OpenBazaar: Using the power of blockchain crowds to disintermediate Amazon

To what extent will blockchain peer-to-peer crowds like OpenBazaar disintermediate the likes of Amazon?

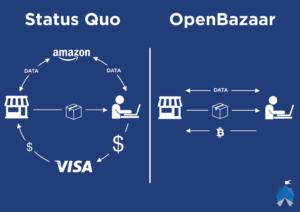

Open-source projects — like the decentralized marketplace OpenBazaar — use crowds and the blockchain to create trusted peer-to-peer relationships for commercial transactions. The OpenBazaar marketplace removes the centralized, data-hoarding, fee-charging middlemen (e.g. Amazon, Visa etc.) from the transaction and instead, buyer and seller interact with each other directly. OpenBazaar merely mediates. “No fees, no restrictions, no accounts to create and you only reveal the personal information that you choose.”

Today, most e-commerce is conducted on centralized, siloed platforms (e.g. Amazon, eBay). If you want to interact with the platform as a buyer or a seller, you have to play by the platform’s policies, relinquish your personal information and pay fees to the platform.

Don’t like it? OpenBazaar provides another way.

How does OpenBazaar work?

At risk of oversimplifying…

OpenBazaar connects and disinterestedly mediates the relationship between buyer and seller. For example, let’s say I wanted to sell my car. I list it on OpenBazaar and the listing is sent out to the peer-to-peer network of OpenBazaar users searching for a car like mine. Once we agree on price, OpenBazaar creates a digital contract, using a bitcoin escrow account and third party moderator that we both trust (i.e. another objective user in the network/crowd.)

The buyer sends the funds in bitcoin to the escrow and I’m notified the funds have been sent. Then I ship the car to the buyer and once the buyer confirms receiving the car in proper condition, the escrow releases the funds to me.

The underlying digital contract requires agreement between two of the three parties (buyer, seller, moderator) in order for the funds to be released. So, in the case of a dispute where buyer and seller disagree on how the funds should be released, the moderator decides which party to side with and either completes or cancels the transaction, releasing the funds to buyer or seller accordingly.

Incentivizing and managing the crowd

The users on the OpenBazaar network are incentivized to participate because they have greater freedom than they would on other e-commerce platforms: the policies for are less restrictive, they don’t have to give up personal information that could be stolen from or sold by the platform, and they don’t have to pay any fees to the platform. However, given its nascent state, OpenBazaar has a lower volume and variety of items and users in the crowd, so buyers and sellers may be forced to use the incumbent platforms.

With respect to managing the crowd, the escrow plus moderator system elegantly resolves disputes between peers in the network. The blockchain provides for anonymity and trust, and makes such a “platform-free” e-commerce marketplace possible.

Value creation, value capture and growth potential

The value creation is obvious, as OpenBazaar improves on Amazon in the areas of policies, personal information and fees. Users have more freedom, are more secure, and pay less.

Value capture is limited to the buyer and seller, who benefit from the value created and save time and money. As a project, OpenBazaar does not appear to capture any value, except in brand equity as a trusted place for peer-to-peer e-commerce. That said, because there is no centralized intermediary operator, there is potential for the value created to be more equitably distributed across those who contribute to the value creation (e.g. those contributing to the project and maintaining the OpenBazaar network.)

Right now, with such clear value creation, the growth potential is high but not without its challenges…

Challenges

The primary challenge OpenBazaar faces is user adoption and reaching a critical mass of items for sale. Right now, the audience is primarily developers and early technology adopters. The majority of internet users are skeptical and distrustful of bitcoin for many reasons, including that it is difficult to explain and understand, it has a slew past high profile heists and it has dramatic price volatility. Subsequently, the low consumer trust and slow adoption of bitcoin extends to the underlying blockchain technology. The perception of high technical barriers to entry is enough to send curious technology adopters back to the familiar Amazons and eBays to conduct their e-commerce.

However, it does seem only a matter of time until these communication, usability and trust issues are resolved and blockchain pervades our everyday lives. At that point, perhaps we may see widespread disintermdiation of seemingly untouchable platforms like Amazon. When, and to what extent will Amazon get disintermediated? Time will tell.

https://blog.openbazaar.org/what-is-openbazaar/#.WO2aM1PyvEZ

http://gizmodo.com/the-6-biggest-bitcoin-heists-in-history-1531881137

https://hbr.org/2017/03/what-blockchain-means-for-the-sharing-economy

Great post Erik! I like OpenBazaar – I have interviewed one of their co-founders as part of a project I was working on for Blockchain. They use blockchain tech to develop a decentralized platform for transacting and get rid of the middleman such as Amazon or eBay (and the 10-15% service fee commission they take). They also use blockchain’s enhanced privacy features.

Two things come to mind as I think about Open Bazaar:

(1) I wonder to what extend it is really a good thing to get rid of the middleman – companies like Amazon or Ebay charge a commission because they create value: For example they provide insurance, manage disputes, manage the community (and filter out trouble makers), conduct background checks, etc. All these activities have a cost that someone has to pay for. I wonder to what extend is OpenBazaar transactions really cheaper than the alternatives when compared in an apple-to-apple perspective?

(2) In terms of value capture, one very interesting concept that is currently emerging is AppCoins (See this excellent post by Joel Monegro of USV here http://www.usv.com/blog/fat-protocols). AppCoins are crypto-currencies that are issued by Blockchain-based protocols in order to capture the value created by the protocol. They can be used to (a) Raise money through Initial Coin Offerings (a concept that could disrupt the entire VC industry) (b) Distribute value across the stakeholders – for example the network participants who are escrows on OpenBazaar could be rewarded by getting OpenBazaar AppCoins in exchange for their services and (c) AppCoins can be used to reward the company itself (The company can issue and keep a bunch of AppCoin, that it can sell on the secondary market onces the AppCoin appreciates). This concept is obviously still very nascent and faces many challenges in particular in terms of regulation (Are AppCoins securities in the SEC sense?).