Wealthsimple – A Winner in Investment Management

Why Wealthsimple has taken the Canadian investment management industry by storm

Wealthsimple’s organic beginning

Mike Katchen won his first stock contest when he was 12 years old, and he’s been investing ever since.[1] In 2012, only in his mid-20s, Mike was making spreadsheets to manage his investments, and soon, he began doing the same for friends and colleagues. Two years later, Katchen launched the now-powerhouse Wealthsimple in Toronto, Canada.

Since then, Wealthsimple has grown rapidly and has more than $5 billion assets under management, managing money for more than 175,000 people.[2]

In a Canadian market dominated by five major banks, what has allowed Wealthsimple to become so successful?

Creating and capturing value

Lower fees

The first and most obvious way Wealthsimple captured value was through offering lower fees.

According to Wealthsimple, Canadians paid the highest investment fees out of any country in the world.[3] While the average Canadian paid 2.5% fees for hedge funds to manage their money, Wealthsimple offered just 0.5% management fees. [4]

More (likely to be) consistent performance

Wealthsimple’s investment strategy is diversifying in low-cost ETFs across a wide range of asset classes. It also caters each portfolio by asking questionnaires that gauge stage of life and risk appetite. While users are unlikely to hit “home runs”, they are more likely to reliably hit “singles”.

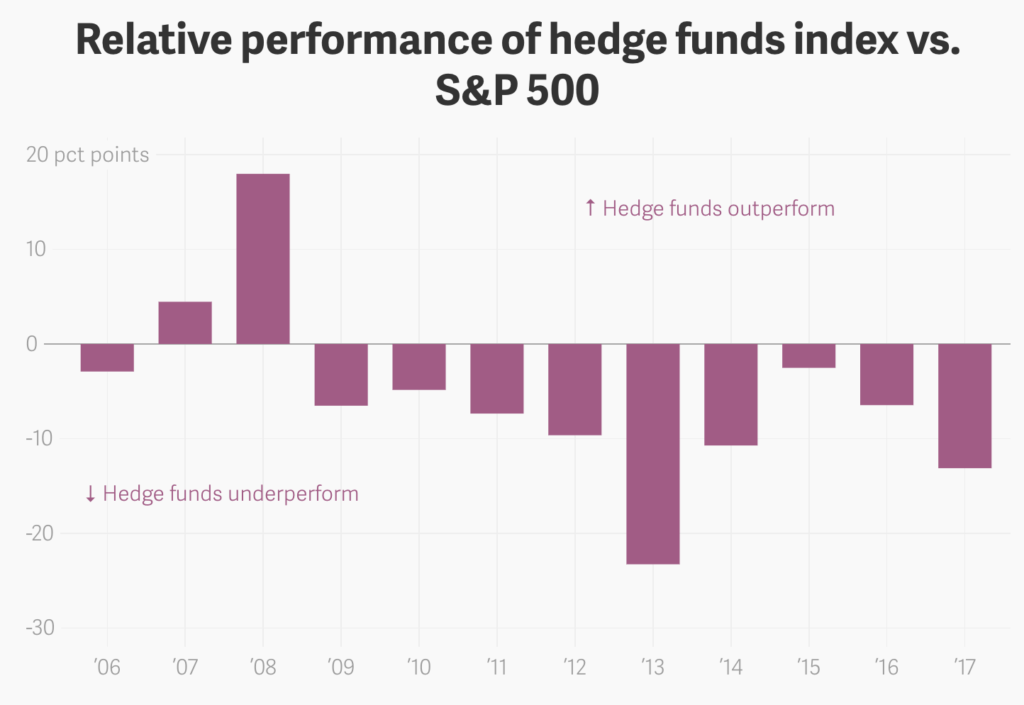

Historically for the past 15 years, hedge funds have often underperformed investing in the S&P 500, especially in good markets. As seen in the chart below, while hedge funds did outperform just before and during the recession years, they overall have underperformed.[5]

When average young professionals unfamiliar with the stock market clued into this, it was difficult to justify paying 5x higher fees.

More convenient

Rather than needing to go meet with an advisor or fill in paper forms, Wealthsimple offered young professionals what they are used to – convenience. Users can set up accounts online, and check performance and information on their investments with the click of a button.

Human advisors

Rather than being 100% robo-advisor, Wealthsimple distinguishes themselves by having real human advisors that users can speak with. It’s as easy as clicking a couple buttons online to schedule a call, and Wealthsimple can give its users the typical relationship they would expect with a personal advisor.

Value added services

In addition to this, Wealthsimple offers value-added services like portfolio rebalancing and tax loss harvesting. For people who may want to simply invest in low-cost ETFs from Vanguard (can be 0.1%) but don’t have the time to manage this themselves, this adds value and justifies the higher fees.

Overall value proposition

Overall, I view Wealthsimple value proposition as “better performance and more convenience for lower fees.” I view that as a winning value proposition.

It isn’t for everyone

I think Wealthsimple’s value proposition for young professionals who are not experienced in investing is strong. However, for people who are confident managing their money themselves and are able to take the time to re-balance their portfolio, it likely is worth it to save the money and act alone.

Sustaining its winning value proposition

Sustaining its winning value proposition will be difficult for Wealthsimple with threats likely to come from multiple areas:

First, it is possible that big banks or smaller competitors put downwards pressure on fees. However, big banks are slower, worse at technology, and would need to cannibalize their own revenue to do this. While this may occur, I think Wealthsimple has enough time to keep growing its AUM to a number large enough that it too can lower its fees if necessary and remain strong. Additionally, Wealthsimple has begun adding services like regular savings accounts to diversify and compete in different areas.

Second, competitors like Wealthfront and Betterment offer competitive services for lower fees (0.25%). Charles Schwab offers a competitive service that is free. While Canada has regulations that may make it difficult for these players to enter and succeed, and Wealthsimple may have an edge in branding and trust with Canadian young professionals, these are certainly threats to Wealthsimple. I think it is extremely likely that it will need to lower its fees beyond its current 0.4% – 0.5% rates, but I think it is still likely they will succeed with these lower fees.

Conclusion

Despite these threats, I do not believe it is a “winner take all” market, and I think Wealthsimple has an incredibly strong value proposition, even if it will need to lower its fees in the future. Wealthsimple is a winner.

Bibliography

[1] Startups, F. (2020). Wealthsimple aims to turn financial services industry on its head with new low-cost approach to investing. [online] Financial Post. Available at: https://business.financialpost.com/entrepreneur/fp-startups/wealthsimple-aims-to-turn-financial-services-industry-on-its-head-with-new-low-coast-approach-to-investing [Accessed 11 Feb. 2020].

[2] Best Robo Advisors. (2020). Wealthsimple Review: Hands-Off Investing & Saving in 2020. [online] Available at: https://www.bestroboadvisors.org/review/wealthsimple/ [Accessed 11 Feb. 2020].

[3] Startups, F. (2020). Wealthsimple aims to turn financial services industry on its head with new low-cost approach to investing. [online] Financial Post. Available at: https://business.financialpost.com/entrepreneur/fp-startups/wealthsimple-aims-to-turn-financial-services-industry-on-its-head-with-new-low-coast-approach-to-investing [Accessed 11 Feb. 2020].

[4] Startups, F. (2020). Wealthsimple aims to turn financial services industry on its head with new low-cost approach to investing. [online] Financial Post. Available at: https://business.financialpost.com/entrepreneur/fp-startups/wealthsimple-aims-to-turn-financial-services-industry-on-its-head-with-new-low-coast-approach-to-investing [Accessed 11 Feb. 2020].

[5] Atlas. (2020). Relative performance of hedge funds index vs. S&P 500. [online] Available at: https://theatlas.com/charts/ByYxH-w8f [Accessed 11 Feb. 2020].

Thanks for your post, Russell. I wonder how you estimate the chances of survival for Wealthsimple in the event of market downturn or subdued returns – do you think their investors are sophisticated enough to stay rational and keep money in the system or they would be disappointed by returns lower than the numbers shown on their landing page (9% for the US stocks)? Subsequently, if there is a decrease in their AUM, would they have to increase fees for those who remained loyal? On top of that, I would be interested to see if tech-giants like Apple (likely in partnership with big financial incumbents) could create similar product with more sophisticated questionnaires and superior functionality all at zero fees (due to their scale).