SumAll: summing data across platforms

A marketing analytics startup is summing data from 42 different platforms to help small and medium sized businesses better understand correlations between social media activity and revenue.

Clothing retailer American Apparel has 1.6M likes on Facebook, 566K followers on Twitter, and 1.5M followers on Instagram.

Low cost airline Southwest has 4.8M likes on Facebook, 1.9M followers on Twitter, and 155K followers on Instagram.

Car service company Uber has 2.8M likes on Facebook, 393K followers on Twitter, and 121K followers on Instagram.

Companies are increasingly using social media to build their business. Yet, businesses average less than a 4% overlap between social media followers and customers. SumAll was founded in 2011to rectify this issue, helping small and medium sized businesses easily view all of their data in one simple location.

Value Creation

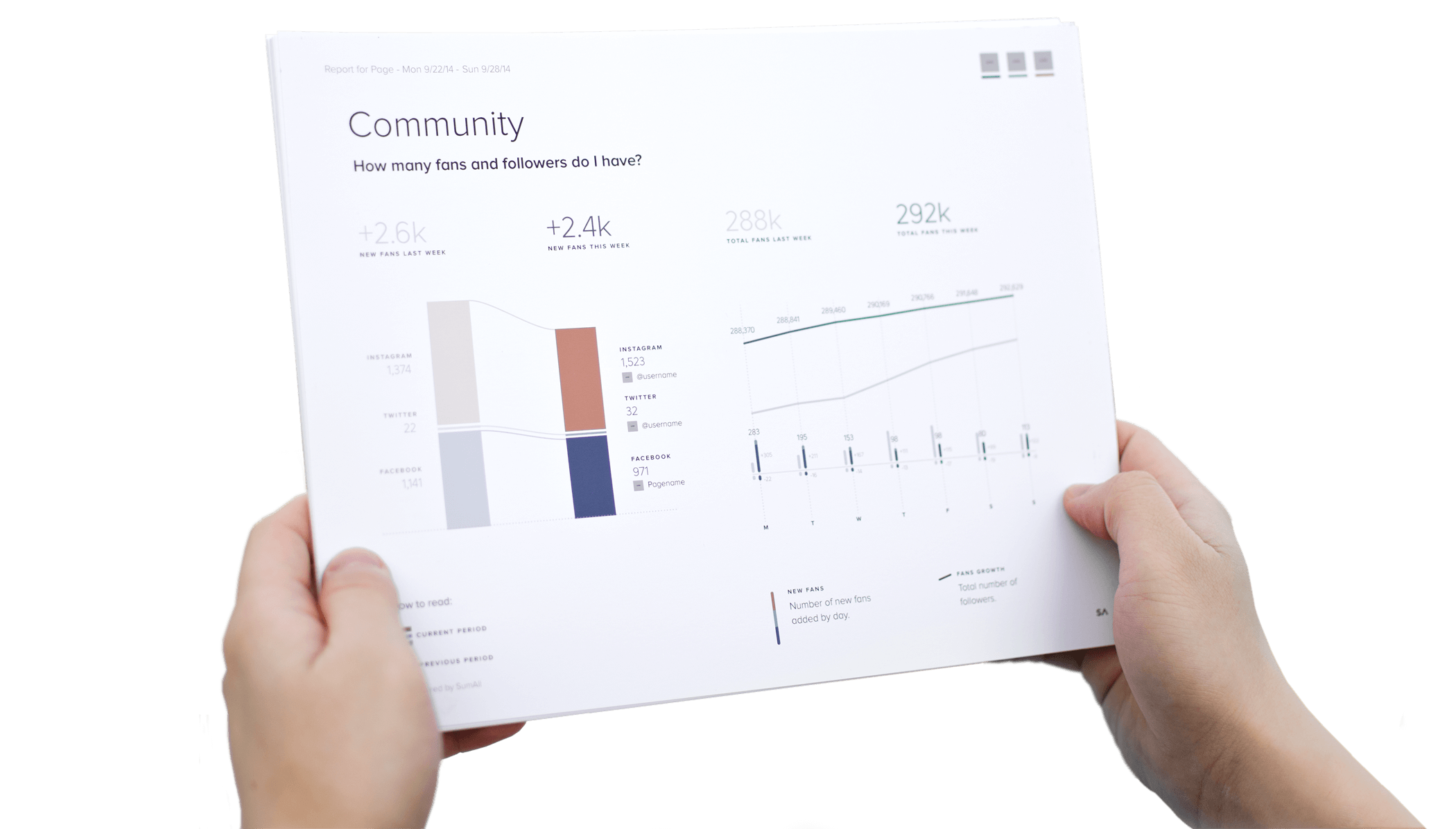

This startup combines data from 42 different platforms, including social media (i.e Facebook, YouTube, Instagram), web traffic (i.e. Google Analytics), and sales metrics. This combination of easily accessible data is used to help companies better optimize their marketing campaigns. Unlike competitors, SumAll seeks to analyze patterns in data across various platforms, providing reports and insights to help target consumers. By aggregating across platforms, SumAll is able to provide insights into how Facebook posts or Tweets may have a correlation with increased website traffic or sales revenue. Additionally, the company creates value through real-time data monitoring and the ability for companies to set and track progress towards goals. Lastly, SumAll’s interactive charts include trendlines to project future performance.

Value Capture

The Basic service with weekly reports is available for free. A paid subscription-based Premium offering is available for $99/month. The latter includes more in-depth reporting, actionable insights, and additional support. The company also plans to launch marketing automation features for Premium subscribers. SumAll is relying on its understanding of data and the information it has gained from customers to be able to continue to refine the insights and recommendations it generates.

Competitive marketing analytics programs are sold to large companies for thousands of dollars. SumAll aims to be affordable, and targets small and medium businesses.

Operating Model

SumAll has built a high performing software system to drive its business model. The large installed user base presents a higher barrier to entry. Because the company has acquired such extensive data across platforms, it is able to not only display data, but interpret that data and understand the correlations that may exist. This is the core element of SumAll’s value creation, and the quality of this data will impact the company’s ability to continue to capture value.

It is not clear how the software is actually analyzing the data. One possible technique would be to do a Difference-in-Differences analysis. By looking at the mean web traffic and sales data for a given company before the company makes a social media post and after the post, SumAll could identify a coefficient to determine any possible correlations. After amassing a large amount of data for similar companies, SumAll may be able to attempt to predict how a future action (such as a Tweet describing an upcoming promotion) will impact website traffic and sales.

Next Steps

Competitors of SumAll include Tableau Software, Pentaho, and JasperSoft. In order to stay competitive, SumAll will need to continue to build and maintain partnerships/compatibility with other online platforms. SumAll got to where it is now by building partnerships with leading software services. However, this was a slow moving process. It took SumAll two years after it launched to integrate data from Google+ into its data visualizations. It is important for SumAll to continue to be aware of the pulse of the market, understanding what levers companies are pulling in their attempts to drive business. Also, the company must maintain a critical mass of user data for each platform. This data is important in order to be able to provide actionable insights. Lastly, SumAll will need to continue to drive conversions from its free offering to its paid subscription in order to capture value.

I wonder if SumAll will shift into providing competitor data as well. My sense is that this is all readily available information, but it’s fragmented, and SumAll would be the aggregator. Competitor data on social media reach would be valuable for companies as they decide how much they themselves want to pay for marketing and promotions. I don’t think this would cause companies to leave the site, because the value they receive is higher than what they might lose. Further, SumAll would just be providing data – it would be up to each company to invest in data analytics and run their own regressions and experiments to understand what caused their competitors’ successes.

SumAll’s strength is offering a solid value proposition for their customers – data analytics to drive the conversion of leads into paying customers. The company is also well capitalized with more than $13 million raised from premier VCs, including Battery Ventures and General Catalyst, and it began to consolidate the market with its acquisition of TwentyFeet, a social tracking tool.

What worries me is that the barriers to entry are not particularly strong in this sector. I could see social media data analytics become a crowded and commoditized sector, thus putting downward pressure of revenues. I wonder if there is anything beyond the amount of data gathered that gives SumAll a competitive edge. One opportunity for differentiation would be to invest in a strong technical team to develop more advanced analytical algorithms or to expand a suite of products.