Quantopian: Crowd Sourcing Hedge Funds

Quantopian harnesses the power of crowds by allowing anyone to contribute quantitative investment strategies through their platform – and get paid for performance.

Quantopian is the first company to leverage the wisdom of the crowds to develop investment strategies. Its innovative business model has rattled Wall Street and opened the door for previously undiscovered talent to break into the world of finance, and blurred the lines between hedge funds and consumer-oriented businesses. Quantopian’s unique business model has attracted attention from venture capital funds and hedge funds alike. Andreessen Horowitz and Steven Cohen’s Point72 Ventures invested $25 million in a Series C in November 2016 [1].

Value Creation

Quantopian hosts a web-based coding interface that allows users to conduct quantitative research with pre-provided datasets such as equities prices,  regulatory filings and more [2]. Users can then use this data, combined the Python programming language and an in-house built trading library, to more easily develop algorithmically-driven trading strategies, without the need to develop the highly sophisticated information technology infrastructure required to do it independently. Mathematicians, statisticians, tinkerers and investment professionals from around the world can explore their trading ideas more easily. Once these algorithms are developed, users compete for cash prizes and the opportunity to put real money behind their strategies.

regulatory filings and more [2]. Users can then use this data, combined the Python programming language and an in-house built trading library, to more easily develop algorithmically-driven trading strategies, without the need to develop the highly sophisticated information technology infrastructure required to do it independently. Mathematicians, statisticians, tinkerers and investment professionals from around the world can explore their trading ideas more easily. Once these algorithms are developed, users compete for cash prizes and the opportunity to put real money behind their strategies.

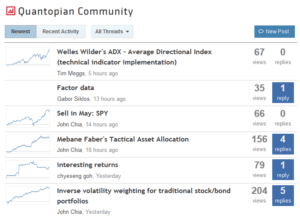

Quantopian emphasizes and works hard to develop its community by hosting events, contests and other projects to encourage developers [3]. The online coding platform allows users to collaborate with each other on code development, further promoting cross pollination which can lead to more innovative algorithms.

Quantopian has also pushed the often secretive hedge fund industry further by open-sourcing its software for developing, testing and implementing algorithmically driven trading strategies, called Zipline. This library, available to all on Github, allows Quantopian to reach into existing hedge funds by offering its tools, thereby acclimating quantitative researchers in those institutions to the platform, potentially drawing them in.

Quantopian leverages their public platform by keeping tabs on all of the algorithms being developed by users, taking the best ones and deploying its own capital behind those strategies. Users who develop strategies that make the cut and become profitable are entitled to a 10% share of the profits generated [4]. Additionally, Quantopian intends to offer these investment vehicles to the public, making Quantopian into a crowd sourced hedge fund – the first of its kind. Beyond this value capture strategy, Quantopian also stands to benefit greatly from its ability to attract top talent, previously undiscovered by the financial services industry. This can create a lucrative secondary value capture strategy as a recruiting platform for hedge funds and the alike.

Challenges Ahead

Quantopian is effectively crowd sourcing the work traditionally done by quantitative trading hedge funds in the search for profitable investing strategies. This may prove to dramatically lower the cost of developing advanced trading strategies in financial markets, and provide investing opportunities to the general public into these sophisticated strategies with lower fees than traditional hedge funds. However, to date Quantopian has not released any information regarding the performance of its investments backed by user-generated algorithms. In a bid to increase credibility as an investing vehicle, Quantopian has begun hiring industry stalwarts to its executive suite [5]. Some worry that by gathering so many disparate user-generated algorithms, they may be falling prey to spurious correlation effects and data-mining [6]. This may ultimately lead to the appearance of high performance in retrospect, but disappointment returns in reality.

Quantopian may be breaking new ground by launching the world’s first open-sourced hedge fund – but must contend with numerous challenges in attracting and retaining high quality users, and providing effective tools to allow them to be productive. As Quantopian begins to launch its publicly available funds to the world, the rest of the street will be watching closely.

References:

[1] https://www.bloomberg.com/news/articles/2016-11-14/andreessen-horowitz-point72-invest-in-crowd-sourced-quantopian

[2] https://www.quantopian.com/

[3] https://www.quantopian.com/events

[4] https://www.quantopian.com/allocation

[5] http://www.prnewswire.com/news-releases/jonathan-larkin-joins-quantopian-as-chief-investment-officer-300280255.html

[6] https://pando.com/2015/03/05/finance-novice-beats-hedge-fund-pros-wins-100k-in-inqugural-quantopian-trading-contest/

Hi David,

This is really interesting, and sounds like a much more effective model than Vetr (which I think you responded to). Feels like incentives are better aligned here. I can imagine the volume of incoming investment strategies is hard for Quantopian to manage effectively. Users are incentivized to find strategies that maximize returns based on a backtest, but if those users are constantly tweaking strategies to fit the data, they could show deceptively favorable results. For Quantopian, sifting through the different strategies, avoiding spurious correlation, and looking for some semblance of causation has got to be tough. I’m very curious as to how they manage that effort. I’m also interested to see performance results whenever they’re released!