SendWave: Plugging into Africa’s Mobile Money Web

What sets SendWave apart in the innovative, highly competitive, and constantly evolving fintech environment in Africa?

Fintech has been one of the fast-growing forms of digital innovation in Africa over the last 20 years. Several initiatives have contributed to this innovative wave, with technologies such as mPesa and mobile money gripping consumers throughout the continent. Some of these initiatives do not only help facilitate financial transactions within Africa but focus on bringing from overseas into Africa (e.g. remittances). SendWave (previously known as Wave) is such an example. Remittances have typically played a significant part in financial transactions in Africa for decades. Consequently, money transfer services have evolved over time from direct bank transfers, transfer agencies such as Western Union, and online options like PayPal. This evolution has picked up pace in this new age of smartphones, apps, and fintech. In the midst of all this innovation and competition, I believe SendWave offer something different and are thus a winning digital innovation.

What Do They Do?

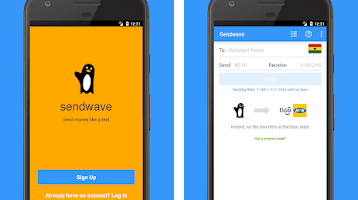

SendWave allows Africans abroad to send money to individual mobile money accounts in Africa. There is a $1,000 daily and $3,000 monthly limit per mobile money account. The company makes its money by offering exchange rate lower than market rates. For example, if I want to send a $100 a friend in Ghana (let’s call him Kweku), SendWave will send the $100 at an exchange rate of GHS5.4 to $1. Thus, Kweku will receive GHS540. Since the market exchange rate for GHS to USD is GHS5.7 to $1, SendWave will have made GHS 30 as revenue for services rendered.

Since its inception in 2014 in Tanzania, SendWave has gained popularity and has subsequently expanded into some of the largest African economies including Nigeria, Ghana, Kenya, and Uganda.

Who Are They Battling Against?

Sendwave’s face some pretty stiff and well-known competitors. These include:

- Western Union

- MoneyGram

- WorldRemit Money Transfer App

- Google Pay

- PayPal

- Direct Bank Transfers

So Why are they Winning?

Based on my experiences transferring money to Ghana, I believe there are 4 key factors that contribute to SendWave’s competitive advantage and set it apart from the above-mentioned competitors:

- Ease of use and friendly interface: This sets SendWave apart from WesternUnion, PayPal, and MoneyGram in particular which can have very cumbersome processes for large segments of populations in Africa. These businesses require bank accounts, debit cards, and some like Western Union have fewer locations (as compared to mobile money) where recipients can pick up their cash. My impression is that PayPal, MoneyGram, and Western Union are better for C2B and B2B transactions whereas Sendwave is more effective for C2C transactions.

- Speed of transactions: My SendWave transactions were completed within 10 minutes on average. This includes time taken to send the money to a mobile network provider and the recipient receiving the cash. This speed allows SendWave to compete effectively with other instant money transfer services.

- Early mover advantage: SendWave were one of the earliest movers in the mobile money transfer space in 2014. Their quality of service has spread quickly via word of mouth and allowed them to move into new markets relatively quickly.

- Operating model: Out of all of four key factors, I believe it is SendWave’s operating model and make it a digital winner. Financial transactions among individuals in most African countries are still cash based and mobile money provides a way for consumers to receive cash almost instantly. What makes SendWave different from its competitors is that it has plugged into this mobile money system, arguably the most innovative fintech product in Africa in the last decade. In effect, SendWave has not tried to create a completely new ecosystem or change deep rooted behaviors. For example, although PayPal is a safe, reliable, and quick service, the verification that make it difficult for the average Ghanaian to register for. Indeed, I had to set them up abroad before being able to use PayPal in Ghana.

Where Can They Be Hurt?

There are two key risks SendWave face:

- New entrants: In the short to medium term, SendWave is likely to face increased competition from new entrants. This could either be new, independent initiatives like SendWave or WorldRemit or current large players like PayPal developing new mobile money services. Indeed, an independent company called SawaPay launched shortly after SendWave and are a direct competitor to them.

- Changing consumer behaviors: In the long term, as African economies become less cash focused, services like SendWave’s would become more and more obsolete. However, this isn’t likely to happen for a while and SendWave should have time to adapt should significant changes in consumer behavior occur.

Thus, although there are risks that SendWave face, I believe it’s perfectly possible for them to address them, adapt, and compete. The company is currently powering forward, growing and entering new markets. In this moment, they are a clear winner.

Mobile money continues to grow especially in emerging markets. This app is great because it simplifies the process of connecting funds across countries from different parties and as I understand, would still work as a delivery model to those with mobile phones (that aren’t smart). I wonder about two things 1. how this might be helpful on the b2b or b2c level and what kind of tax implications there might be and 2. is there a way or a reason to penetrate the non-smartphone mobile user market? If non users bought a phone could it be assumed that they would get a feature phone instead of a smartphone? I wonder what the upside would look like with changes in these factors.

Great article! On top of the arguments that you have elaborated, I think that a big competitive advantage they have is their current user base. As a business with strong network effects (same-side), low differentiated market (there are no multiple products per company) and high multi-homing costs, it seems reasonable to think that this will most likely be a “winner-take-all” or 2 winners-take-all market. In this sense, Sendwave is extremely well-positioned to react to new entrants and adapt to long-term cash-less trends. It will be also very interesting to learn what are the next steps they are planning and if the money transfer success is considered as a key opportunity to offer complementary financial products for the same customer base.

Great article! I haven’t heard of Send Wave but I understand how complex and expensive its is to send money from the US to Nigeria. Also, a significant amount of the money in the system is from remittances. This space is definitely ripe for disruption and with the growth of the Nigeria diaspora the growth opportunities for this business is robust. However, given that most of these transactions need to go through banks and western union has an endearing relationship with banks; I wonder how this has limited their growth prospects