Transunion – Competing with Data Giants

How Transunion remains relevant as the #3 credit bureau

Transunion describes itself as “a leading global risk and information solutions provider to businesses and consumers.” Most of us know it as one of the 3 primary credit bureaus that monitor our creditworthiness. About ¾ of Transunion’s revenue comes from businesses evaluating consumers’ ability to pay, managing credit risk, investigating fraud, etc. The remaining ¼ of revenue comes from consumers who subscribe to Transunion to track their credit profile and score.

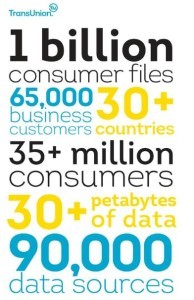

As one might expect for a company that traffics in consumer information, Transunion is one of the most data-intensive companies in the world. In fact, when it went public earlier this year, Transunion dedicated the front page of its prospectus to listing different measures of its data usage:

These numbers are continuously increasing. In fact, the number of petabytes of data that Transunion maintains has grown by 25% per year since 2010. Transunion sifts through this massive amount of data by employing machine learning techniques with sophisticated algorithms.

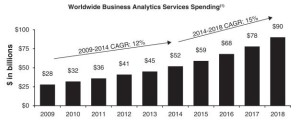

Transunion believes it has an attractive market opportunity. Indeed, it defines its opportunity as the $59 billion spent on “business analytics services” each year. As IDC notes, this market is rapidly growing at ~15% per year:

However, while Transunion is undoubtedly a “big data” company playing in an attractive space, it’s important to evaluate it in the context of other big data companies. After all, its current revenue is only ~$1.5 billion of the purported $59 billion market and is small even when compared to the subset of other major credit bureaus – Equifax generates ~$2.7 billion while Experian is at ~$4.6 billion. This might appear to be negative for Transunion because credit bureaus exhibit direct network effects. The more data a credit bureau already has, the more useful its analysis will be for customers. And the more customers that use a credit bureau, the more data it will acquire – this is because customers provide data in addition to consuming it (i.e. banks offer the credit bureaus information on consumer defaults in addition to purchasing data from credit bureaus when underwriting consumer loans). Transunion survives as a smaller player because it has convinced enough customers to purchase its credit analytics instead of or in addition to that of Experian and Equifax – this has prevented the market from devolving to a “winner-take-all” situation (though it has perhaps become one where “three winners take all”). Transunion has accomplished this by acquiring unique data sources and developing unique analytics. For instance:

(1) Time Series Data Analysis

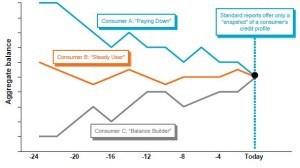

Most credit analyses evaluate a consumer’s creditworthiness at a given point in time. Transunion was the first bureau to recognize that time series data could be an effective supplement to point-in-time data in predicting default risk. For instance, a consumer who has been paying down debt could be lower-risk than a consumer who has been building debt, but a traditional credit score would treat them the same if they have the same current level of debt:

Transunion “productized” this insight with CreditVision, the first solution from any of the credit bureaus to leverage trended data to help customers make lending and marketing decisions. It did so by developing an algorithm that analyzed up to 30 months of historical data covering “changes in balances, credit limits, past due amounts, and payments.” This resulted in scores that ended up being superior predictors of default.

(2) Blending Public Records Data with Credit Data

Customers typically have to purchase public records information separately from credit data. For instance, Bank of America might pay LexisNexis to authenticate a consumer’s identity / arrest history and might pay Equifax for the same consumer’s debt default history before underwriting a mortgage. However, not only is it cumbersome to procure information from multiple vendors, but Bank of America must rely on its internal resources to determine how to integrate the public records and credit data in making a final assessment.

Transunion, whose CEO formerly led LexisNexis, recognized this pain point and led a multiyear effort to acquire public records datasets and to associate them on a person-by-person basis with credit histories. As a result, Transunion is now the only scale provider with both public records and credit data. It productized this solution as TLOxp, which “leverages data matching capabilities across various datasets to identify and investigate relationships between people, assets, locations, and businesses, allowing us to offer enhanced due diligence, threat assessment, identity authentication, and fraud prevention and detection solutions.”

At this point, the blended datasets effectively represent a proprietary database. The barrier to entry is not only the upfront time and effort Transunion invested to collect and integrate the data, but also the expanded data flow the company now receives because it offers TLOxp.

(3) Industry-Specific Data

In addition to integrating historical data and blending datasets, Transunion has tried to differentiate itself by acquiring industry-specific data to complement baseline consumer credit data. For instance, Transunion has obtained vehicle-level data (i.e. accident history) to help auto insurers underwrite policies more efficiently. In healthcare, Transunion developed a product to help insurers search for alternate plans under which a given consumer may be covered (i.e. Medicaid, Supplemental Security Income, TRICARE) to minimize claims payouts.

While Experian and Equifax have vertical solutions of their own, Transunion’s industry-specific data and analytics helps it serve customers more effectively in the industries it chooses to play in.

(4) Building Business in New Geographies

Recognizing its limitations as a smaller player in developed economies, Transunion has aggressively built out its international business. For instance, Transunion co-founded (along with a local partner) the first credit bureau in India in 2001 and has benefitted not only from the country’s rapid GDP growth, but from the even faster growth of the credit-active population. Being first to market is especially valuable in countries like India where datasets are not as readily available for purchase – although it takes longer to achieve scale, the barriers to entry are higher because the first player accumulates a more proprietary set of data. It can therefore offer higher-quality data/analytics at lower marginal cost than new entrants.

Transunion is attempting to replicate its Indian success in other geographies – international revenues now make up almost 20% of its business.

Challenges

While Transunion has been scrappy in differentiating itself versus its larger peers to date, it faces a number of challenges going forward. First and most importantly, unique analytics can be replicated if the underlying data is not proprietary. For instance, the historical data in CreditVision is not as unique as it was when it was first introduced a few years ago because Equifax and Experian have recently developed similar solutions (Equifax introduced the Dimensions product suite while Experian put out its Trended Solutions product).

Even seemingly proprietary data, such as Transunion’s blended public records/credit data, can be replicated over time. While the company does now receive incremental data due to its blended solution, it only took a few years for it to build the blended database in the first place.

Industry-specific data, while interesting, puts Transunion into competition with niche vendors who may have superior vertical solutions. For instance, Solera and Polk are dominant competitors in the vehicle history / auto insurance space. Indeed, Transunion procures much of its auto data from vendors like these and is therefore basically a reseller of this data.

The international opportunity, while interesting, is nascent enough that the market may not have “tipped” to the point where new competitors cannot enter. For instance, even after massive growth over the last 15 years, only 15% of India’s adult population is “credit active.”

While it’s difficult to know the ease with which competitors can replicate Transunion’s differentiators, it is clear that the company will have to continue innovating just to stay in place.

Really interesting and obviously data-intensive space here. I’m especially interested in the piece you mention about growth in new markets like India – I have to think this represents the largest long-term opportunity for companies like TransUnion. The question remains in my mind though, will those markets evolve in the same way that they have in the US? Will there be as many as three major players in consumer credit bureau space or not? As you mentioned, there is a relatively strong network effect here. It would be interesting to find out what competitors are doing in emerging markets and can first movers find a way to turn this into more of a “winner-take-all” game in certain geographies?