TradeMe’s Kiwi Dominance

Started in 1999, TradeMe is the largest online marketplace in New Zealand by a considerable distance. 85% of the New Zealanders have a TradeMe Account[1], and the site was the 4th most popular website in New Zealand in 2018, behind global giants Google, Facebook, and YouTube[2]. In my opinion, there are 4 key reasons for TradeMe’s total dominance:

1 – First Mover – TradeMe was able to scale quickly as a result on being the first local online Marketplace in New Zealand. When it entered the market in 1999, it was the first time New Zealanders had another option to buy items (especially secondhand ones) aside from newspapers, auctions, and their personal networks[3].

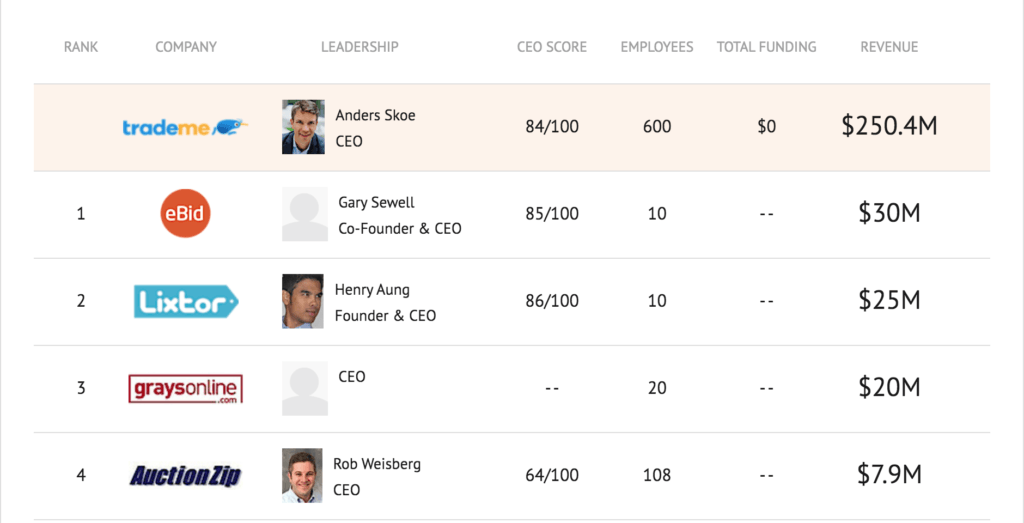

2- Strong Network Effects – Given its clear value proposition and the simplicity of transactions, the site’s popularity grew quickly, and the network effects snowballed. The more buyers it had on its platform, the more sellers signed up, which attracted more buyers and so on and so forth. This has made it extremely difficult for anyone to compete effectively with TradeMe over the years (see a comparison of TradeMe and selected competitors below[4]).

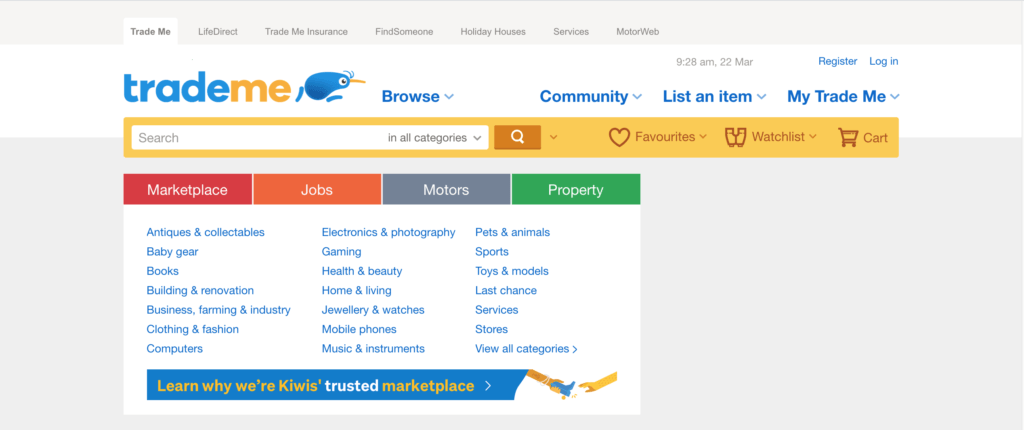

3- Variety of Services – TradeMe provides a variety of different marketplace-based services (see a picture of the TradeMe homepage below[5]). Although its major categories include Property (purchases and rentals), Jobs, Motor, and Marketplace (which includes several general items), TradeMe also offers links to dating sites, and insurance applications.

4- Different Sale Options – Transactions on TradeMe vary from sales between companies to individuals and individuals to individuals. It also offers auctions and fixed price sales. Given this and the fact that the marketplace offers several categories, TradeMe often feels like a mix of eBay, Amazon, Zillow, and PriceLine.

How TradeMe Captures Value

Buyers do not face any direct charges from TradeMe which is another attractive feature of the platform which further increases its popularity. TradeMe captures the value it provides by charging sellers 3 different types of fees[6]:

- Success Fees – These are approximately 8% and have a ceiling of $NZD 250

- Withdrawal Fees – Sellers are charged $NZD3 every time a listing is withdrawn before it closes

- High volume listing fees – Sellers are charged additional fees if they are selling an item that is already exists in bulk on the platform.

TradeMe also leverages its strong position by paying sellers in 30-day cycles[7]. This gives the company a great financial advantage since it receives its payments as soon as transactions are processed.

Is TradeMe’s Edge Scalable and Sustainable?

Given TradeMe’s total dominance, it is difficult to see how the company can scale further in New Zealand. International expansion in the Oceania region would also either be extremely difficult given the amount of competition in larger economies (e.g. Australia) or not worthwhile given most countries in the region have much smaller population sizes than New Zealand. Thus, a more important question is whether TradeMe’s dominance is sustainable. The answer is yes.

TradeMe’s biggest competitors include Amazon, eBay, and Facebook Marketplace. While these companies are global behemoths, TradeMe seems to have the following advantages over one or all of them:

- Local loyalty and local market dominance – TradeMe’s dominance is huge and there may be a sense of loyalty New Zealanders feel for such local success stories.

- Shipping costs – Shipping costs make it very expensive for consumers to buy items overseas on Amazon. Moreover, goods eligible for international shipping to New Zealand are limited on Amazon.

- One Stop Shop – As mentioned earlier, TradeMe provides numerous services and many types of sale and purchase options

- Payment and Delivery Function – This is TradeMe’s main advantage over Facebook Marketplace. Facebook Marketplace does not offer a way for customers to pay for items purchased or help sellers with delivery[8]. Facebook lets seller and buyers work out those details between them.

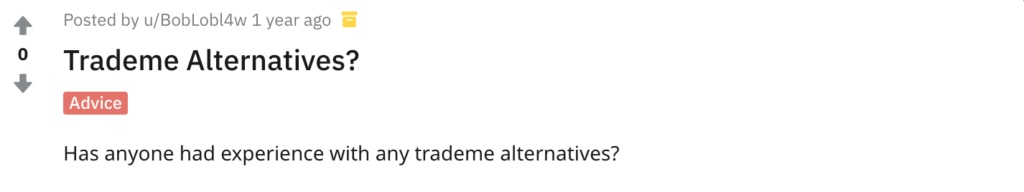

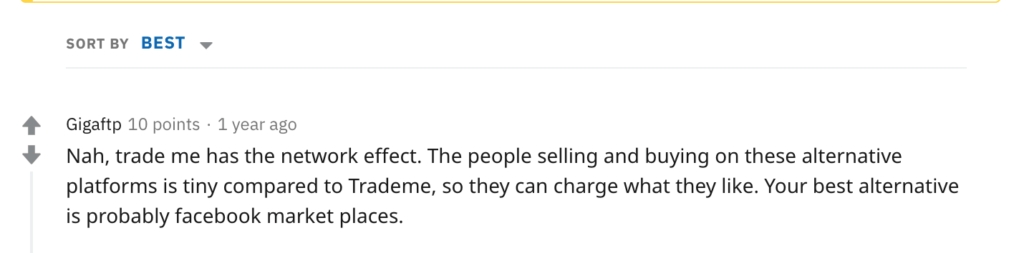

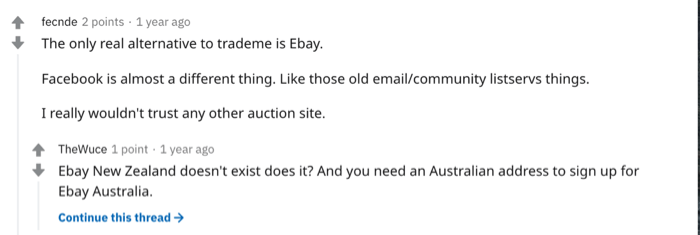

TradeMe’s dominance is demonstrated further when we look at excerpts of Reddit enquiries from consumers trying to find alternative competitors to TradeMe[9].

Finally, TradeMe management are not resting on their laurels. For example, in response to entry threats posed by Facebook Marketplace, TradeMe immediately began offering credit to inactive sellers that they could use to reduce success fees for sales they made[10]. Thus, although any competition TradeMe faces will likely result in some downward pressure on the its fees, it is likely the company will weather any storm in the medium term given the company’s grip on the market and non-complacent management.

[1] https://www.great.gov.uk/selling-online-overseas/markets/details/trademe/

[2] https://www.glimp.co.nz/blog/broadband/what-websites-do-kiwis-visit-the-most

[3] https://www.tvnz.co.nz/one-news/new-zealand/trade-me-turns-20-stiffer-competition-than-ever

[4] https://www.owler.com/company/trademe

[5] https://www.trademe.co.nz/

[6] https://www.trademe.co.nz/seller-information-centre/getting-started/fees/

[7] https://www.great.gov.uk/selling-online-overseas/markets/details/trademe/

[8] https://www.pocket-lint.com/apps/news/facebook/139045-what-is-facebook-marketplace-and-how-can-you-use-it-to-buy-and-sell

[9] https://www.reddit.com/r/newzealand/comments/9qvr85/trademe_alternatives/

[10] https://www.stuff.co.nz/business/opinion-analysis/84965607/facebook-marketplace-no-trade-me-killer-but-could-still-inflict-a-wound