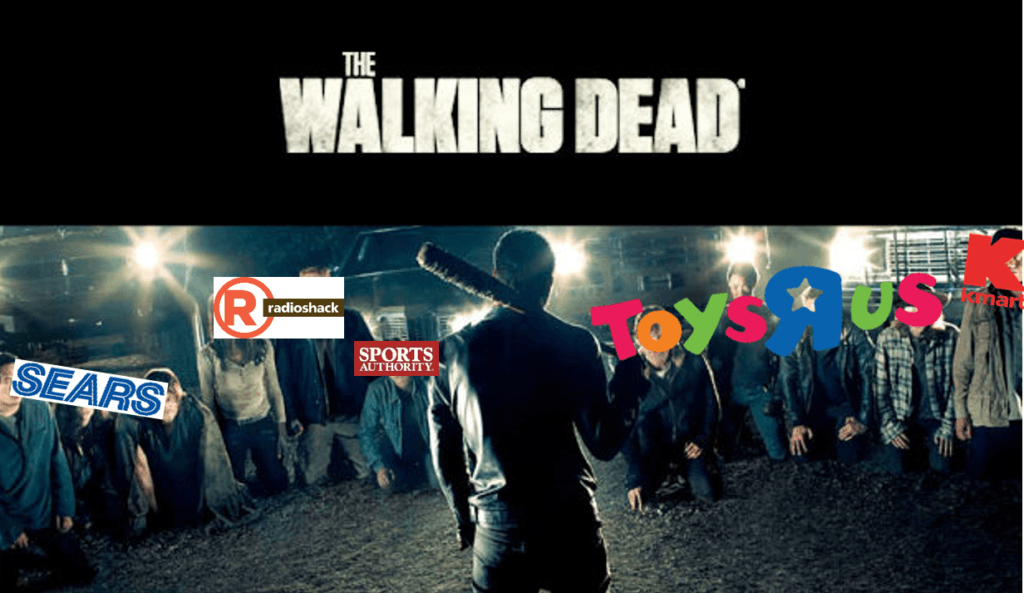

Toys “R” Us: Now Cast in The Walking Dead

Toys R Us losing ground in an online retail world.

In an increasingly digital age, traditional big box retailers are taking a big hit. They are slowly realizing that their stores are becoming nothing more than galleries for online shoppers. Given its current trajectory, Toys R Us seems to be amongst the walking dead of big box retailers.

Retail Industry Shifting Online

In the past 10 years, U.S. retail e-commerce sales as a percent of total retail sales have increased from ~2.5% to ~8.5%, with no indication of a slowdown (1). Consumers have become more comfortable shopping online. A major driver of this is Amazon leading the way with fast, free and efficient shipping. Many retailers, including Toys R Us, have worked with Amazon in the past on fulfillment (giving Amazon valuable data for free) but have started to break away as the online retail channel has exploded with increased digital connectivity across laptops, phones and tablets – not just desktops anymore.

In the past, retailers saw e-commerce as a supplemental business that could be outsourced. In 2000, Toys R Us decided to work with Amazon, which ultimately ended in a lawsuit (2). In 2006, they started taking e-commerce more seriously and decided to outsource their online operation to GSI Commerce – a white label service provider that handles many retailers’ entire web operation from marketing to fulfillment and even customer service. However, as online sales have continued to take over the retail industry and approach nearly 10%, retailers such as Toys R Us have realized they need to be omnichannel to serve the new digital consumer (3).

Toys R Us Losing in an Online World

Toys R Us has seen its sales decline continuously over the past five years (4). The primary driver for this decline has been a combination of increased competition from traditional and online retailers. Initially, Walmart became their biggest threat and competitor throughout the 90s. However, since the dot com era, online sales have become their biggest long-term threat. Especially as traditional retailers such as Walmart have done a better job in the online retail space.

Toys R Us captures value by being the one stop shop for all toys and baby products by providing a wider selection of these items than any other mass retailer could. They also allowed consumers to come and see the products first hand before they buy them. Especially big ticket items such as bikes, swing sets, sporting goods, etc. Unfortunately, the internet has allowed consumers to find an even greater selection online and shop different stores simultaneously to find the cheapest option. Consumers have also started feeling comfortable with buying without seeing the item firsthand. If they really feel the need to see before they buy, then they have started to go in store, check out the item and then buy online at the cheapest retailer. Due to this new shopping behavior, being omnichannel has become very important.

As a result, Toys R Us decided to bring its web store operations in house in the summer of 2016 (5). However, I believe it may already be too little too late. While Walmart has been investing heavily in Walmart.com for years, Toys R Us is just getting started. They have a lot of catching up to do with Amazon and Walmart and they aren’t headed in the right direction. Combined international and domestic holiday sales for 2016 fell more than 3% from the prior year. Meanwhile, toy sales in 2016 were expected to end up 6.5% over the previous year (6).

The Living Dead

Digital disruption knocked Toys R Us off its feet over a decade ago and it still hasn’t been able to get back up. In an online world, retail has become very difficult due to thin margins and increased requirements of shipping/logistics. Economies of scale mean everything and as the 800 pound gorillas in the space get larger, it will be harder for specialized retailers like Toys R Us to keep up. I expect the bleeding at Toys R Us to continue and wouldn’t be surprised if there is an acquisition and/or bankruptcy filing in the foreseeable future. It’s never a good sign when a company with negative profitability has to keep raising debt or extending the maturity of their junk bonds (7).

Sources:

(1) http://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

(2) http://usatoday30.usatoday.com/tech/news/2009-06-12-amazon-toys_N.htm

(3) https://www.internetretailer.com/2015/07/09/toys-r-us-makes-big-e-commerce-play

(4) http://www.hoovers.com/company-information/cs/revenue-financial.toys_r_us_inc.492ce56b8e60565b.html

(5) https://www.internetretailer.com/2017/01/18/targets-online-sales-grow-more-40-december

(6) http://www.northjersey.com/story/money/shopping/2017/01/17/toys-r-us-holiday-sales-drop-more-than-3-percent/96351158/

(7) https://www.wsj.com/articles/toys-r-us-poses-a-test-for-junk-bond-markets-1456099656

Nupur – thank you for this really interesting post! As a veteran of Target Corporate, it is really interesting to see that some of the choices Target made were not unique. They too utilized Amazon for their online platform in the early 2000’s until they recognized that they were providing their most valuable resource – customer data – right into the hands of a growing competitor.

I read your post and wonder if Target’s actions to move to its own omnichannel platform in 2011 was “early enough” to stop the bleeding or if they too face a similar future fate.

Additionally, I agree – the issue of showrooming has become quite a struggle for big box retailers, but I hope the movement towards price promotions and matching online prices will help to alter some consumer habits slightly and encourage in store purchases.

Is there anything you think the big box retailers can do to compete with Amazon and/or online retail? Or do you see big box retailing falling completely to the wayside in future?

Hi Nupur, great post. I have a different view on this – i worked with TRU quite closely when I was running the Toys division at eBay and believe that they’re still a major player because of the nature of their offline business. Though certainly they don’t have the logistical infrastructure in place for a serious challenge to Amazon (and they were bitten in the back by both Amazon and eBay at various points in history), they still provide a unique and immersive offline experience that drives the business, especially at the holiday time (scarcity, lack of time, etc). This automatically drives their online engagement despite the clunky interface. Children and thus parents actively want to go to TRU to spend time in their store which then drives a lot of brand stickiness. The important point about TRU is that they still have a substantial market share and all they really need is a flip of the switch with online (Shopify, etc) to make up for lost ground. I think they’re definitely behind, but have an easy way to catch up

Hi Nupur, great post. I have a different view on this – i worked with TRU quite closely when I was running the Toys division at eBay and believe that they’re still a major player because of the nature of their offline business. Though certainly they don’t have the logistical infrastructure in place for a serious challenge to Amazon (and they were bitten in the back by both Amazon and eBay at various points in history), they still provide a unique and immersive offline experience that drives the business, especially at the holiday time (scarcity, lack of time, etc). This automatically drives their online engagement despite the clunky interface. Children and thus parents actively want to go to TRU to spend time in their store which then drives a lot of brand stickiness. The important point about TRU is that they still have a substantial market share and all they really need is a flip of the switch with online (Shopify, etc) to make up for lost ground. I think they’re definitely behind, but have an easy way to catch up