Opendoor: Transforming the Residential Real Estate Market

Residential real estate is one of the largest markets yet to be transformed by digitalization. Opendoor is trying to change that.

Opendoor is a platform company focused on bringing together buyers and sellers in one of the most important product categories in the United States: residential real estate. With an annual transaction value of $1.6 trillion and a low customer satisfaction score, residential real estate is seemingly primed for disruption, but just 13% of real estate buyers prefer shopping for a home online. The figure is even lower for sellers. Despite their limited progress thus far I believe Opendoor is in the process of building the next great platform, transforming the home buying and selling experience for the better in the process.

Opendoor’s primary competitor in the online residential real estate space is Zillow. Launched before Opendoor, Zillow has focused their attention on aggregating the demand side of the market by organizing home listings. They have also added a unique ‘Zestimate’ figure which estimates the values of homes that have not been or may not be on the market for some time.

Opendoor has approached the market from the opposite side, by focusing their attention on the needs of the seller. Opendoor has created the first viable alternative to selling your home via the traditional realtor led way in some time. Leveraging a proprietary pricing algorithm, and a considerable war chest of debt and equity capital, Opendoor provides competitive cash offers to home sellers within 24 hours of a submitted request. If a homeowner accepts the offer they can receive cash and complete the sale in their home within just a few weeks.

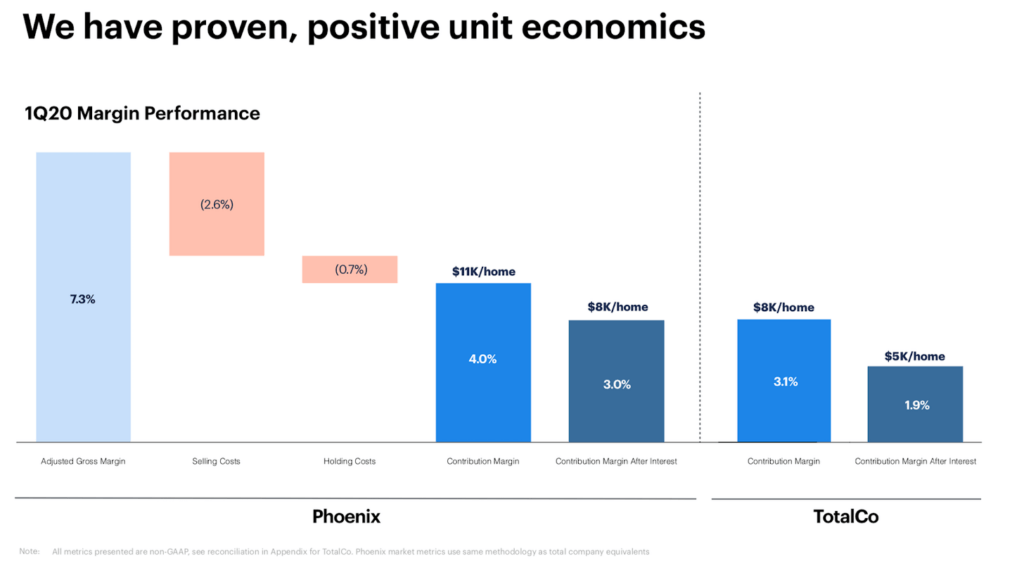

To help facilitate this magical seller experience Opendoor assumes inventory risk from the seller. Once they’ve paid cash for the home they list it on the market and attempt to sell it to interested buyers accessing the other side of their platform. As compensation for inventory risk and associated selling costs Opendoor charges around 8-10% the value of the home. This charge is assessed in the form of a purchase discount at time of sale, meaning that a seller receives an offer around 8-10% below the market value of the home. The seller is “paying” for the convenience, speed, and certainty that Opendoor offers by accepting a lower purchase price.

The Opendoor platform creates value for both home buyers and sellers. Sellers are able to access liquidity more quickly, and bypass the hassle associated with listing and showing a house. Buyers get value as Opendoor passes along some of its 8-10% margin in the form of home discounts, which are applied to help speed the sale process which reduces Opendoor’s carrying costs.

Opendoor’s model creates unique network effects, which also allows them to capture significant value. Opendoor meaningfully benefits from cross-side network effects. As sellers sell their home at a discount to access quicker liquidity it allows Opendoor to seed their platform with attractively priced homes which in turn attracts home buyers hungry for discounts. More buyers gives Opendoor the confidence to purchase more homes on more favorable terms to sellers as they can accurately estimate how long it will take to sell the home and at what price. This virtuous cycle compounds, enabling Opendoor to offer a better experience to both sides of the platform over time.

Opendoor’s model is also inherently protected against multi-homing and disintermediation. Unlike Zillow, which lists homes that may also be posted on other platforms, Opendoor will feature exclusive inventory, as any home listed on their platform has already been sold to them. Given that Opendoor is matching buyers and sellers with non-overlapping time frames who are not repeat purchasers, disintermediation makes little sense.

These dynamics make Opendoor’s model highly defensible, and in turn highly scalable. While Opendoor must transact on relatively thin margins, the flywheel dynamic described above will allow them to capture outsize value over time. With each additional purchase and sale Opendoor’s pricing algorithm becomes more savvy, helping to reduce their exposure to mispricing risk. As more people use the platform the average listing time will decline, allowing Opendoor to hold onto a larger portion of their 8-10% fee. Finally, Opendoor’s model is well suited to capitalize on housing price contractions. During downturns homeowners will seek certainty and will sell to Opendoor at discounts. Opendoor’s capital reserves enable them to buy homes at a discount, and then wait to sell them until the market recovers.

While critics will be wary of the capital intensive nature of Opendoor’s business, their strategy could enable them to become a category leader in a vertical that has resisted digitization for a long time. With the twin tailwinds of perma low interest rates, and an increasingly digital savvy homebuyer, Opendoor is well positioned to succeed.

Sources: https://www.opendoor.com/w/how-it-works

https://www.notboring.co/p/knock-knock-whos-there-opendoor?utm_campaign=P.S.+You+Should+Know…&utm_medium=email&utm_source=Revue+newsletter

https://www.cbinsights.com/research/report/opendoor-real-estate-teardown-expert-intelligence/

My good friend Alex works for Open Door. It’s been fascinating to hear about their development! They are really changing the model for residential real estate – one that you can envision being scalable to other parts of the real estate industry.