Nubank: Digital Banking

Nubank is a Brazilian digital bank. Nubank’s products include credit cards, debit accounts, and most recently, personal loans. As a digital bank, it provides all of its services through digital channels, upending the traditional banking industry that relied on physical branches. Nubank was founded in 2013 and as of 2019 had 8.5 million customers, becoming the largest digital bank outside of Asia [1]. In addition, with 5 million credit card customers, Nubank is the fifth largest credit card issuer in Brazil [2].

Creating and Capturing Value

Nubank has several competitive advantages that have allowed it capture value from incumbent banks.

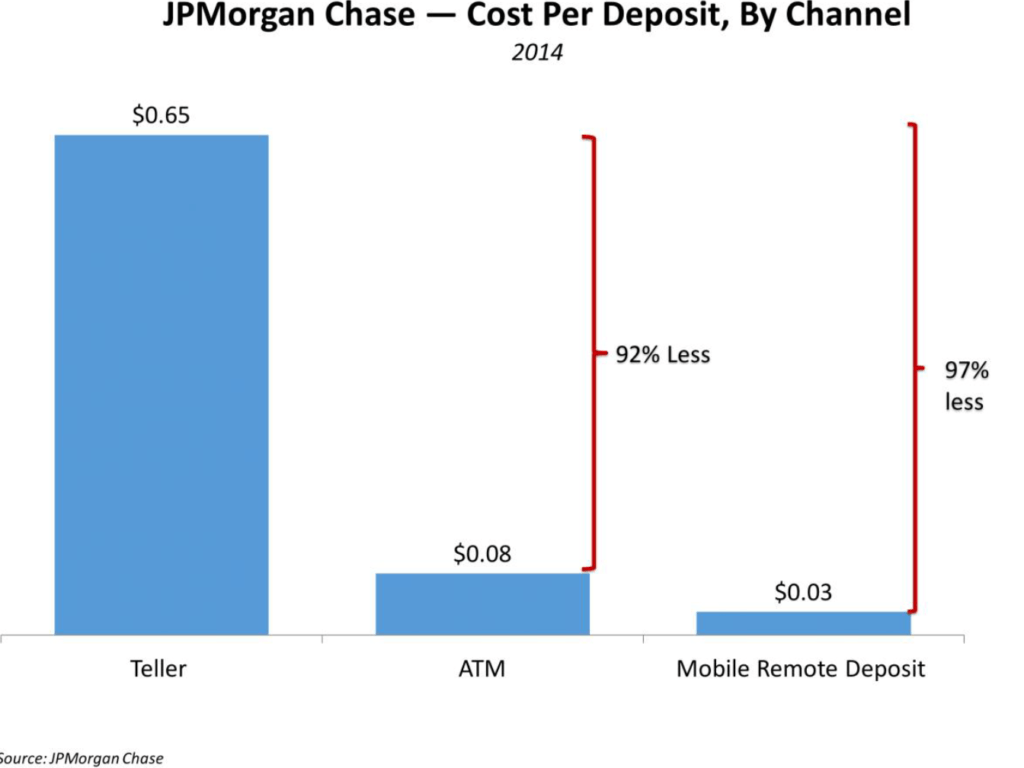

- Cost advantage: Digital banks can serve customers at a fraction of the cost of traditional banks. The image below compares JP Morgan’s cost per deposit between its bank tellers and mobile services and is provided for illustrative purposes. Instead of spending capital on physical branches, digital banks can reinvest capital in their technological solutions and provide incentives to consumers. Nubank does not charge fees to consumers. Its interest rates vary between 2.75% and 9.99% per month. While these rates exceed those of international markets, they are below Brazil’s average of 13.9% per month [3].

- Overcoming barriers to entry: The banking industry’s barriers to entry included their branch network. Digital channels have allowed banks to acquire and service customers without having to deploy capital and spend time building a network of branches. Nubank has been able to scale quickly.

- Convenience: Digital banks appeal in particular to millennials, as they are less likely than earlier generations to use bank branches [4]. One explanation for this behavior is that millennials find digital banking more convenient than traditional banking. Through digital banks, consumers can skip the long lines at branches. Research analysts at JP Morgan analyzed the ease of opening an account at different Brazilian banks. With Nubank, registration for an account took 20 minutes on the app, approval for a credit card was received within 1 day, and the card was delivered within 8 days. At incumbent banks, credit card approval varied between 1 and 21 days and the card was delivered within 8 to 31 days [5].

The Incumbents

Brazil’s banking industry has been traditionally dominated by five players: Itau, Banco Santander, Bradesco, Banco do Brasil, and Caixa Economica. Through no fee products and lower interest rates on lending products, Nubank threatens to erode the profitability of incumbents. Eroding margins is more plausible in a banking industry that is the amongst the most lucrative in the world: Itau and Banco Santander’s ROEs of 18% and 15% [6], exceed the ROE averages of the banking industry in the United States and Europe [3]. The Brazilian banking industry also charges amongst the highest interest rates in the world on its credit products.

The proliferation of digital banking has forced incumbents to rethink their business model. Traditional banks have responded by introducing their own digital products. The number of bank branches in Brazil has been declining in the past few years, with a 6.6% decrease in 2017 [7]. Yet, incumbents will not be singularly focused on digital products as they also serve populations that still prefer to have their banking services delivered at a branch.

Unbanked Consumers: A New Source of Value?

Unbanked consumers are traditionally under-served because banks cannot service them profitably. Unbanked consumers have deposits that are less stable (implying lower revenue streams for banks), and higher branch usage (implying higher costs for banks) [8]. With lower costs, digital banks need to generate less income per customer to reach profitability. As a result, they are uniquely positioned to serve unbanked communities.

Unbanked consumers may also have a higher default risk. Banks incur higher underwriting costs to service loans. Digital banks are uniquely positioned to lend to these consumers as they can assess risk in a more cost-efficient manner. Digital banks can make use of proprietary data sources and have the internal capabilities to provide data insights on the credit worthiness of consumers.

Nubank has yet to explicitly target unbanked consumers, but it would be uniquely positioned to do so. By servicing these costumers, it would be creating a new market as opposed to stealing market share from incumbent banks.

Time will tell whether the incumbents will continue to see a decline in their market share, or whether they can enhance their digital capabilities and customer service to match that of Nubank.

Citation

- (2019). You probably haven’t heard of Nubank. But it could be a $10 billion company, so you should.. [online] Available at: https://www.vox.com/recode/2019/6/5/18654454/nubank-softbank-valuation-brazil-banking-funding [Accessed 24 Sep. 2019].

- com. (2019). Brazilian Fintech Nubank Launches Debit Card To Reach 120M Clients. [online] Available at: https://www.forbes.com/sites/angelicamarideoliveira/2018/12/11/brazilian-fintech-nubank-launches-debit-card-to-reach-120m-clients/#4bd59fcb51b8 [Accessed 24 Sep. 2019].

- Fintechs target Brazilian banks’ fat margins | Financial Times. [online] Available at: https://www.ft.com/content/78058d7c-7c90-11e7-9108-edda0bcbc928 [Accessed 24 Sep. 2019].

- Heggestuen, J. (2019). Ahead of the Curve: The Digital Disruption of Retail Banking. Business Insider.

- Brazilian Digital Banking. (2019). Nubank & Incumbents. JP Morgan.

- net. (2019). Itau Unibanco Holding S.A ROE 2006-2019 | ITUB. [online] Available at: https://www.macrotrends.net/stocks/charts/ITUB/itau-unibanco-holding-sa/roe [Accessed 24 Sep. 2019].

- Hussain, A., & Khan, E. (2018, Mar 15). Fintech proliferation, evolving clients compel bank branch closures in brazil.SNL Latin America Financials Daily Retrieved from http://search.proquest.com.ezp-prod1.hul.harvard.edu/docview/2014645710?accountid=11311

- Tesfaye, M. (2019). Fintech and Financial Inclusion. Business Insider.

Great article on Nubank nailing it in Brazil (and expanding throughout Latam!). I personally relate to the story in a way. I closed my account with brick and mortar Santander in Chile given how bad customer service was. I did not change to Nubank then, instead I went for a less massive, more relationship driven bank where my account executive could actually pay attention to my requests. But if Nubank through digital technology can deliver a better service than the most attentive branch staff, I wonder how it may end up disrupting even the higher end of retail banking. At least where I am from, people choose a bank for either the benefits or the service. Maybe Nubank is slowly undercutting big banking on both fronts?

Great article. In reading it, I had two thoughts. First. if the incumbent banks were to launch digital bank interfaces (apps, websites, etc.) how much of the customer traffic to Nubank could they win back? Second, other than default risk are there other factors that make the unbanked population less attractive (bankable economic activity, etc.).

The second question is one that is of particular interest to me because we often see that digital entrants (in industries that offer historically sticky products) often need to rely on winning previously excluded customers to bolster growth from switching clients who may take longer to convince. If the commercial attractiveness of that excluded population is markedly worse (or different than the broader population), it is possible for the company to experience relative under-performance if it ever decided to rely heavily on that population.

Such an interesting read that connects to my first-hand experience at FGI Brazil! Playing the side of the incumbent, I was tasked to help Itaù “create a digital offering that would allow its millennial users gain the full benefits of a large bank, while also giving them ample opportunity to experiment”. What my team and I found out is that most users had already “made the switch” by using NU Bank and other digital competitors, while Itau was relegated to a “safety option” if they were looking to make large transactions. Overall, we discovered that over 60% of the users we interviewed preferred digital banks because they are open 24/7, they helped users save time and reduce stress, as well as obtain fast payment options. Not only that, but the digital team at Itaù was not very open to the idea of “disrupting their business model” with new ideas, even when we had spent 10 days researching the best ways to create digital products for them.