Quicken Loans – Rocketing Forward the Digital Mortgage

Quicken Loans is transforming the mortgage process through digitization and automation

For decades, the purchase of a new home began with the generally uncomfortable and often impossible task of gaining financing from a shark-like retail banker whose ear-to-ear grin provided little comfort that anything less than an arm and a leg would be needed to realize the dream of white picket fences and sprawling backyards. The soul-bearing experience could last months, with a black box dictating one’s future and the only sure thing: an unpleasant and expensive experience. As home ownership increased, the process became simpler and easier, but remained one of the relics of a pre-digital age. Over the last decade or so, Quicken Loans has completely changed this process for the better.

Often viewed as a lagging industry when it comes to digital innovation, some financial services companies, most notably  Quicken Loans, have built remarkable business models centered around automating and streamlining processes previously reserved for face-to-face conversations. In 2015 alone, Quicken Loans originated $79 billion in mortgages, placing the company third behind finance giants, Wells Fargo and Chase. Quicken was a very early adopter of digital innovation, beginning the process of offering mortgage loans online in 1999. Quicken continued to grow in the early 2000’s, but the financial crisis provided the key catalyst for the business, with new regulations and costs to traditional mortgage originators skyrocketing, while Quicken continued to find ways to harness the power of automation to reduce their own costs to underwrite.

Quicken Loans, have built remarkable business models centered around automating and streamlining processes previously reserved for face-to-face conversations. In 2015 alone, Quicken Loans originated $79 billion in mortgages, placing the company third behind finance giants, Wells Fargo and Chase. Quicken was a very early adopter of digital innovation, beginning the process of offering mortgage loans online in 1999. Quicken continued to grow in the early 2000’s, but the financial crisis provided the key catalyst for the business, with new regulations and costs to traditional mortgage originators skyrocketing, while Quicken continued to find ways to harness the power of automation to reduce their own costs to underwrite.

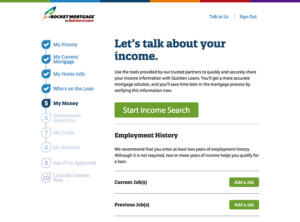

The online lending product creates value for customers by offering an easy-to-use interface that allows consumers to determine their eligibility for loans without needing to trek from bank to bank comparing rates. Combined with a savvier customer who can use Intuit or LendingTree to compare rates, customers are increasingly comfortable cutting out the middleman and interacting directly with the web-based or application-based interface. Additionally, Quicken’s partnerships with credit bureaus, financial institutions and regulatory authorities allows the company to more easily verify details, reducing the costs and risks associated with the underwriting process. Given these cost advantages, the company can offer more competitive pricing (generally seen in fees vs. rates) which results in direct customer savings. Quicken has found strong growth in refinance originations and FHA lending where price sensitivity tends to be a key consideration.

The online lending product creates value for customers by offering an easy-to-use interface that allows consumers to determine their eligibility for loans without needing to trek from bank to bank comparing rates. Combined with a savvier customer who can use Intuit or LendingTree to compare rates, customers are increasingly comfortable cutting out the middleman and interacting directly with the web-based or application-based interface. Additionally, Quicken’s partnerships with credit bureaus, financial institutions and regulatory authorities allows the company to more easily verify details, reducing the costs and risks associated with the underwriting process. Given these cost advantages, the company can offer more competitive pricing (generally seen in fees vs. rates) which results in direct customer savings. Quicken has found strong growth in refinance originations and FHA lending where price sensitivity tends to be a key consideration.

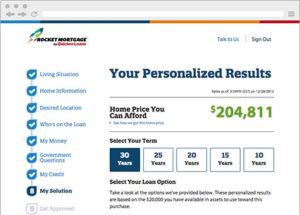

In late 2015, Quicken further revolutionized mortgage lending through the launc h of Rocket Mortgage which is largely focused on streamlining the home loan application process. The new process allows for e-signature, credit report downloads, importation of key information and document storage. Quicken’s online lending product also allowed for customization tools previously only available by negotiations with mortgage brokers. Quicken’s tools allow customers to make trade-offs between rate, term, monthly payments, fees and other aspects of their loan to determine the best personal fit.

h of Rocket Mortgage which is largely focused on streamlining the home loan application process. The new process allows for e-signature, credit report downloads, importation of key information and document storage. Quicken’s online lending product also allowed for customization tools previously only available by negotiations with mortgage brokers. Quicken’s tools allow customers to make trade-offs between rate, term, monthly payments, fees and other aspects of their loan to determine the best personal fit.

As many industries have, mortgage lending is likely to continue to shift to a digital medium going forward. Competitors such as loanDepot and Social Finance (SoFi) have also entered the arena, given the size of the mortgage loan origination market and the secular shift to digital. To date, loanDepot still lags heavily behind Quicken Loans in terms of the quality of their online and mobile product, requiring far more non-digital processes to complete the process. SoFi, originally focused primarily on student loans has focused more on the strategy of changing credit underwriting and utilizing different data sets to determine the risk of borrowers. Along with peers in the personal loan space (Lending Club, Avant, Prosper), much remains to be seen regarding the adequacy of the measures in place to reduce risk. These risks, now amplifying by the magnitude of damage during the financial crisis, present larger problems to firms that seek to find “creative” underwriting methodologies to offer cheaper loan products, including the requirement to repurchase improperly issued loans from government agencies.

While the home loan origination market continues to shift to digital, the rate of adoption remains relatively muted, but has been seen accelerating over time. Quicken’s commanding lead in the market, continued focus on innovation and automation and strong brand should allow for success in the digital age of finance.

Given that Rocket Mortgage requires people to upload lots of personal data, cyber security must be paramount in this space. Has Quicken taken any visible steps to assure customers of the safety of their information?