Outfront Media: Billboard of the Future

Outfront Media is keeping out-of-home advertising relevant in the online world

Outfront Media (formerly CBS Outdoor) has grown its revenue at an annual rate of ~4.5% over the last 5 years. This may seem unworthy of a “winner” in comparison to the double and triple digit growth rates logged by the Facebooks, Netflixes, and Ubers of the world. However, context is everything.

Outfront Media is the nation’s largest out-of-home advertising company. It owns or leases billboards, posters, and other displays on highways/roads, public transit, malls, and other locations. It then sells advertisements on these displays to local and national brands:

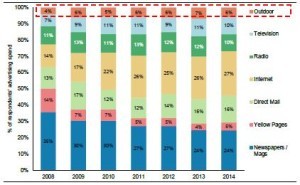

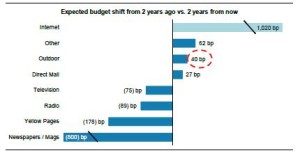

The dominant theme in advertising, of course, has been the inexorable shift from “offline” to “online” channels. It is remarkable, therefore, that out-of-home advertising has actually increased its share of advertising spend since 2008 and is projected to continue doing so at a faster rate than any category other than online:

Source: Morgan Stanley Research

This resilience is partly attributable to the nature of out-of-home advertising. People spend 70% of their days outside of home and billboards/posters are hard to miss even in a digital world (https://www.oaaa.org/OutofHomeAdvertising/TheValueofOOH.aspx). However, Outfront Media and a subset of its peers are catalyzing industry growth and taking share through digital initiatives that are revolutionizing one of the world’s oldest business models.

Digital Screens

Outfront Media’s most substantial digital opportunity is the conversion of static displays into digital ones. It is replacing paper and paint with electronic screens at a rate of ~150 displays per year.

Digital displays meaningfully increase the value delivered to customers and the value captured by Outfront Media in the following ways:

- Digital displays improve capacity utilization by increasing the number of advertisements that can be shown in one location. This allows Outfront Media to allocate and price advertising space/time more efficiently. For example, a retailer might be willing to pay more for an advertisement during the day when it is open and a nightclub might pay more through the night.

- Digital displays can dynamically respond to the environment around them. For example, an advertisement for WalMart might show umbrellas if it is raining, shovels if it is snowing, and sunglasses if it is sunny.

- Digital displays reduce the cost and lead time associated with rolling out a new campaign. The process of changing static displays is highly manual – a crew needs to physically change what is on the display. The labor is expensive and the pre-planning is cumbersome. Digital displays can be changed with the click of a button.

- Digital displays extend Outfront Media’s network effects and allow it to access more national ad dollars. Out-of-home advertising was historically a very local business because of the difficulty of coordinating displays in different parts of the nation and because few vendors had a national footprint. In fact, most of Outfront’s peers derive 80% – 90% of their revenues from local ad spend. Digital displays allow Outfront to coordinate out-of-home advertisements more broadly than was previously feasible given the manual selling/logistical process. As such, Outfront can now offer programmatic, broad-based, nationwide advertising campaigns. For example, McDonald’s can more easily advertise a new menu offering on billboards nationwide. This is quite rare among advertising channels – only TV and, more recently, some Internet offerings can claim as broad a reach – and offers Outfront Media a competitive advantage versus smaller out-of-home advertisers.

- The impact of the aforementioned effects is that digital conversions are financially attractive for Outfront Media. On a per-screen basis, digital displays generate 4-6x the revenue that static ones do due to increased capacity utilization and more targeted ads. Indeed, digital revenue has been growing 10%+ and is helping boost Outfront’s overall growth. Moreover, digital revenue comes in at 85% gross margins vs. 70% for static (due to the lower maintenance costs). Of course, the digital conversions involve upfront capital costs. However, they have fallen ~40% over the last 4 years (for billboards, the capital expenditure is now ~$250,000 per display). Given the enhanced revenues and margins associated with the conversions, analysts estimate the investment payback period is ~3 years and that the ROIC associated with digital billboards is a robust ~30% (Source: JP Morgan Research).

Measurement

Among online advertising’s greatest selling points is measurability. Websites can not only track the number of “eyeballs” that view an ad, but also the number people who click on it, etc. Out-of-home advertising was historically on the other end of the spectrum. Indeed, the phrase “billboard effect” came to refer to an unquantifiable advertising impact. However, Outfront Media has teamed with other out-of-home advertisers to develop a digitally-enabled rating system called TAB. It combines cameras, motion sensors, eye-tracking technologies, and 3rd party data to quantify the number of people who have passed a specific out-of-home display and to estimate the number who looked at the display (http://www.outfrontmedia.com/tools/research/pages/default.aspx, http://tabonline.com/). As TAB claims, this creates a “standardized, quantitative, and reliable” tool for brands to better understand the value from specific out-of-home displays and for Outfront to price accordingly.

Interaction

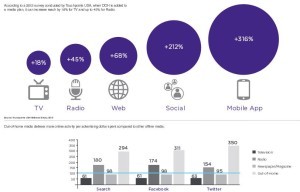

One factor that brands consider in selecting advertising channels is the degree to which they encourage consumer interaction. Out-of-home advertising is highly effective at encouraging interaction through various platforms:

Source: Outfront Media (http://www.outfrontmedia.com/Tools/HowToAdvertise/Documents/OutfrontMedia-Why-OOH.pdf)

Outfront is leveraging digital technologies to increase the degree to which consumers can interact with out-of-home displays. It is rolling out touchscreen displays, interconnecting with social media, and leveraging near-field communications (NFC) to encourage people to interact with displays using mobile devices. While still nascent, these efforts to promote engagement mark the next frontier for out-of-home advertisers.

Outfront Media’s efforts are certainly not without risks. Digital screens make up ~10% of Outfront’s revenue. Assuming the company is prioritizing the highest-return conversions first, then returns to future static-to-digital conversions will be lower than they have been. Indeed, some analysts believe Lamar Advertising, one of Outfront’s competitors, has already reached the point where future digital conversions do not generate an ROIC in excess of its cost of capital. However, Outfront has certainly played a role in keeping the industry relevant while other old-line ad channels decline and may very well continue to create the billboards of the future.