The Swiss watch industry under pressure, loses share against smartwatches

The hardware and the software will come from Silicon Valley. But the watch case, the dial, the design, the idea, the crown, that part of the watch will, of course, be Swiss ~ Jean-Claude Biver [1]

Jean-Claude Biver might be right that watch design comes from Swiss, but sales in the future may, of course, go to Silicon Valley.

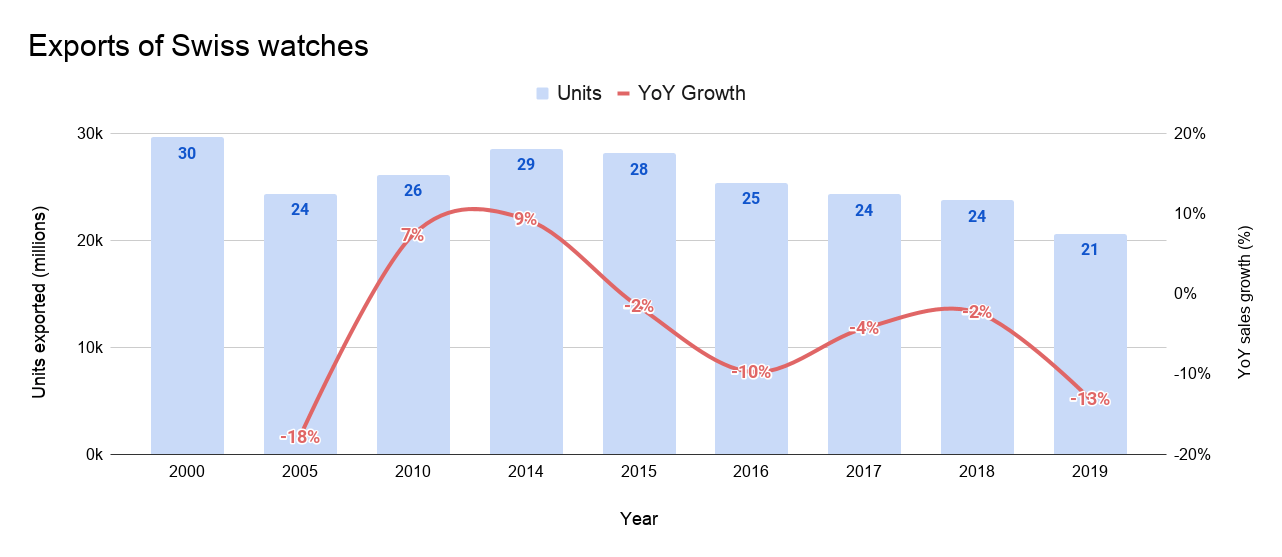

A recent report on watch sales shows that Apple, for the first time, sold more watches than the entire Swiss industry in a year. The report estimates that Apple sold almost 31 million compared to 21 million of the Swiss watch industry, that’s a 36% increase and 13% decline, respectively, compared to 2018. [2]

Smartwatches, and especially the Apple Watch, are delivering a better product appealing to younger generations, who want to have a connection with the digital world, and older generations, looking for devices that can help them track exercise and health.

The window for Swiss watchmakers to react, and make an impact in this new market, may be closing.

Swiss Industry

Almost 50 years ago, the Swiss watch industry was almost destroyed by reacting slowly to quartz technology, believing that people serious about watches would never own an electronic device in their wrist. The industry was only able to go back to business after the development of their own quartz watches and a marketing rescue to reignite the love for mechanical watches. [3]

The recent decrease in exported units echos this past. Sales have been decreasing since 2015, and while revenues have been growing, this is only driven by high-end luxury watches, which only represents 8% of the total units exported by Swiss watchmakers. Apple Watch, and other competitors, are eating away the less expensive segments that represent 30% of the revenue for Swiss watchmakers. [4]

Smartwatches

Early players of the smartwatch industry consisted of niche products such as the Pebble, or sport tracking devices like Fitbit. The first real smartwatches were released by Samsung, Motorola and others around 2013. The product that defined the segment was the Apple Watch, released for the first time in April 2015 (coincidentally, the same year that Swiss watches sales started to decline).

While the first-generation of smartwatches compromised on performance, battery, and other functions, a fast release cycle improved almost every feature and function, and the results can be seen on a strong 30% growth YoY for the Apple Watch.

Consumer behavior

“We believe,” Mr. Cook said during the 2014 introduction, that the Apple Watch “will redefine what people expect from its category.” [5]

Consumer behavior is also changing. Smartwatches changed the expectations of what is possible to do in a watch, from basic synchronization with phones and their ecosystems (iOS and Android) to advanced health metrics such as performing electrocardiograms on the go. As the population in the developed world grows older, this type of feature increases the adoption of smartwatches. Peter Stast, of Citizen-watches, comments that the “affordable luxury” midmarket is going to suffer against this type of device: “Health is worth more than prestige.” [5]

For young consumers it’s not only health or exercise tracking, the importance of connecting with the rest of the digital ecosystem through their phones running iOS or Android is relevant: a suite of services and apps is available only using those two platforms, this forces luxury brands to use the same operating systems, reducing differentiation.

Response

Reactions by Swiss watchmakers have been mixed. Some of them fear another episode as the quartz revolution that almost killed them. Others see this as an opportunity to expand their brands into more segments. Some brands have released their own smartwatches (the majority with poor results).

While it is true that a luxury watch is still a status symbol, this may not hold true in the future. Once younger generations get used to having a device that is more practical than beautiful in their wrist, it may be difficult to reignite the love for mechanical ones. Other reasons might explain the decrease in Swiss watch sales, but smartwatches for sure are part of this decline.

Swiss watchmakers need to be careful and revert this tendency before it’s too late.

Sources:

- Bloomberg. (2015, January 19). TAG Heuer Discards “Swiss Made” Label to Take on Apple Watch. Retrieved from https://www.bloomberg.com/news/articles/2015-01-19/tag-heuer-casts-aside-swiss-made-label-to-take-on-apple-watch

- Strategy Analytics: Apple Watch Outsells the Entire Swiss Watch Industry in 2019. (2020, February 5). Retrieved from https://news.strategyanalytics.com/press-release/devices/strategy-analytics-apple-watch-outsells-entire-swiss-watch-industry-2019

- Forbes. Naas, R. (2020, February 11). Apple Watches Outsell Entire Swiss Watch Industry, But Don’t Ring The Death Bell Yet. Retrieved from https://www.forbes.com/sites/robertanaas/2020/02/07/apple-watches-outsell-entire-swiss-watch-industry-but-dont-ring-the-death-bell-yet/#55260dbb78f1

- FHS. (2020, February 11). Watch industry statistics. Retrieved from https://www.fhs.swiss/eng/statistics.html

- The New York Times. (2019, June 29). Apple Watch Hasn’t Crushed the Swiss. Not Yet. Retrieved from https://www.nytimes.com/2019/06/29/fashion/smartwatches-apple-tag-heuer.html

Thanks so much for your article. While I agree that Swiss watches are likely to be substituted out by technological watches with higher utility, I don’t the solution is for Swiss Watchmakers to create their own smart-watches. To win in the smart-device industry, you need to build the engineering capability to conduct multiple design iterations fast enough to compete with an Apple or Google. Time is not on the Swiss’ side(pun intended)… but in all seriousness, the watchmakers could explore outsourcing the IT of the watch to smart device company, and take a position where they add their brands onto the finished product. The nature of what a Swiss watch is will change, but it does not mean the industry has to die.

Interesting article! I wonder if these Swiss watch-making companies will be able to compete with the likes of Apple in creating technology-advanced smart watches. I believe a key differentiator is not only in Apple’s tech capabilities but also in the ecosystem and network of connected devices they have created. I believe Swiss watch makers may have to focus on what they are good at (manufacturing, design), and on their more upscale product segments and lucrative, high-margin customers to stay alive and sustain growth.

Hi Walter! Thanks for your interesting post.

As a lover of traditional Swiss watches, I am sad to say that I am not surprised that industry is under strong pressure. High tech “fun” pieces with conveniently available information for your health benefits seem ideal for our time’s wants and needs.

However, I believe there is still hope for the Swiss, and not necessarily (if at all) through an entrance into smartwatch competition. Rather, I believe it should stick to what it knows best – high-quality, elegant, and expensive watches. What it must do, however, is recreate their status of being “it”-items. The luxury handbag industry is still able to successfully sell off bags worth thousands of dollars, some approaching $10k or above per piece. Even with convenient bags or backpacks, the luxury handbag will likely stay a coveted item in many forms. Even if convenient bags came with new technological features, and even if produced by Apple, I doubt they would replace the luxury handbag. This is to say that fun, high-tech, and convenient products serving our needs are not necessarily desirable – there is still a significant place for beautiful but less useful luxury items.

Although I do not have a magic recipe, I believe that much comes down to marketing and a willingness of Swiss watch makers to go out of their comfort zones to renew their brands and appeal to the next generation of stars, including Hollywood stars but of course also social media influencers, users they may have previously not considered elegant enough but that dominate the ruling of future consumer trends. This, however, is not a marketing class, and thus I will not speculate further. Nevertheless, to summarize: despite innovative technology solutions there is still a place for Swiss luxury watches (and other non-tech, unpractical, expensive items), but they must target and appeal to those who create the “it”-items on social media and alike, because they are the large determinants of where people are willing to spend large sums of money.

At least that’s my view.

Hi Walter,

I really enjoyed reading your thoughtful post on the Swiss watch industry (especially as my husband is planning to go into this “dying” industry next year). While I do agree that the Swiss watch industry is facing challenges in attracting younger consumers who are interested in wearables and smartwatches, I think that it’s important to distinguish what type of digital innovation these companies pursue. Like some of the comments above, I believe that for the higher tier luxury watch brands, it does not make sense for them to compete in the smart watch space and instead should look to differentiate themselves from techy, social aspects of smartwatches. In that vein, I would advise them to focus on what makes them special – the art and craftsmanship that goes into a mechanical timepiece. One that isn’t mass produced, and builds its own social community among its unique owners. What I would suggest, however, is that they invest in updating the way that they interact with their consumers to communicate through more social platforms, centralized customer databases, dynamic pricing, etc.

The group of watch brands that may be under fire, may be the Fossil watches of the world which compete with Apple watches in price and lack in utility. Some of those brands have decided to partner with tech companies to introduce their own more fashionable smartwatches, but it’s still unclear whether that is a good strategy. It will be an interesting battle nonetheless especially as companies like Apple expand to further categories in the consumer space.