TOMRA – Potatoes to the Right, Rocks to the Left

TOMRA creates technology based solutions that enable advanced collection and sorting systems across the food, recycling, and mining industries.

TOMRA creates technology based solutions that enable advanced collection and sorting systems across the food, recycling, and mining industries. Founded in 1972, TOMRA is a Norwegian company that started with its initial technological innovation in Reverse Vending Machines (RVMs) – automated collection of used beverage containers. Over time, TOMRA has refined its technology, expanded into sorting, and is in the process of developing deep learning tools to further accentuate its products. Today, TOMRA has done ~100,000 installations of its sorting and collecting products in over 80 markets worldwide. [1]

The Product & Technology

TOMRA’s first product was its Reverse Vending Machine which was developed to provide a local grocer with a machine that could easily take back empty bottles. The collection business bloomed from there with TOMRA’s latest product which allows for multi-bottle collection and oversees the pick-up, transportation, and processing of used beverage containers.

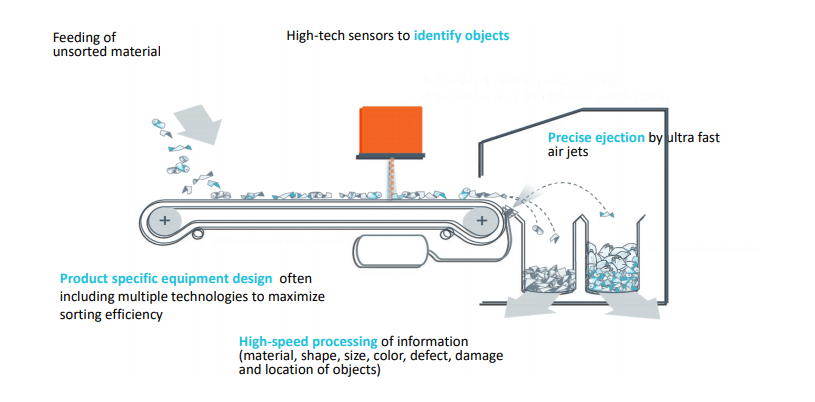

TOMRA then expanded to create sensor-based solutions for sorting and processing a variety of products for the food, recycling, and mining industries. Prior to TOMRA, workers in these industries were sorting these products by hand – individual inspection of food products, examining material content of ores, etc. With the sensor technology, companies can install these devices to target and recognize certain materials according to specified characteristics. For example, with TOMRA’s mining sorting technology, the sensors can be programmed to target certain color, atomic density, transparency or conductivity. Once a particle content is matched, TOMRA’s technology allows it to be selectively extracted using a pulse of pressurized air to separate valuable mineral ores from rock. TOMRA has employed similar technology to help farmers sort produce, grains, nuts, etc. [3,5] See example of machine below. [1]

In 2019, TOMRA has developed its deep learning AI-technology GAIN to further enhance its current sorting technology AUTOSORT by classifying objects that could not previously be separated without compromising throughput speed. GAIN aims to mimic human learning by training based on thousands of images to determine which items should be separated during the sorting task. Then, the technology continues to learn such that the image identification gets better over time. [6]

Exhibit 1: Sensor-based Separation

“Deep learning increases the sorting sophistication, effectiveness and flexibility of our market-leading AUTOSORT machines,” says Carlos Manchado Atienza, regional director Americas for TOMRA Sorting Recycling. “GAIN technology will allow our sorting machines to adapt to new waste streams, which gives our customers more flexibility to adapt to changing market conditions.” [4]

Challenges & Opportunities

For TOMRA, broader trends have emerged that keep the sorting and collecting industry as areas of growth for many corporations. In terms of recycling and waste generation, companies and consumers are looking for ways to be more environmentally conscious and TOMRA is focused on building a circular economy for plastics and optimizing resource productivity. They believe there is significant value proposition for the packaging, steel, and paper markets to re-use recycled materials if it can be collected more efficiently and less waste, lower costs, and higher throughput in the sorting space. In addition, TOMRA has expanded rapidly geographically and is the market leader for its products in many countries around the globe.

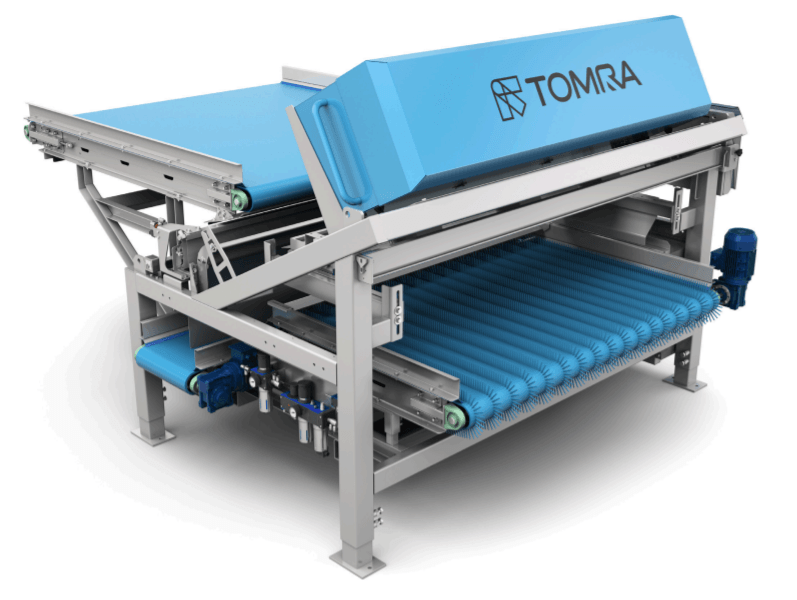

Unlike many of the companies we have seen in DIGT, TOMRA offers its technology as an embedded part of the equipment it sells (see Field Potato Sorter below). Given that the industries that TOMRA focuses on are high capex industries that require heavy machinery, the nature of long equipment lifetime and capex budgets may hinder TOMRA’s growth. Furthermore, it requires TOMRA to have a much larger sales and customer service team to service any needs to the equipment and training for the underlying technology. To expand faster into other horizontal segments, TOMRA could look to adapt its sensor and deep learning technology to make it attachable to existing sorting equipment on the market. This would still allow TOMRA to keep the technology and have the ability to update the technology over time without requiring companies to purchase new equipment.

Exhibit 2: Field Potato Sorter

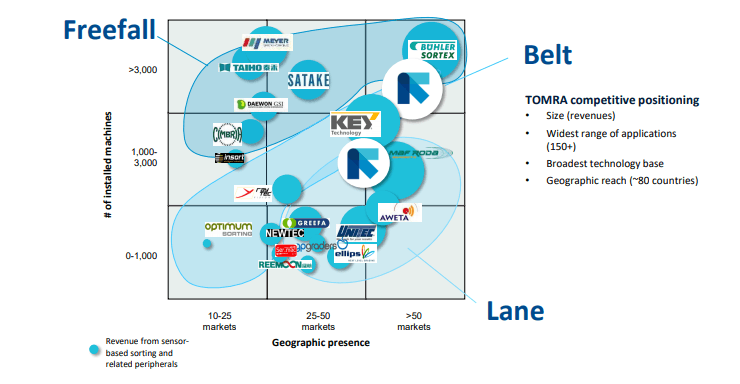

Given the wide range of applications for this technology, competitors have also cropped up in the space. Companies such as Key Technology, Sesotec, GREEFA, etc have begun to develop similar sorting technology that also utilizes cameras and sensors to automate inspection. See competitive landscape as for food sorting technology as per TOMRA’s investor presentation below. [2]

Exhibit 3: Competitive Landscape in Food Sorting

Being a pioneer in the space, TOMRA has expanded geographically quickly to establish its dominance in the sector – 80 countries thus far across a wide variety of applications. However, TOMRA’s vulnerability will likely be in niche segments such as pharmaceutical where its competitors may be able to leverage industry expertise to infiltrate more quickly that TOMRA. In addition, when equipment begins to falter or needs updating, customers could look to “shop around” for new technology solutions on the market. As mentioned previously, TOMRA will need to ensure it maintains its strong customer relationship and sales functions to encourage customer stickiness as more competitors come onto the marketplace.

Finally, another risk in this space is around environmental regulation and the geopolitical environment that surrounds sustainability and environmental practices. For some countries, this will pose an opportunity for TOMRA. For example, the EU has implemented a circular economy strategy that is targeted towards design, use, reuse, and recycling activities in the value chain. TOMRA is well positioned bridge the loop in collecting and recycling plastics to achieve these goals. However, it is also possible that increased regulation around recycling and materials will cause increased complexity for TOMRA that will require them to adjust their strategy or consumer relationships.

Overall, TOMRA is in a strong position as the pioneer in the space, dominant market share, and premium nature of the product. However, TOMRA faces increasing competition with more recognition AI that can help companies with higher throughput, lower cost, and increased efficiency in sorting. One potential consideration is for TOMRA to license its technology to companies rather than tie it to its equipment. This would allow it to utilize its strong geographical penetration and expand quickly into other industry segments to further build a competitive moat for the business.

References:

- TOMRA Website (https://www.tomra.com/en/about-us)

- TOMRA 2020 Investor Presentation

- TOMRA 2019 Annual Report

- https://www.recyclingproductnews.com/article/32386/tomra-launches-gain-deep-learning-for-sensor-based-sorters

- https://recycling.tomra.com/blog/get-ready-for-big-data-tomra-introduces-deep-learning?hsCtaTracking=da6ff749-3258-49e1-873d-bbf40e8450b6%7C09346f78-0ddc-4244-87f7-02a92aed12bd

- https://resource-recycling.com/plastics/2020/01/03/pe-sorting-is-enhanced-with-deep-learning-technology/

Interesting post! I worked in mining before HBS and appreciate the details on sorting applications you mentioned here.

The challenge I saw was that the value creation could be unclear for the mining customer as it has to commit somewhat significant capex before being sure in the end-results. Since sorting is only one element of a complex processing chain it is very difficult to foresee whether it will be successfully integrated into production line. For this reason I wonder if TOMRA could integrate vertically (at least with its software) to provide more comprehensive solutions.

Another source of worry for the mining company could be a lack of comfort with sharing its operating data with a third party. For example, the company could be afraid to lose its competitive advantage for operating a certain type of mines if TOMRA makes this know-how widespread.

I also agree with the idea to license out their technology as another revenue source, though I’m not sure if anyone would buy it. I don’t think it takes much effort or money for them to license it, which is why I’m still for it. But, I don’t think it would be smart for a businessperson to build a physical product around a technology that’s going to need to be updated and that is in the same competition space.

So, I think it makes sense for Tomra to try licensing, but I don’t think they’re going to get many takers unless they sign a non-compete with the company they’re licensing to.