Trendyol riding the wave of Turkish e-commerce growth

Trendyol, launched by an HBS dropout only 6 years ago, is now Turkey’s largest flash sales e-retailer. With 20 million sales a year, annual run-rate of almost $350 million and backing from top international venture investors (Tiger Global Management, Kleiner Perkins Caufield & Byers and the European Reconstruction and Development Fund), it is hard to ignore. What’s more, Trendyol still has plenty of room to grow by riding the wave of growing e-commerce in Turkey (growing at 22% over the last five years), which currently accounts for only 2% of all retail sales.

Trendyol, launched by an HBS dropout only 6 years ago, is now Turkey’s largest flash sales e-retailer. With 20 million sales a year, annual run-rate of almost $350 million and backing from top international venture investors (Tiger Global Management, Kleiner Perkins Caufield & Byers and the European Reconstruction and Development Fund), it is hard to ignore. What’s more, Trendyol still has plenty of room to grow by riding the wave of growing e-commerce in Turkey (growing at 22% over the last five years), which currently accounts for only 2% of all retail sales.

Flash Sales

The concept of platforms providing flash sales have been around since 2001, pioneered Vente Privee in 2001 in France and popularized by Gilt Groupe in the US. Originally flash sales came to existence to overcome strict sales laws in Europe, that mandated times and date of sales for European retailers. Vente pioneered a concept of limited time only online sales, which helped retailers get rid of excess inventory any time of the year and gave customers an option to shop discounts all year round. Given the short-term nature of the sales, they did not fall under the European law.

Flash sales website played an interesting role in the growth of e-commerce in emerging markets. Unlike in developed countries, where flash sales came after a well-established e-commerce sector, in EM they acted as a catalyst of e-commerce growth. Customers were willing to forgo the offline experience (and risk of not receiving what they want) to buy clothes at a discount. This clear value proposition attracted masses, in turn forcing Trendyol and its vendors to build out infrastructure for a smoother customer experience (e.g. shipping to remote areas, provide returns etc.) With time, Trendyol became the trusted platform for online shopping. The exact same phenomenon happened with Zalora in Asia and Zalando in Eastern Europe.

Trendyol

Today, Trendyol serves more than 12 million women. In fact, 70% of all women in Turkey who shop online have shopped on Trendyol. What is even more interesting, is the fact that more than 70% of all sales came from outside the major metropolitan areas, showing that it fives consumers product access where they lack high street equivalents.

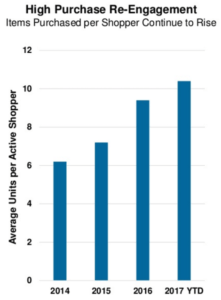

With high purchase re-engagement (see chart below) and 90% of web traffic being organic, Trendyol became the natural go-to partner for brands. For local, less known brands, it offered a platform to be discovered and sold online, without the need to set up own e-commerce logistics (particularly when serving rural areas). For international brands trying to enter Turkey, it became the go to platform promote the brand locally.

In addition, starting as digital only, Trendyol was at an advantage to its offline competitors by the sheer amount of data it gathered to analyze trends and predict inventory. With time, it could use this data not only to increase the efficiency of its supply chain, but also to create its own private label. Today Trendyol’s private label represent 38% of its revenue and growing. Its pure size and advanced supply chain technology coupled with the proximity of its HQ to suppliers (over 1000 suppliers are within 30 miles), it can test new products within a week and rapidly scare up if they prove successful. Obviously, its ever-growing private label is disadvantageous to its partners, but today given Trendyol size and popularity, brands can’t do much but continue to partner with it.

As the Turkish e-commerce market continues to grow, Trendyol is well positioned to continue to expand. With the proliferation of copycats, it is at risk of losing some brands due to multi-homing nature of e-commerce. However, any revenue impact from this should be mitigated by the growth of its private label.

Sources:

- https://www.businesswire.com/news/home/20160531006247/en/Trendyol.com-Turkey%E2%80%99s-Largest-Fashion-E-tailer-Hits-New

- https://econsultancy.com/blog/69136-six-emerging-retailers-with-effective-strategies

- http://www.businessinsider.com/trendyol-is-turkeys-gilt-and-is-actually-more-popular-in-one-important-area-2011-8

- https://www.reuters.com/article/us-turkey-ecommerce/young-turks-e-commerce-start-ups-bet-on-enviable-demographics-idUSKCN0ZE142

- https://www.fbicgroup.com/sites/default/files/Quick%20Take%20on%20Top%20Flash%20Sales%20by%20FBIC%20Global%20Retail%20Tech%20Sept.%203.pdf

- https://facebookmarketingpartners.com/wp-content/uploads/2015/02/Trendyol-Case-Study.pdf