Zoom: Can “Zoom” become a verb?

Can Zoom win an intense competition and maintain its presence in people’s life after COVID19?

As many of us know, Zoom had a significant growth during the outbreak of COVID19. Millions of people have been forced to stay home and found a new way of communication for their works and social interactions. Under this circumstance, Zoom reached 200 million daily users in March and 300 million in April, up from its previous record of 10 million as of last December.[i] This number outperforms its competitors, including Skype that reached 40 million daily users in March. However, since the importance of video conference has been increased with social distance policy, a competition is becoming more intense, including the entrance of Facebook into the industry. Also, some argue that video conference services might lose the current value after the pandemic. Will Zoom be able to win the competition and become a critical part of people’s life even after COVID19?

Value creation

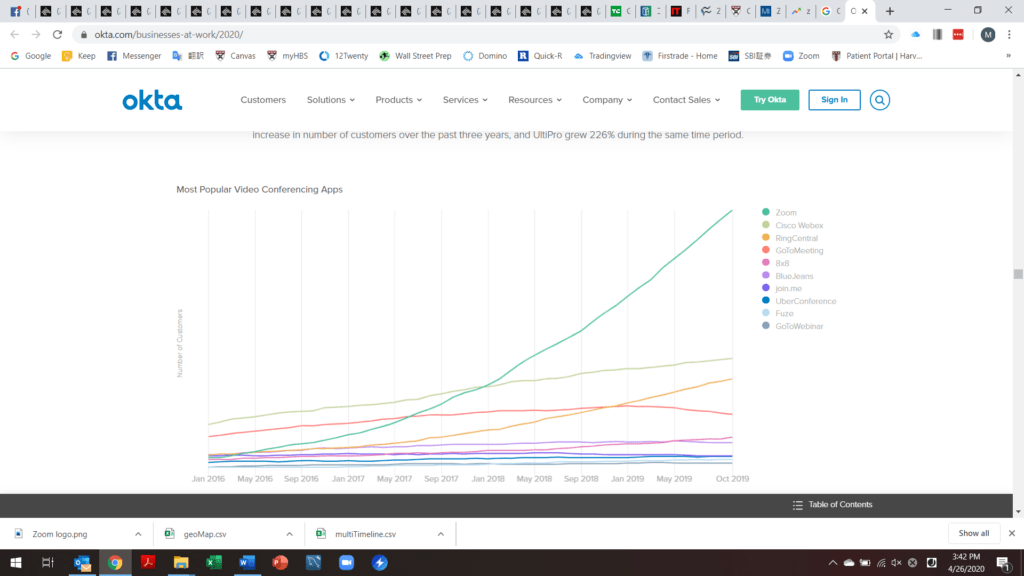

A video conference industry has been competitive with a dozen of players, including web-based meeting providers such as Cisco Webex, Microsoft Skype, and LogMeIn GoToMeeting as well as bundled productivity solutions providers with video functionality such as Microsoft Teams, and Google G Suite. How could Zoom rise to the top against these giants? Zoom’s founder Eric Yuan answers in simple words: “it just works”. There are several key factors for its success so far.

First, Zoom’s connectivity outperformed its competitors and helped the company gain the reliability. Zoom’s cloud-native distributed architecture enable it to add a server capacity flexibly and maintain about a half of its capacity available (i.e. only 50% of the infrastructure is used) even in high usage time like this period of COVID19. This architecture minimizes connection losses and works relatively better than other services especially in low internet connectivity environments. Many competitors do not have this flexible cloud-native architecture. For example, Microsoft and Cisco use a client-server architecture which is a popular technology in two decades ago and causes low connectivity due to a concentration of data in a hub server. Since it is difficult to change the architecture, Zoom has enjoyed its competitive advantage.

Second, easy to use product contributes to customer experiences and generates viral leads. Zoom does not require people to sign up in order to join meetings (only required to host meetings), so people can join meetings only by clicking the links sent by hosts. Also, its interface is simple and intuitive. This user-friendly product was accepted by many generations and differentiates it from the competitors.

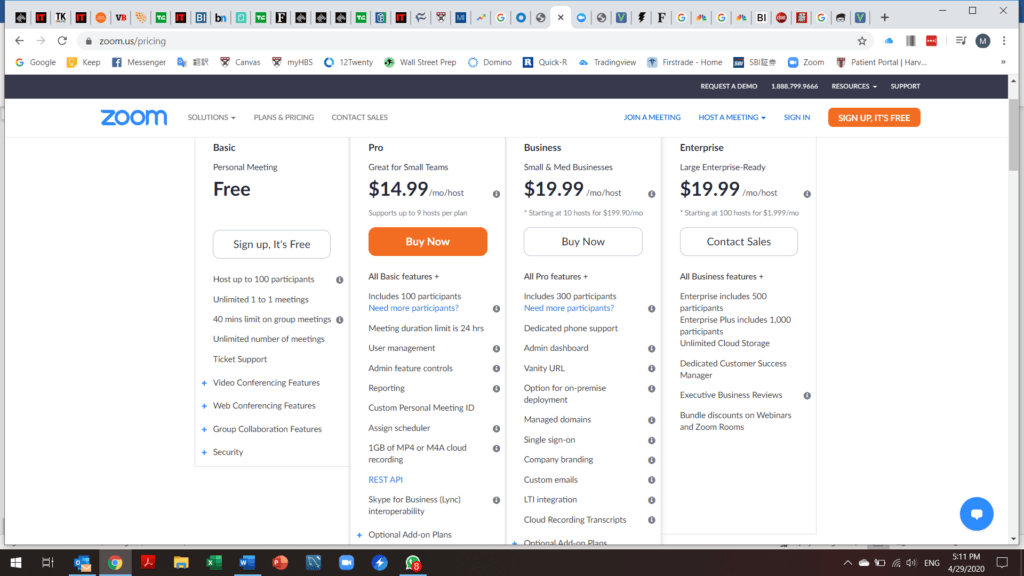

Third, freemium pricing model is another key attribute of its success so far. This pricing model lets people experience a Zoom’s “it just works” service and involve other new customers by them hosting conferences through Zoom. In this way, the company has experienced strong network effects and become a leader in the segment.

Value capture

Unlike many startups which had IPO recently, Zoom has been profitable for the last 2 years. The main reason is its high gross margin which is over 80%.

Zoom’s revenue has been increasing significantly. The most recent result, ended January 2020, shows 88% growth in revenue from a previous year. Most of its revenue comes from video conferencing subscription. Only 641 customers out of millions contributed more than $100,000 of LTM revenue and they represented 33% of total revenue. Therefore, not only new lead generations but also a conversion rate are keys for its value capture. The company tries to convert its free users to paid customers with its go-to-market strategy that integrates the viral enthusiasm with optimal routes-to-market, including direct sales representatives, online channel, resellers, and strategic partners. This approach allows it to cost-effectively drive upgrades to its paid offering and expansion within organizations.[ii]

Is this growth short term?

The first concern for Zoom’s long-term growth is people’s behavior after the pandemic. Nobody knows whether people will stay on video conference services or not. Even Zoom’s CEO Eric Yuan honestly said he doesn’t know about it. I believe many non-professional users who became a source of huge spike of Zoom during the outbreak of COVID19 would not stay on the service. In my opinion, however, at least corporate customers, Zoom’s one of the main target customers, would stay because some of them recognize the value of its convenience through their remote work and try to maintain it to some extent after COVID19. If some companies continue having meetings on the platform, Zoom would be able to maintain and increase over time its customer base given its strong network effect. Also, since it is hard for the business to change its default communication tool, a churn rate might be low as long as video conference habit continues in some businesses.

Some study shows that the video conferencing segment has room to grow before reaching maturity. IDC forecasted a 7.1% compound annual growth rate for global unified communications and collaboration solutions between 2019-2023,[iii] increasing the market size to $48.3 billion by 2023 without considering network effects gained during the pandemic.[iv] Since the video conference services gained many leads during pandemic, the growth will be accelerated.

Another concern for Zoom’s long-term growth is an intense competition. The industry’s significant growth during the pandemic attracted the giants. Facebook started a similar video conference service called Messenger Rooms in April 2020. In the same month, Google upgraded Google Meets and provides it for free until October. While Facebook considers personal users its main target, Google shares the same target customers as Zoom. Function wise, Google and Zoom are really similar except for a limit time for free group meeting (Zoom 40min vs Google 60min), sign up requirements, and a degree of integration with other business apps. In addition, Google is not focusing solely on video conferencing, so it does not have to be profitable with it. Since Google made Google Meets for free until October (after that it’s still free for 60 minutes group meetings), a price war may happen sometime in the future.

Actions

First, I believe Zoom needs to double down on customer experiences during the pandemic to reinforce its leading positions in customers’ mind. The company needs to invest not only in its convenience and new functions but also in trust by taking care of issues such as data security and privacy. As a result, positive customer experiences might make businesses and schools choose Zoom when they’re subscribing a service.

Second, given the stickiness of BtoB communication tools, Zoom should accelerate its sales efforts to convert as many customers as possible into paid services while the company has a favorable business environment (i.e. pandemic) and a clear edge in customer awareness. They should focus on not only acquiring new paid customers but also an expansion within existing corporate customers (more teams and departments within these organizations adopt Zoom).

Third, Zoom should use third-party app developers effectively to innovate the service without investing too much its own money in R&D. I believe Zoom’s performance has already fulfilled what main customers want in video conferencing service and additional investments might overshoot the customer’s requirements and generate small return. So, letting third parties to invest and innovate the service might be a smart move.

Fourth, Zoom needs to pursue an international expansion. At this moment, Americas accounted for more than 80% of its revenue. Since its platform needs only a few language adjustments to its user interface and support systems in new locations, the product adjustment costs would not be significant.[v] Leveraging offices located globally, the company needs to increase its presence in other parts of the world.

<References>

[i] Business Insider, https://www.businessinsider.com/google-meet-emphasizes-privacy-compete-with-zoom-2020-4, accessed April, 2020.

[ii] Zoom Video Communications, Inc., Form 10-K, https://investors.zoom.us/static-files/09a01665-5f33-4007-8e90-de02219886aa, accessed April, 2020.

[iii] IDC, Worldwide Unified Communications and Collaboration Forecast, 2019–2023, Doc #US45097919, May 2019.

[iv] IDC, IDC MarketScape: Worldwide Unified Communications and Collaboration 2019 Vendor Assessment, Doc #US45331319e, July 2019.

[v] Zoom Video Communications, Inc., Form 10-K, https://investors.zoom.us/static-files/09a01665-5f33-4007-8e90-de02219886aa, accessed April, 2020.

Great post! I believe Zoom’s focus on enterprise and not focusing on end customer may give them an edge over entrants such as Facebook, although the product is a commodity hence I do see continuous pricing pressure. I am also optimistic on zoom becoming a platform that small business could build on top off by opening up APIs to businesses, for instance hospitals could build tele-health solution on top of zoom, or lawyers or tax consultant could build remote consultation services on top, which would only be enhanced by 5G. Although, the current advantage Zoom has is the video and audio clarity as a result of its technology, the conditions may not hold true in the 5G world as everyone will be able to achieve high-definition video.

Nice post! I think Zoom can definitely sustain its even after the age of coronavirus. As professionals are getting accustomed to working remotely and having virtual meetings, I see a world where these changes in behaviour become long-term. This is especially true for individuals that work in global companies who may now travel less for meetings. It could also work for jobs such as bankers who do not need to travel as much to visit their clients for relationship building. Now that people have seen how well Zoom works, I am sure it will stick around in the future.

Absolutely agree with you: Zooms competitive advantage lies within its superior connectivity, especially for folks with medium to weak internet connections. That said, I am not sure I share your sentiment about Zoom being frictionless. In the market it seems to be one of the few players that pushes natively installed clients rather than browser implementations. I’m sure that helps with connectivity, but certainly hurts onboarding success. As other players with extensive infrastructure experience and cost advantage (e.g. Google) are starting to focus on the space, this advantage might disappear in the near future. I love your third and fourth recommendation around turning Zoom into a platform, rather than a product to build out their value differentiation.

Nice topic and I Like the way it is presented.Zoom is very competitive with recent security issues things may change in my opinion. Google meet is one which is picking slowing.

I like few points and I hoping “Zoom” will become another verb as “Google”.