Palantir – Solving the “Biggest” of big data problems

Palantir – A discussion of its keys to success and what could threaten its mighty hold on big data analysis.

Palantir is a software company that provides data modeling, data summarization, and data visualization for firms with large quantities of data.

The core of its value creation model lies in its ability to enable the analyst (say, at a multinational bank or a government agency) to generate the insights that lead to value-accretive tasks such as unique investment trading strategies as well as invaluable actions such as preventing the next act of terrorism. The firm relies on both the analysis of data, in order to determine its relevance and significance, as well as the creative usage of data to visualize its applications across multiple domains. Its closest competitors, Ayasdi and Centrifuge, differs primarily their broader industry (Healthcare and retail, in the case of Ayasdi) and functional focuses (security focused only).

To provide an example of its data usage, here is a description of their two platforms:

Palantir Metropolis: A quantitative analysis platform that enables multi-study demands. Clients: Palantir Metropolis is used by hedge funds, banks, and financial services firms.

Palantir Gotham: A platform that allows for cross-organization collaboration and presents data in semantic, geospatial and temporal views. Clients: CIA, DOD, fraud investigators at the Recovery Accountability and Transparency Board, and cyber analysts at Information Warfare Monitor.

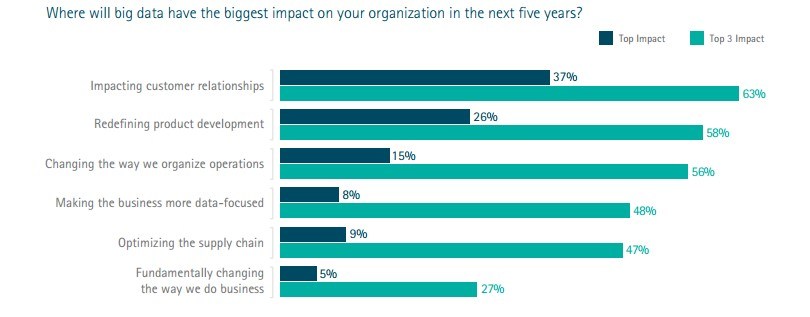

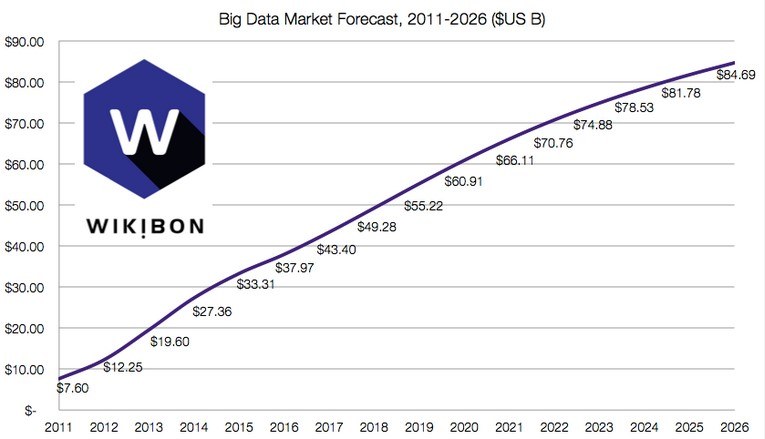

Having clients such as the CIA and SEC, and working across a number of functions such as crisis response, R&D, cyber security, anti-fraud, and human trafficking provides the firm with unparalleled access to data, the interpretation of which would be useful to the government agencies of any country in the world. Furthermore, industry reports cited below indicate that the role of big data has only just begun. While Palantir is focused on high-value implications of data analysis, these platforms will be just as useful across a number of industries such as manufacturing, telecommunications, healthcare, etc.

There are a few key factors about Palantir’s operating model that enable its success in value creation and capture.

- Talent – The company is and was fortunate to have access to talented engineers in Silicon Valley who were completed dedicated to the their mission and tackling the “biggest” problems in the world. This was important given that their client’s, particularly in finance and intelligence, would share this passion, making for a great product market fit.

- Open source development –Gotham’s developers have engaged in open source development, which allowed them to reap the network effects of community bug testing and further feature development, particularly with geography calculations.

- Secrecy – Despite the availability of open source development on some platforms, most industry professionals do not have a full understanding of the company’s processes and techniques for developing platforms and its enhancements. This air of secrecy lends itself to protecting the information of its clients, and staving off encroachment on their client base.

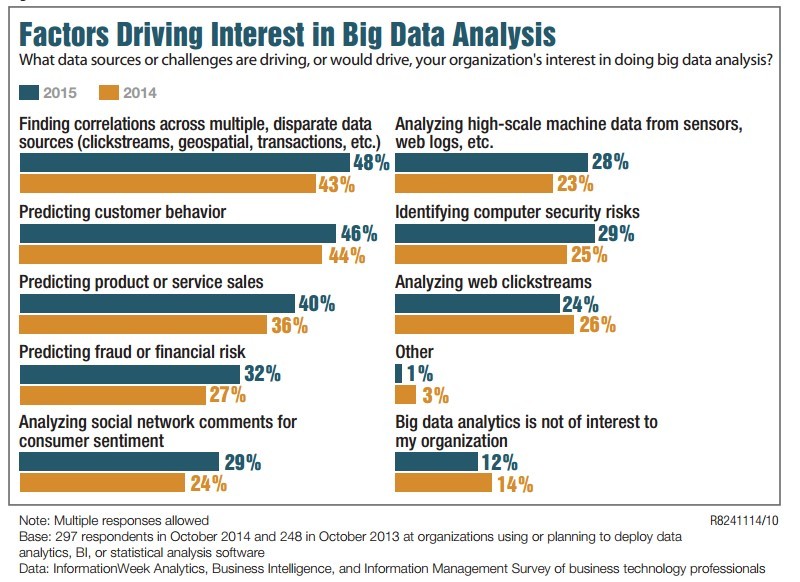

Based on the above two graphs, I anticipate several threats to their current success:

- The response of the deep-pockets tech giants: How long with the likes of Oracle, SAP and IBM stand by and allow Palantir to corner this portion of the big data market? Aside from their $20 Billion valuation, which would be an extraordinary price to pay, I would think that this is an extremely ripe acquisition target.

- Maintaining their secrecy: Their secrecy is key to maintaining success. Any major data breech would threaten the security of its clients and the credibility of the company.

Sources:

https://www.palantir.com/about/

http://www.slideshare.net/palantirtech/architecture-1546613?next_slideshow=2

http://www.forbes.com/sites/quora/2012/12/12/how-did-palantir-build-such-a-strong-brand/

http://boundlessgeo.com/case-study/palantir-open-source-development-success-story/

Thanks for sharing all this insight. However, I do not view acquisition as a threat to Palantir. Any company to acquire Palantir would likely do so for its customers, its talent, or its IP and would have to pay a significant multiple do so. There are a limited number of players whose balance sheets could sustain the size of this transaction (those that you mention) and be able to reap the synergies to justify it. Palantir’s diverse customer base (from national governments to CPG companies) mean it may be more capital efficient as a standalone company. If a company were to acquire Palantir for its talent (and Palantir’s engineers represent the top of the top), that talent is unlikely to be satisfied within the constraints of a large, traditional company and may flee. Therefore, even if Palantir were to be acquired, it would likely continue to be run as a standalone business, in which case it makes little difference from a business trajectory standpoint whether Palantir eventually goes public or is bought by a strategic acquirer.

Another threat would be disintermediation. I could imagine that many of the biggest clients would want to hire their own sophisticated talent if they think the utilization of those data scientists makes sense. That way, particularly sensitive clients like intelligence agencies would maintain control over the process.

Thank you for the article. I was unaware of Palentir before reading this piece. Another potential threat to the company is firms who do their own data analysis and interpretation. As use of the Internet and data analysis tools become cheaper and more widespread, companies will be able to internally reproduce what companies like Palentir currently offer. What do you think is Palentir’s competitive advantage to hedge against this scenario?