Omada Health: Becoming a Gold Standard for Digital Health Interventions

With the rise of US smartphone adoption as well as chronic conditions, a myriad of digital health companies have started but never really gained traction. Omada has shown the health care community what a successful digital health intervention should look like: engaging, evidenced-based, and economical.

When I was a college freshman, one my professors started lecture by asking the class to look to their left and their right. He then made the bold declaration that one of us in this group of three students would eventually fail out. I never verified this assertion, but I do remember the uncomfortable shock inspired by his statement. Now think about this: if you were seated next to two other randomly selected Americans, two out of three of you would be clinically overweight or obese.1 For pre-diabetes alone, there are nearly 86 million individuals that cost the US healthcare system over $200 billion annually.2,3

Statistics like these have inspired the Centers for Medicare and Medicaid Services (CMS) to reimburse diabetic prevention programs.2 Specifically, CMS pays physicians up to $450 per patient for the first year of diabetes prevention programs, and up to $180 per patient in subsequent years.2 Omada Health is the country’s largest federally-recognized supplier of diabetes prevention programs and for good reason.

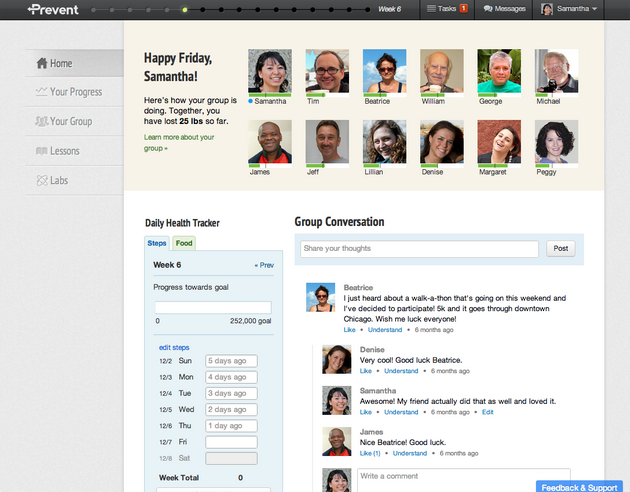

Omada’s diabetes prevention product is a digital take on clinically-proven programs. It is composed of a 16-week program that includes a smart wireless scale, an online social network, weekly core lessons, a personal health coach, and a pedometer.4 Although no in-person meetings take place, virtual group conversations with a participant’s social network and health coach exist.

Value capture is segmented into a direct-to-consumer model as well as a B2B model (mostly with employers or health plans). Individuals that purchase direct pay a monthly subscription fee, whereas rates with businesses are individually negotiated. Sounds fine and dandy but how has it gained so much traction?

First, each participating business or health organization only pays for participating members who see a clinical outcome – a significant departure from traditional health care delivery models. More generally, digital interventions have blossomed in the last decade as smart phone penetration has reached all-time highs in the US (80%).5 Until now, behavior and lifestyle changes have been extremely challenging problems. Without a device that is carried around all the time, it is difficult to keep users motivated to make lifestyle changes when they have been used to a status quo for decades. Thus, leading commercial weight loss programs have showed an average program engagement of a measly 6.6% after 12 months.2 How does Omada’s program stack up against that? 65% over 12 months – a full order of magnitude higher.2

When you look at textbook digital health interventions, Omada has really hit the nail on the head in terms of executing on some key levers. Engagement and clinical outcomes related to interventions work best when a patient believes they have therapeutic alliance with a supporting figure.6,7 That is, when a patient believes that someone else cares about their progress and success, they perform significantly better. In Omada’s program, this takes the form of a personal health coach who interacts via messaging and voice calls to understand patients’ personal needs so that they can recommend and motivate the most effective solutions. This is supplemented by a community of 10 to 15 other users with similar demographics and locations who can relate to you, cheer you on, and offer advice.

Secondly, Omada’s weekly lessons are based on a clinically-supported evidence base. One long term study that Omada published in a peer-reviewed journal highlights program participants after 2 years. Study results showed that program starters lost an average 4.7% body fat after 1 year, and 4.2% after 2 years. Furthermore, these participants reduced A1c levels by an average of 0.38% after 1 year and 0.43% after 2 years.8 These numbers were slightly better for program completers. Besides proving significant weight loss and diabetes risk reduction over sustained periods of time, these statistics compel adoption not only by individuals and employers, but by health providers and health systems as well. A recent partnership with the AMA and Intermountain Healthcare is further evidence that Omada’s solution is accepted as science, not snake oil, by the scientific community.9 The collaboration sets a milestone as the first time the AMA has worked with a digital health provider to refer users to an online intervention.

In 5 years, Omada has collected a base of over 75,000 patients, and that number is trending upwards.10 Likewise, revenues have doubled from $9.8M to $19.9M between 2015 and 2016. While most of the money in healthcare crowds around treatment – particularly for chronic conditions – Omada has identified a niche opportunity in prevention. Needless to say, they are executing nicely.

References:

[1] https://www.niddk.nih.gov/health-information/health-statistics/Pages/overweight-obesity-statistics.aspx

[2] http://fortune.com/2016/04/22/omada-digital-health-diabetes/

[3] “Omada Health: Riding the Clinical and Regulatory Waves,” Robert F. Higgins, Lisa Zhou. Harvard Business School, 2015.

[4] https://www.omadahealth.com/about

[5] https://www.comscore.com/Insights/Rankings/comScore-Reports-January-2016-US-Smartphone-Subscriber-Market-Share

[6] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC1464091/

[7] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3198542/

[8] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4409647/

[9] https://www.omadahealth.com/news/ama-omada-health-intermountain-healthcare-partner-to-reduce-incidence-of-type-2-diabetes

[10] http://www.geomarketing.com/omada-health-digital

[Image 1]: http://vator.tv/news/2015-09-16-omada-health-raises-48m-to-help-prevent-diabetes

[Image 2]: https://techcrunch.com/2012/12/11/nea-backed-omada-health-launches-its-16-week-digital-health-program-to-bring-diabetes-prevention-online/

Great post! Would be curious to hear your take on how replicable the Omada model is. Is it truly differentiated? Or is this easy for competitors to replicate?

ah sorry – see comment below

Hi Alice! Thanks for the question. First, digital health companies certainly have an easier time selling to self-insured employers. The clinical rigor that is needed to convince these organizations is less stringent compared to that which is required to sell to a health plan or integrated delivery network (IDNs). It just so happens that health plans and IDNs have significantly higher reach in terms of patients/users for a digital health service. Once Omada gains a foothold with players like Humana and InterMountain Health (which they’ve already done to different extents), Omada will gain a large user base all at once which it can then in turn learn from iteratively. Additionally, these players (health plans and IDNs) are also less likely to switch services. Lastly, Omada’s competitors may not lag behind on building an engaging lifestyle-changing experience, but generating the data to prove outcomes will take much longer.

So great to see a post about Omada – I definitely believe that are the leaders of behavioral change in the diabetes space. Besides barriers to entry as Alice mentioned, I would also be curious to see how Omada can scale their model in a way that is profitable and continue to show sustained results. Only time will tell!

Thanks for the post and further clarifications in answer to Alice’s question.

I’m wondering how much further leverage can Omada get by partnering with hospitals in US and abroad and collect more data that would allow it to improve the quality of its offerings? Partnerships could help it on the path to profitability and increase user engagement.