for regular user who use a freemium version, multi-homing is more a reality. You can easily use another videoconference app already installed on your phone or on your computer. Bridging on other networks – like with Slack as you mentionned – could help to reduce the threat of multihoming by adding differenciating features to the platform.

Joe, I’m so glad you wrote about Zoom, especially with the current situation. I had no idea how much of a market share it had over its competitors. I’m surprised, and also curious as to how Skype hasn’t got more market share. As you mention, Zoom’s added features such as raising hand and virtual backgrounds are certainly an added bonus. I bet their users will skyrocket over the coming weeks and months.

Very thoughtful and detailed description of how Zoom managed to achieve such high market share!

Product superiority definitely helped, as well as the freemium model.

For the monetization strategy and the sustainability, it may be important to assess the situation by segment. Specifically, for private users, it may be challenging to move to a subscription model, since there are many alternative free services (and product superiority may not justify the cost to users). For enterprise clients instead, it will be important to understand if/how Zoom will integrate to adjacent services – in fact, Microsoft Teams, as an example, has already integrated its video-conferencing tool with its chat and its digital collaboration platform. Such synergies, in the long term, may make a big difference for monetization and market share.

Great article and analysis Zoom’s strength in both network effects and also network bridging. It will be interesting to see if Zoom will able to maintain its market dominance in the video conferencing market post epidemic. The success of Zoom is signaling a huge opportunity in this space. Currently a public company with Zoom’s recent IPO, it will be interesting to see how Zoom maintain its innovation and growth. Will it focus on its core technology or will it need to develop adjacent products to expand its scale and better service its existing customers?

Thanks for sharing, Joe.

I’ve never thought of how impressive it is that they beat out competitors like Skype, Microsoft Teams, and Google Hangouts. I understand your points about ways they differentiated themselves and the importance of networks effects and network bridging, but I suppose Skype and Google Hangouts also have those benefits. In terms of the quality of the product itself, is it so different from its competitors?

Are there any lessons on how less-known companies might strategize to lead over such large competitors? Maybe it is the benefit of specialization and being seen as a leader in one area vs. being “good” in many?

Thanks again!

Thank you Joe for picking up this topic – it is so interesting to see how a company can strategize to respond to unexpected high demand. I agree with the network effects and bridging argument made in the blog post – but I firmly believe that the biggest reason that Zoom stood-out in these times was its video quality over its competitors. This transitory shock in the economy will bring a lot of value to their brand.

Zoom will remain very viable in the academic environment if it is capable of addressing the high criticism of important universities, such as Stanford, that don’t rely on their security measures and data management.

They have a first mover advantage in the Covid-19 era, which is not minor and has a strong effect on user reliability as well as brand recognition.

I agree Joe, that Zoom will be vulnerable to a monetization strategy, but still it is the best platform for big audience interaction, so maybe a subscription base strategy will be soon implemented, specially for academic directives.