NEXT BIG SOUND | Think Moneyball, But For Music

There is more science to creating a musician’s career that meets the eye, and Next Big Sound has been cracking the code for the past ten years.

In 2005, Alex White worked as an intern at Universal Music Group [1]. As part of his summer responsibilities, White looked at numbers of CD sales to inform the next steps in artist development. The industry still used record sales in 2005 to identify which locations to tour, where to ship merchandise, and how to invest marketing dollars. However, White didn’t buy many CDs anymore. Since the advent of the iPod in 2001, fans had been moving in mass away from CD purchases and towards downloads and streaming.

In the summer of 2009, White and three classmates from Northwestern University decided to join forces to tackle the blind spot in the music industry by creating Next Big Sound [2]. They started by recording the number of plays for different artists on MySpace and providing insights to the industry via a free newsletter. By 2010 they had several thousands of members and the data-starved music industry was clamoring for more insights.

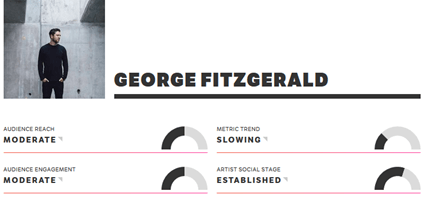

Next Big Sound works as a freemium offering. White and his team source data from Facebook likes, Twitter mentions, Instagram posts, Vevo views, Wikipedia visits, and Pandora spins. All those sources are combined through an algorithm to determine artists’ influence and popularity [3], and the outcomes are displayed on a powerful central dashboard. Artists are classified in epic (e.g. Frank Ocean), mainstream (e.g. ODESZA), established (e.g. George Fitzgerald), promising (e.g. Weval) or undiscovered (e.g. my neighbor’s band). The service also provides valuable data about the demographics of the audience (gender, location), its engagement, and the artist’s reach right after new releases.

The value for both sets of stakeholders, artists and labels, is clear. Paying clients of the service are tech-savvy artists trying to understand how to grow their reach. The product’s premium tier offers recommendation and prediction services, suggesting ways to leverage social media platforms to increase engagement, or even picking which song of a new album would outperform the rest as their next single. Label executives from UMG, Sony, and Warner use the software to decide how to allocate marketing budgets and better develop their artists. The startup promises to predict record sales for most artists within 20% accuracy, giving record labels a clear idea on ROI [2]. The service can also help them build a pipeline of new artists by uncovering talent that’s trending in real time on social media. Furthermore, Next Big Sound offers “Predictions Charts” with the list of potential artists about to blow up.

In 2015 Next Big Sound was acquired by streaming service Pandora [5]. The deal followed the trend of similar startups being acquired by other streaming platforms, such as The Echo Nest and Spotify in 2014, or Semetric and Apple in 2015. Pandora, which is well-known in the industry for its discovery radio platform and for the Music Genome Project [6], already offered a similar product for artists and labels (the “Artist Marketing Platform”) that could complement NBS.

However, as a direct result of this vertical integration, the value proposition of Next Big Sound as an aggregator of data has been eroded. The recommendations and predictions provided by the software are only as good as the data that feeds the algorithm, and due to the change in control, the data is now incomplete. Spotify, the largest streaming platform, discontinued its collaboration with NBS in 2016 in favor of their own tool, “Spotify for Artists”. Artists and labels should therefore be wary of blindly following recommendations from a tool that doesn’t source data from streaming giants such as Spotify, Apple Music or Amazon.

Sources:

[3] http://observer.com/2017/01/pandora-next-big-sound-moneyball-music/

[6] https://www.pandora.com/about/mgp

[7] https://community.spotify.com/t5/Closed-Ideas/Bring-Back-Next-Big-Sound-Insights/idi-p/1472010

Great post! It is a huge pity to see the further vertical integration of the industry that leads to the missing of the data sources. At the same time, it is also doubtful that the data and results provided by the “Spotify for Artists” are as accurate as NBS. As a result, if you’re doing a third-party business analytics service in music industry, it is important to keep the identity of your independency and inclusivity. Once you’re bought by one of the upstream players, you will lose your value.