Square and the Future of Digital Payments

Square has developed a platform allowing businesses to capture multiple payment methods and manage their businesses– can they continue to succeed?

What is Square?

Square was founded in 2009 by Jack Dorsey (of Twitter fame) and Jim McKelvey. The idea occured to Dorsey after McKelvey mentioned he was unable to complete a sale for his glassblowing business since he could not accept credit cards. Since Square’s first product release in 2011 it has experienced meteoric growth and is now a staple in many small to medium retail establishments.

Square has a number of point-of-sale (POS) solutions with varied pricing. They allow for card, contactless, and digital payment methods, making it easier for smaller businesses to capture multiple modern payment types. They also provide an online dashboard for business owners to track their payment data.

How Does Square Capture Value?

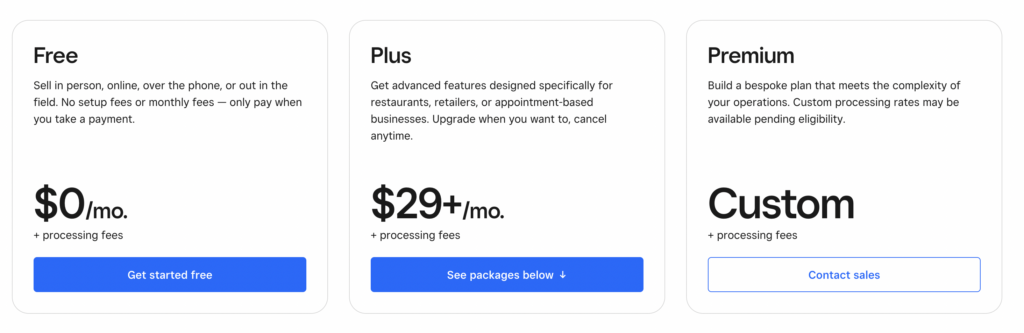

Charging Sellers, not Buyers: The core way Square captures value is by charging transaction and membership fees to the sellers. The three membership tiers are shown below:

Following the standard “Freemium” model of many platforms, Square offers a free monthly subscription that includes software to accept and manage payments. The more advanced memberships include increased support and features supporting larger businesses. Hardware is priced starting with a free chip reader that attaches to smartphones. More advanced POS hardware is available for purchase.

The main way Square makes money is not through hardware or software sales, but through transaction and processing fees. These generally fall in the 2-3% range for businesses. While this number varies across products, Nerdwallet estimates that most POS systems fall in the 2.5-3% range, putting Square well-aligned with the competition.

It is crucial to recognize that Square (like most POS systems) charges the sellers, not the buyers. Who to charge (and how much) is a critical question for two-sided platform businesses. General best-practice is to charge the side that is 1) less price sensitive, and 2) values the growth of the other side more. In this case, businesses are less price sensitive than customers, and businesses value the capture of more customers far more than customers value having more business options. Square’s ability to capture buyers who don’t carry cash, or even those who forgot their wallets and can only pay by contactless methods, is of high value to the sellers.

Physical Hardware Blocking Multi-Homing: Square is naturally moated against new physical entrants because space in retail is limited. Sellers do not want multiple separate POS systems to deal with, so if Square is able to capture business early, there is a strong first-mover advantage.

Is Square Positioned to Continue Capturing Value?

Often, network effects aren’t enough, especially in an industry where the technology is nascent (like contactless payment). Square has several other strengths that support further success:

Established Trust: Payments and finances are a sensitive topic. In 2014, Verifone (a rival payment company) claimed that even beginner programmers could write code to essentially “skim” Square payments, allowing hostile parties to capture sensitive credit card data. While Square initially countered this by claiming that credit cards offer fraud protection, they shortly came out with end-to-end encryption. Since then, Square has also launched an attempt to disrupt the merchant services industry by taking on regulatory risk for customers and charging them less to manage that risk.

Continued Innovation: Fintech is a fast-growing industry. Square has continued to innovate and continue its momentum. They now accept cryptocurrency transactions, help firms manage their payroll and HR, and are breaking into the merchant services industry. Continuing to build out a platform where customers derive increased value will help them build a moat against new entrants.

However, no company is completely safe. Square will have to face down several risks as well:

Legal and Regulatory Risks: As previously mentioned, payments and finances are sensitive and closely monitored. Especially with Square’s foray into cryptocurrencies, the law lags the technology. As more regulations are proposed Square could face increased unexpected risk to its business. In addition, as platforms grow and expand their scope, antitrust becomes a risk.

Loss of Trust: Trust is lost far more easily than it is gained. Square came under fire in 2020 for withholding payments from sellers, essentially holding 20-30% of their transactions in escrow. Square claimed this was a security measure to protect sellers against risky transactions. There is currently a class action lawsuit ongoing. Additionally, Jack Dorsey was sued in 2021 after claims that Square was selling financial data on users to advertisers for Twitter. That lawsuit is also ongoing, however Dorsey departed his role as CEO of Twitter in late 2021.

Risk of Disruption: While Square has positioned itself well against POS and merchant services competition, it still faces the risk of lateral disruption. The rise of DoorDash/UberEats/Postmates has essentially deemed physical POS systems obselete for many transactions. For many other industries, online shopping has removed the need for physical retail spaces at all. Square has attempted to combat this by providing commission-free delivery with support from third-party delivery partners. This is essentially an entirely new platform for Square between the delivery services and businesses. The problem is that buyers, being price sensitive, are already multi-homing on a number of delivery apps, and if a business is using Square they may not show up on those apps, removing them from the customers’ viewpoints.

So What Will Become of Square?

Square has set itself up nicely for success, but the financial services industry is saturating and expanding fast. Dorsey has a proven track record as an innovator with a strong sense of market currents. Continued innovation, getting ahead of legislation, and keeping transaction fees as low as possible are crucial to Square’s success in an increasingly crowded market.

In my previous line of work, I covered the payments space and it’s been fascinating to see the rise of Square. Payment infrastructure required to accept payments has historically been expensive and a barrier for small businesses to accept payments. Square came to the market with an easy DIY pack that made it incredibly easy to manage payments. What is fascinating about their business though is the ancillary services they provide that make the lives of small business owners so easy (inventory management, working capital, etc.). Incredible story on how to create value in a highly commoditized space like payments.

Thanks for writing this post Kate! It was a pleasure to read and I particularly liked how you explain why it makes more sense to let sellers take the burden of cost, rather than the buyers. However, one item I’ve always been curious about is, how square differentiates itself from other services such as credit card or apple pay for instance? Is there something unique offered by square that apple pay doesn’t do?