No Signs of Surrender at This Retail Bank

Many have prophesied the death of retail banking – and while the traditional retail model may be dead, at least one traditional bank is changing to keep up with the times.

Being a retail bank in 2018 is not a sexy place to be. In fact, it’s a downright painful battle field:

- On one side they have blood thirsty fin tech companies in payments, peer to peer lending, roboadvisors, crypto currencies, etc. threatening to chip away at their most profitable business lines

- On the other side, they have empire building big tech companies such as Apple, Amazon, and Alibaba who are willing to provide services at less than cost to bring consumers into their data ecosystems threatening to enter the space

- Behind them they have the trauma of the financial crisis and mess of botched mergers, bailouts, and stringent regulations

- In front of them is a new reality of fully digital banking competitors, cyber security concerns, and rampant digital changes

It’s enough to make anyone raise the white flag of surrender. But for Bank of America’s retail bank, their emblematic American flag logo is still flying high over the banking vs. technology battlefield.

As with any retail bank, Bank of America makes most of its money from lending – in the form of mortgages, auto loans, student loans, credit cards, etc. Much of the funds for these loans comes from account deposits which the bank attracts through loss leader services such as free checking. They also make money through payments, cross border transactions, etc. but it’s really the lending that keeps them afloat.

Customer deposits is the flywheel that keeps this company running and the esoteric threat of new tech services luring away customers or portions of their deposits is cause for serious concern.

Bank of America and its competitors have a unique advantage to fin techs: their cost of capital is much lower, they have federally protected insurance, and a built in customer base.[1] But, to win and retain deposits they must be able to compete with the seamless, simple, and innovative technology solutions coming to market.

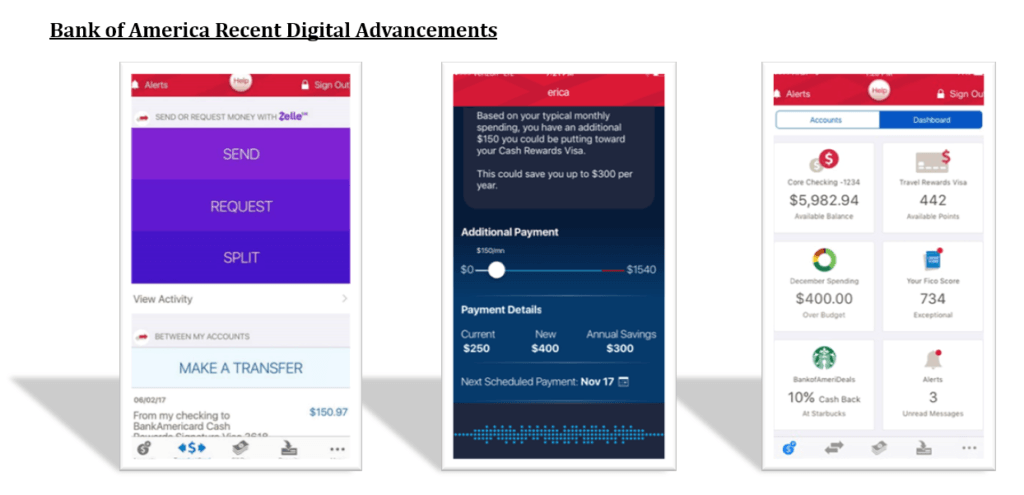

Not to be deterred, under the leadership of Cathy Bessant, the 10,000 person technology team has transformed the bank into a digital power house that puts the customer experience first. Recent changes include:

- Adoption of a user centric, agile development process to bring innovation to market as quickly as possible

- A partnership with fin techs such as Zelle, which allowed $1.5bn real time peer to peer payments in October 2017 alone[2] (vs. multi day settlements seen with services like venmo)

- Closing over 1,600 hundred branches since 2009 (26%), and retrofitting the remaining branches with contactless ATMs and other technology enabled solutions[3]

- Introduction of Erica, a digital assistant on par with the likes of Alexa that can provide a personalized banking experience

- Winning patents from the USPTO for a cutting edge crypto currency exchange

These changes and others enabled the bank to have over 1 billion digital interactions with their customers in Q2 of 2017 alone.[4] Importantly, much of this has been additive: digital growth in many cases has not been at the expense of non-digital engagements.[5]

However, pursuing a winning strategy going forward will require far more than a laundry list of tech advancements. What will most aid the bank in this drastically shifting landscape is its evolving mentality towards the future of banking. For example, the bank once considered itself a fintech company able to compete easily with new entrants. Learnings in this space has taught them otherwise. As Bessant puts it:

“[We learned that] ’Fail fast and big’ is not in our lexicon…A VC funding…does not fit the way a large public company is constructed. The basic building blocks of fintech will never be ours…

That being said, big business has to be great at doing three things in this area…We have to teach [fin techs] how to do business at scale. We have to be brilliant at buying from fintech companies because there are times they are better and faster, and think of something we have not… Further, we must learn how [rethink economics] in order to partner differently.”[6]

This shift in mentality from trying to thwart or beat technology to embracing and working alongside it is one that will allow the bank to continue winning and preserving customers in the space for the time being. Frankly, at this point most fin techs cannot exist without underlying bank services. And most big techs don’t want to be subject to banking regulations. By choosing to act now and evolve in tandem and partnership with these companies rather than fighting them every step of the way, Bank of America is laying the groundwork to preserve its relevance in the future.

[1] https://hbr.org/2017/04/how-banks-can-compete-against-an-army-of-fintech-startups

[2] http://newsroom.bankofamerica.com/press-releases/consumer-banking/zelle-continues-take

[3] http://www.businessinsider.com/bank-of-america-upgrades-digital-platforms-2017-12

[4] http://www.businessinsider.com/bank-of-america-upgrades-digital-platforms-2017-12

[5] http://www.businessinsider.com/digital-continues-to-define-bank-of-americas-future-2017-7

[6] https://www.forbes.com/sites/peterhigh/2017/06/19/the-future-of-technology-according-to-bank-of-americas-chief-operations-and-technology-officer/#73cd0c777c54

Additional Sources:

https://www.ft.com/content/bc846657-1af0-368e-a933-f14bc971d321

Agreed that it is surprising that an incumbent retail bank like BofA is investing so much on the technology side. While they have made communicating and interfacing with users easier, the technology moves to date seem aimed at ensuring current depositors don’t bolt, rather than doing things to attract new and younger depositors. Ease of use has certainly increased, but the motivation to increase deposits still seems stuck somewhat in the old age. They seem to be aiming to capture other forms of financial transactions (e.g., peer to peer payments), but are doing little to address the core of the business as you lay out, traditional checking and savings accounts. Many FinTech startups appear to be focusing on enticing for millennials’ share of wallet, positioning themselves as alternatives to traditional retail banking accounts. BofA should focus its tech group and other tech acquisitions on initiatives that directly address this issue.