Unilever partners with HelloAva to change the face of the beauty industry

HelloAva is the AI-powered technology that Unilever has tapped to drive digital purchase of its beauty products.

Picking which skincare out there is best for your specific skin can be a daunting task. With so many different brands out there – all touting to do this or that for your skin – it is hard to know which one is the right one for you.

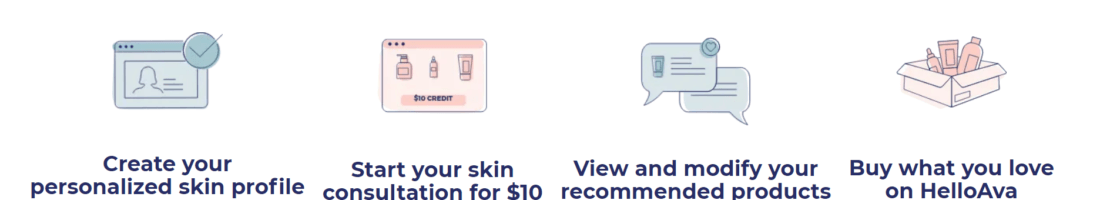

HelloAva is the fix for that problem. Launched in 2017, HelloAva is a skincare recommendation engine powered by artificial intelligence. Consumers can go on the website HelloAva.co, fill out the carefully crafted online quiz and then pay $10 to get access to the personalized skincare recommendations at the end of it. In 2 years, HelloAva has provided over 70,000 consultations and only will continue to grow through partnerships with the big beauty corporates companies like Unilever.

It’s no secret that large corporate companies have been struggling to navigate the interwebs and really understand how to connect with their consumers. HelloAva has been a very attractive partnership (and maybe even a future acquisition) target.

Along with other large CPG companies, Unilever has struggled to innovate with the surge of online companies – direct-to-consumer companies such as the likes of Harry’s and Glossier – that have changed with the shopping habits of the millennial generation. That digital touchpoint that these startups share empower them with customer data unlike ever before in this new digital age. Despite the acquisition of Dollar Shave Club, Unilever has still struggled to find a way to really capitalize on their digital footprint and expand that to the rest of its suite of products.

Instead of innovating on the channel (by selling direct-to-consumer onlines and alienating their large physical wholesale retailer base), Unilever decided to start a content website called All Things Hair back in 2013 to promote their products and pair them with a side of information. This website went on to expand into 8 different markets, including the US, UK and Russia. With a strong hair tutorial YouTube channel, the website AllThingsHair.com did have good engagement and seemed to have a good number of online foot traffic – with 92,000 subscribers and 170,000 unique visitors per month in 2019. However, aside from brand partnerships, it didn’t seem like there were clear monetization opportunities from the site. And this is where HelloAva was really able to add value.

To differentiate from other content websites – and to (it seemed like) more explicitly figure out a way to drive sales and conversion – Unilever paired up with HelloAva to use its AI-powered technology to recommend personalized haircare products to its content readers and hopefully customers. Similar to the HelloAva website, customers filled out a questionnaire online, uploaded a picture of their hair, then were shown personalized, recommended hair products and provided links from trusted retailers to purchase said products. Unlike the HelloAva original website, this new website was complimentary – and did not make a profit from the service, but rather from driving increased conversion to the ultimate sale of Unilever products.

While Unilever was able to use this digital technology and data to bolster their businesses with retailers (unlike the other digital innovation in the personal care / consumer retail space – the direct-to-consumer companies), I foresee potential problems with this model going forward for both Unilever and HelloAva.

From HelloAva’s point of view, partnering up with only one corporate company can put your AI-technology at risk for biasing your data to not only just recommend Unilever brands (since there’s more information on those brands now), but also lose potential the value proposition and trust of the end consumer: HelloAva was previously described as brand agnostic – something that appealed to customers because they thought they were getting a recommendation tool that was truly something that was personalized to them and not a marketing tool like how Unilever is using it.

Additionally, now that customers are not paying for the recommendation tool powered by HelloAva, the barrier to entry is a lot lower – which could lead to less committed consumers playing around with the website and entering less reliable data into system – essentially, muddying up the HelloAva’s results. The technology uses data of people’s hair types and preferences to match them with products based on a data set – however, what if the data set is now just filled with people who were not truly committed to finding their perfect hair product, but was just clicking through the questionnaire for fun? The tool is only as good as its data and there are greater risks now that the business model has changed through this partnership with Unilever.

However, it depends on what the end goal is for HelloAva is. If it is to truly help consumers find the product that best fits them, like the founder had initially said during the launch, then perhaps partnering with Unilever – a company with the incentive to drive up sales in their particular brands – might not have been the right move. Partnering up with a retailer – a company that is more agnostic about brands and is more just incentivized to increase overall sales – might make more sense to maintain this value proposition.

Sources

- https://www.glossy.co/beauty/unilever-tackles-personalization-with-ai-startup-helloava

- https://techcrunch.com/2017/05/15/helloava-launches-a-chatbot-for-personalized-skin-care-recommendations/

- https://www.allure.com/story/hello-ava-app

- https://www.happi.com/contents/view_breaking-news/2019-07-18/helloava-launches-hair-platform/