Netflix – Getting Smarter Everyday

Netflix exhibits both direct and indirect network effects through its recommendation engine, content acquisition process, and enabling devices.

Founded in 1997 as a DVD by mail service, Netflix has transcended this physical product delivery service and become a platform for so much more. As Netflix moved to become an online streaming service as well as a producer of original content, it has created a business with significant network effects. Netflix exhibits both direct and indirect network effects through its recommendation engine, content acquisition process, and enabling devices.

Approximately 75% of Netflix’s viewer activity is driven by recommendation. The Netflix engine makes recommendations based on the metadata of the individual show, and more importantly, the user’s behavior. As more users get on the platform and watch content, the Netflix recommendation engine grows smarter. [1] As a result, an increase in the platform’s usage leads to a direct increase in value for other users through better recommendations. The same could be said for the company’s content acquisition strategy more broadly. Netflix collects terabytes of data on consumer viewing behavior so it is incredibly well-informed as it approaches its content acquisition negotiations, and when creating original content.[2] These direct network effects that occur from having more people using the Netflix platform, help the company create a better product and enhance the user experience overall.

Netflix also has experienced indirect network effects on OTT enabling devices, including streaming media players that enable your TV to connect to the Internet (such as AppleTV, Roku, and Chromecast), smart TVs that are Internet-enabled, and other TV-like devices in which people can consume content (such as the iPad, Kindle Fire, etc.). For example, Roku sales have continued to outpace those of its aforementioned competitors which can in part be contributed to its close relationship with Netflix.[3] Starting in 2008 when Roku unveiled the first Netflix Player, the two have worked closely together.[4] In fact, Roku even revealed at CES this past January that it was partnering with Netflix to create a 4K Smart TV.[5] Thus the increase in usage of Netflix, promoted the increase in usage and value of Roku and others.

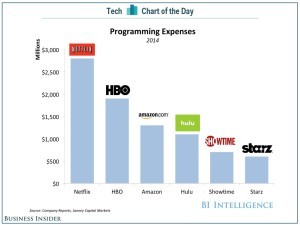

In a world in which network effects are becoming increasingly important to consuming content, incumbents such as the traditional cable providers, are having a hard time competing. Initially Netflix and the cable companies were not direct competitors. Netflix’s business model revolved around monetizing studio’s library content, which previously wasn’t being monetized in a truly lucrative way. However, as Netflix has moved into premium original content, and continued to invest in its own library – their power as a major distribution player has increased. In 2016 alone, they are estimated to be investing ~$6bn in content, making the service better poised to serve as a traditional cable replacement service.[6]

However, it is not just the rights to this content Netflix is acquiring, it is the user behavior data. With over 65mm subs as of the end of Q2 2015, Netflix possesses more than triple the amount of video subscribers as the US’ largest cable provider – Comcast.

One way for incumbents to compete is to evolve. We’ve seen this through the creation of cable apps such as Xfinity TV and TWC TV. These apps allow customers to consume TV anytime, anywhere, and on any device. Furthermore, they have comprehensive back end systems collecting user data. We’ve also seen this through updated guides and STBs that enable cable providers to collect more comprehensive data on usage. That said, the cable providers have historically been very hesitant to use any of this data due to legal restrictions associated with their Title II status. Thus, I believe Netflix is in a power position, and as its search engine grows smarter, and its content library grows stronger, it is further cementing itself as a permanent fixture in the global media landscape.

[1] http://www.wired.com/2013/08/qq_netflix-algorithm/

[2] http://www.ventureconsulting.com/assets/Is-Data-Analytics-the-difference-between-Netflix-and-the-rest2.pdf

[3] http://www.cnet.com/news/roku-beats-apple-tv-again-on-usage-and-purchases/

[4] http://hothardware.com/news/inside-the-tech-of-the-netflix-player-with-roku1

[5] http://www.bizjournals.com/albany/morning_call/2015/01/roku-to-build-smart-television-with-netflix-tcl.html

[6] http://www.businessinsider.com/netflix-will-spend-5-billion-on-programming-in-2016-2015-2

I believe Netflix Should capitalize its wide user base and find a smart way to incorporate ads into its content. I am not sure if the Hulu ,model is the right recipe but marketing content can become a small part of the Netflix experience without jeopardizing its market share.

I think one way Netflix could try to enhance its direct network effects is by allowing users to recommend content to others, and enable a feature that reports back whether the user actually watched the content and asks them what they think.

Imagine how many times someone has told you to watch a show, and you’re like, “o yea, I’ll definitely check that out!”

I think a more powerful interaction would be for me to be able to “send” you a recommendation, and I could actually keep track of who follows up on my recommendations. Users might get reminders like “Bob recommended you to watch Y – watch it now?” and after a user watched a recommended show or movie, it would ask users to “tell Bob what you thought”.

I think this type of interaction would be very powerful and benefit Netflix quite a bit.

It would create a social stimulus for users to watch content they might not otherwise watch. It would also strengthen the reason for users to provide reviews and ratings to content. Holding people accountable to other people would make Netflix far more powerful.

Thanks for the interesting article! Netflix is definitely a great example of leveraging direct and indirect network effects to not only drive viral growth for themselves but also for shaping the OTT industry we witness now. While Netflix’s network efforts continue to benefit it while taking on competition from the traditional cable players, their ability to beat competition from some of the newer players operating under a differentiated business model is not as straight forward. The network effort they have built on both sides of the platform (user and content provider) is not as dominant when they compete with these new players. The direct and indirect network effects of the their platform has helped them to grow both their user base and the content base in parallel, an element crucial for their success. The new competitors are approaching them by having one side of this user / content in place and looking to gain traction with the other side. Along side, they are able to offer an improved offering which could likely benefit the user better.

The biggest competition comes from Amazon. They have one side of the platform in place i.e. the users. Amazon is now looking to strengthen the other side i.e. content. Thanks to Netflix’s efforts towards making content providers move to the OTT model they are now comfortable sharing their content with Amazon as it is an additional source of revenue at minimal incremental costs. The fact that Amazon has a combination of the Netflix model (monthly service fee for some content for Prime Members) and a pay-per-view model, it makes Amazon more attractive to content providers.

Similarly, the broadcasters are approaching it from the other end. They have the content in place and are acquiring customers. Netflix has made the consumer comfortable with the concept of OTT and now broadcasters are leveraging this for their OTT platforms. A wide variety of options that broadcasters have through their OTT platform and more importantly their quicker-to-consumer timelines make the broadcaster a preferred platform.

What is interesting in the Netflix case is that a business model which has been built through a combination of direct networks and indirect networks can be beaten. It requires an incumbent who has already built one side of his platform for a different business model to expand into the space.

Great post! I like JG’s suggestion and Karthik raises some really interesting points.

Content distributors are focused on capturing the exclusive rights to TV shows and, in the past few years, developing original content. As a result, users like myself are forced to multi-home if we want to watch House of Cards (Netflix), Transparent (Amazon), and The Mindy Project (Hulu). It would be interesting to know what the multi-homing rate is among online TV/movie distributors. Quality, a particularly subjective measure for entertainment, is a major decision-making factor here. However, Netflix is arguably in front of peers in terms of the quality of its user interface and data analytics. It could push even further in this area (lose your queue of shows, friends’ recommendations if you leave Netflix) and optimizing for tablet/mobile/multi-screen viewing to increase switching costs and grow its share of the pie.