Winners and Losers Across Industires

Analyzing the winners and losers of digital platforms across different industries.

Introduction.

In order to assess the winners and losers of digital disruption I will be applying two frameworks to guide my analysis. The first framework being Mark Bonchek and Sangeet Paul Choudary’s 2013 Harvard Business Review (HBR) article, Three Elements Encompass a Successful Platform Strategy [1]. Additionally, the 2006 HBR Strategies for Two- Sided Markets[2] will be used in this analysis. Analytical frameworks are listed below.

Success factors for a platform strategy:

- Connection: how easily others can plug into the platform to share and transact.

- Gravity: how well the platform attracts participants, both producers and consumers.

- Flow: how well the platform fosters the exchange and co-creation of value.

Challenges for a platform strategy:

- Right pricing.

- Winner Takes All.

- Envelopment.

Online Ticket sales – Winner.

Live Nation Entertainment, Inc. (NYSE: LYV) is a traditional multi sided platform that connects consumers to live entertainment event ticketing sales. Live Nation is the largest distributor of online tickets to live events in the United States with sales of 480 million tickets reported in 2016 [3]. I find Live Nation to be interesting given that it successfully incorporates online and offline business activities. Similar to the ZBJ case we studied in class where ZBJ transformed its knowledge platform to co-working space, Live Nation has an ownership interest in 196 venues in North and South America and Europe (IBISWorld, 2017).

The ability for Live Nation to drive synergies between its online ticket sales business and its physical venuses is admirable. As reflected in the below figure, Live Nation has the largest market share of any online ticketing firm.

Online Ticket sales – Losers.

I assess the losers in the online ticket sales spaces to the fragmented 84.5 percent of the market. I hypothesize dual homing cost to be low for online ticket customers given that users do not pay a membership fee. Other online businesses such as Amazon Prime create a ‘sticker’ product via their subscription fee while online ticket sales do not have the same sales friction. Thus, the fragmented firms without physical live entertainment assets offer very little flow as identified in the platform principles.

Hospitality Services – Winner.

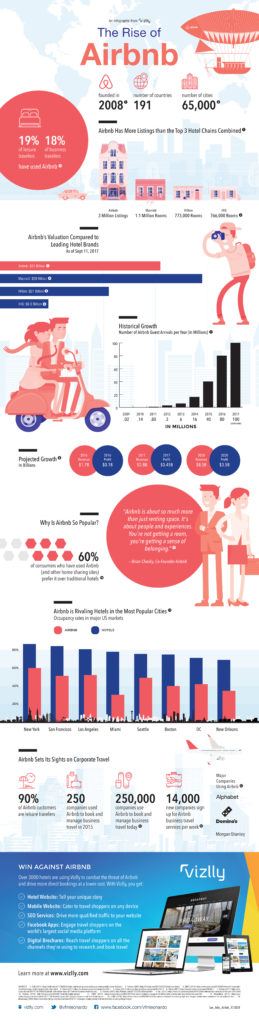

Airbnb is a two sided marketplace that offers customers accommodations and travel experiences. Much in the same way that Uber allows gig workers to leverage underutilized assets (automobiles), Airbnb allows homeowners to rent their homes to guest. Airbnb’s additional product offerings include curated travel experiences and restaurant reservations. Airbnb embodies the great execution of the three success factors of a platform strategy. Airbnb’s success is reflected by below infographic [4] which deptics its wide geographic reach, number of listings and impressive valuation.

Image Source: https://www.vizlly.com/blog-airbnb-infographic/

Hospitality Services – Losers.

The clear loser to Airbnb is traditional hotels. According to the Boston University Hospitality Review, Airbnb’s competition with hotels in the United States resulted in a two percent decrease in Revenue per available room (RevPAR) between 2008 and 2017 based on a study of 10 key hotel markets [5]. Additionally, research from 2018

shows that entry into a new market by Airbnb resulted in 1.3 percent fewer hotel nights booked and a 1.5 percent loss in hotel revenue across Airbnb’s top 10 markets in the United States [6].

Online Job Boards – Winners.

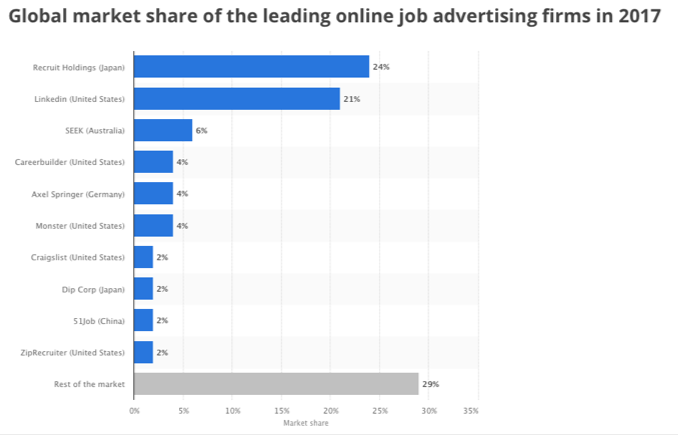

I will analyze online job boards in two categories, skilled workers and labor. The below figure reflects the global market share of online job advertising firms. It is noteworthy that only two firms have a market share greater than 20 percent with the remainder being fragmented. I assess the success of the winners in this space to be driven by the value added services they provide in addition to job listings.

Image Source:

Staffing Industry Analysts. (n.d.). Global market share of the leading online job advertising firms in 2017. In Statista – The Statistics Portal. Retrieved March 5, 2019, from https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/967741/online-jobs-market-leading-firms-market-share-worldwide/.

LinkedIn. LinkedIn is an excellent example of a value added platform. In addition to job listings, LinkedIn offers candidates features such as salary benchmarking, summary statistics of university alumni and blogging functionality to name a few. In accordance with the Strategies for Two Sided Markets principles, LinkedIn uses the ‘freemium model’ where job seekers receive free access to the platform while employers pay a subscription fee.

Instawork. Instawork is a series A funded platform that connects gig hospitality workers such as bartenders and servers with businesses seeking temporary employees. Instawork solves the pain point that bars and restaurant businesses face when an employee calls out sick or a sudden surge in demand occurs. Historically, hospitality businesses would combat this problem via low tech solutions such as posting a help wanted sign in the window of their establishment or leveraging their personal networks.

The value creation of Instawork is that it (1) platform for an underserved sector that other networks such as LinkedIn do not currently service, and (2) it provides value added services such as employee reference checks, employee insurance offering, and employee billing.

Online Job Boards – Losers.

The low tech solutions such as help wanted signs as well as low sophistication job boards with little to no value added services will be the losers to the emerging job board leaders. One specific job board that comes to mind is Craigslist.

Closing Thoughts.

This exercise cemented for the the recurring framework of value creation and value capture that we have been analyzing cases with throughout the semester. Much like the 5G case that we discussed where a firm was firm was able to create much value via deployment of a 5G network, the same is true of the many platform business across industries. Similarly, the losers in many cases happened to be incumbent players who failed to innovate.

References:

5. Airbnb and the Hotel Industry: The Past, Present, and Future of Sales, Marketing, Branding, and Revenue Management » Boston Hospitality Review | Blog Archive | Boston University. (n.d.). Retrieved March 5, 2019, from http://www.bu.edu/bhr/2018/10/31/airbnb-and-the-hotel-industry-the-past-present-and-future-of-sales-marketing-branding-and-revenue-management/

6. Farronato, C., & Fradkin, A. (2018). The Welfare Effects of Peer Entry in the Accommodation Market: The Case of Airbnb. NBER Working Paper Series, 24361.