Staying Relevant, Trendy, and In-The-Know

Spotify has been able to retain its number one position in the music streaming market since pioneering it in 2008 — how exactly did it make use of big data analytics and deep learning to achieve this in a space where consumer preferences are ever-changing?

I am a daily user of Spotify, an on-demand music streaming service. One of my favorite things to do alone is to walk around with earphones in, listening to music from one of my saved playlists on Spotify or treating myself to new music discoveries from their “Discover” recommendation engine.

How Exactly Does Spotify Recommend Songs?

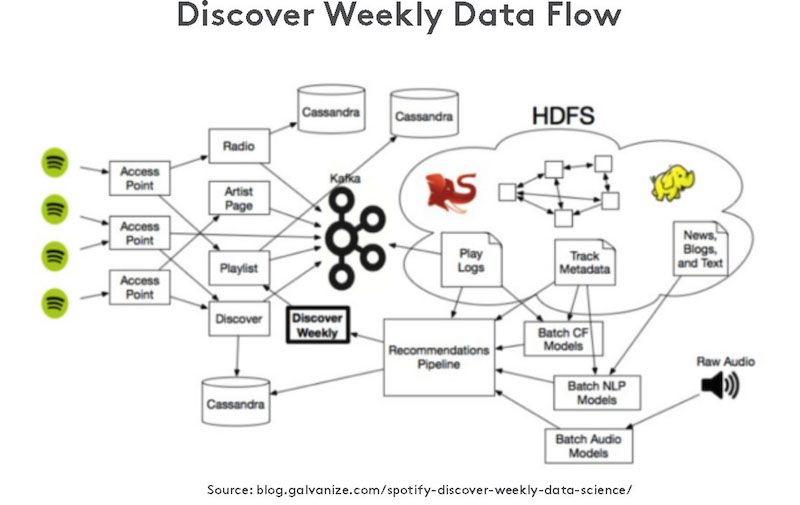

Spotify has millions of users worldwide that feed music preference data into their big data analytics. Through user actions and its use of various data models, Spotify dissects and categorizes song patterns to enhance its recommendation engine.

User actions include liking a song, repeating a song, skipping a song, and so forth – a clear behavioral indication to Spotify about the user’s penchant for a particular song at the point in time. However, as with any other user-based inputs, this can potentially be misleading, erroneous, or infrequent. Aside from user actions, Spotify employs three models to run its recommendation engine. The first is collaborative filtering, a popular technique that deploys a filtering algorithm based on user-created playlists. Secondly, it uses natural language processing to browse discussions about artists and songs on the internet (e.g. news articles, blog posts, etc.) to understand what the world is discussing about music, songs, and artists and pick up descriptive keywords to associate with its song portfolio. The last and most intriguing is Spotify’s use of convolutional neural networks (CNN), which analyzes raw audio data (i.e. the song’s BPM, musical key, loudness, etc.) to assess the waveform data of a song to subsequently classify songs based on music type. Essentially, Spotify’s recommendation engine takes billions of user playlists and the particular user’s listening history to (1) find similar songs and (2) identify the user’s music “taste profile.” This allows it to put together a highly curated list of recommended songs in its weekly “Discover” playlist.

Spotify has long been a firm believer in pushing boundaries using AI and has spent significant time and capital to develop this incredible technology (e.g. acquiring several data science companies). This effectively allowed it to retain its number one position in the music streaming service market since pioneering the service offering in October 2008 – a truly impressive feat.

Further, the use of big data analytics and deep learning is incredibly important to an on-demand business like Spotify, not only to keep the users engaged (and therefore subscribed to its services) but because consumers’ music tastes are constantly changing and highly susceptible to new trends. As such, use of big data analytics is critical to stay in tune with music listeners’ interests at any point in time and not render key value offerings of its business (e.g. the recommendation engine) useless – it is key to making Spotify feel “relevant” and “in-the-know” to its users.

Spotify vs. Apple Music

The largest challenge Spotify should expect to face is its rivalry with Apple Music, which is second to Spotify in terms of subscribers in the music streaming market and is widely considered the “best alternative” to Spotify. As with all of its other products and offerings, Apple has made Music an incredibly user-friendly and convenient option for the many users that are highly integrated into the Apple ecosystem. Apple Music also offers hi-resolution lossless and spatial audio albums, which Spotify has yet to launch, and its track count has already surpassed that of Spotify. And, of course, it employs impressive algorithms as well as human experts to generate the best recommendations for its users.

Another key point of leverage for Apple is that Spotify relies on Apple’ App Store as the only platform to offer its iOS app to consumers. Due to this, Spotify pays Apple 30% commission on revenues generated from its iOS app, including subscription purchases. Thus, Spotify’s main competitor reaps profits from Spotify’s success and also has full control over Spotify’s only channel to an estimated billion of people who use an iPhone.

I’m highly interested in how this competitive dynamic will play out and how Spotify will continue to hone in on its craft to retain its number one market position. Thus far, Spotify has launched several non-music offerings on its platform (e.g. podcasts) but given the high potential of opportunities presented by the extensive amount of data that Spotify has collected on its users’ music preferences, I would be excited to see if Spotify comes up with another innovative way to make use of this valuable asset.