Mercado Libre – the giant marketplace takes care of all your logistics and financial needs

Mercado Libre allows users to buy, sell, get credit, insurance, create a business, and much more, all in only one platform.

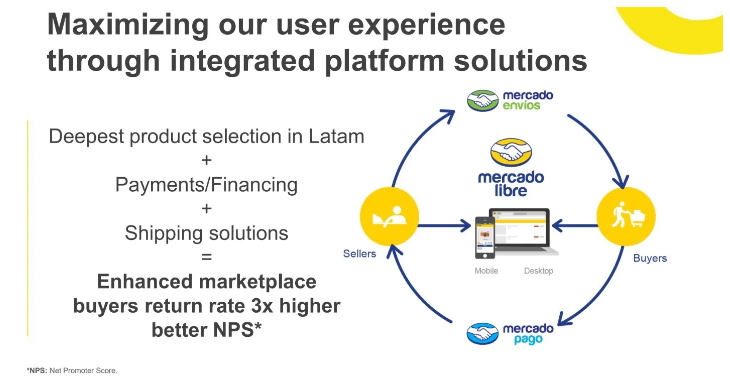

Nowadays, Mercado Libre is the leading e-commerce and fintech platform in Latin America, it has reached and connected more than 130 million unique active users in its entire ecosystem. The platform has been able to achieve these impressive results by delivering a suite of technology solutions, both digitally and offline, across the whole value chain of commerce.

Mercado Libre offers users of its platform six different digital payments and e-commerce solutions:

Mercado Libre (marketplace)

It represents the core of the business, being the largest marketplace in Latin America, it allows users to buy and sell a variety of goods online. This platform enables members to “search and match”, it is designed to allow buyers to view the options that different sellers are offering and select the products that match their preferences. In this case, the seller group will take the match unless it decides to reject it.

The division also collects data from users of the platform and the transactions between them which can also be exploited to generate advertising opportunities and increase returns.

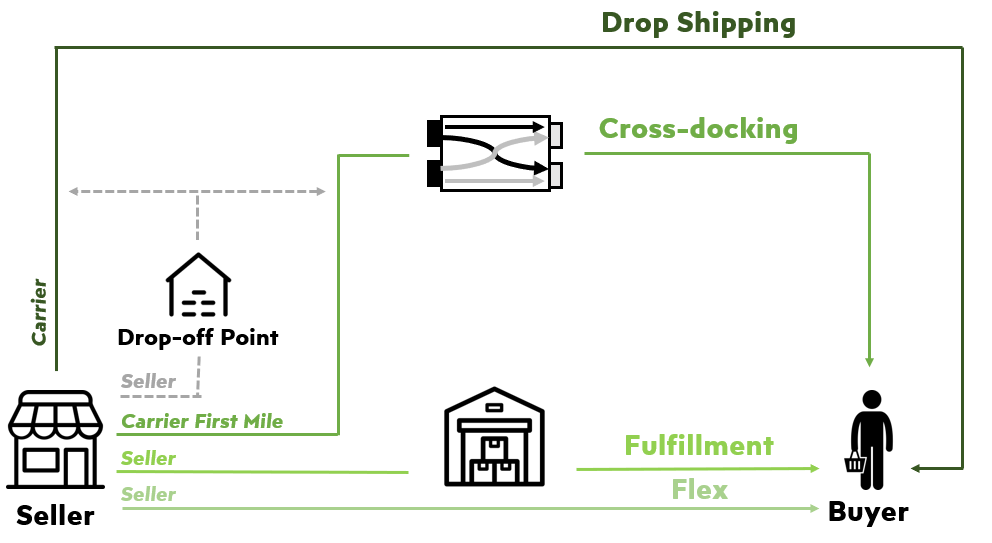

Mercado envíos (logistics solutions)

This powerful solution allows users of the platform to connect among different physical locations. The marketplace arm leverages this tool to eliminate friction between buyers and sellers, by using a mixture of first and third-party logistics providers with solutions including drop-shipping, fulfillment, cross-docking and flex. Because of Mercado Libre’s scale, combined with sophisticated technology and unique warehousing facilities, shipping costs can be decreased, which translates in more value for the end users of the platform.

Mercado crédito (credits)

With this tool users can get access to loans at favorable rates. The platform’s machine learning capabilities determine the scoring rate of each user, which creates opportunities for merchants and consumers to expand their business and close any transaction they are interested in. Users can use the credit to buy either in Mercado Libre’s marketplace or through the wallet in a physical store.

This solution tries to promote inclusion by solving the regional problem of lack of access to credit. For people in certain socioeconomic sectors, it is difficult to build a business as they do not have proper credit score to receive loans from traditional institutions. For this reason, Mercado Libre acts as their underwriter creating a positive flywheel, as more small businesses now can sell on their marketplace and bring more product options to consumers.

Mercado shops (SaaS)

This division allows users to create their own online store and get access to Mercado Libre’s powerful ecosystem, getting exposed to increased traffic and facilitating payments.

Mercado pago (Fintech services)

The Fintech arm enables members to easily send and receive payments on and offline in a safe way. This solution tries to increase financial inclusion by allowing democratization of payments. This division is also increasing at a fast rate and is allowing the Latin America region to replace cash with a more streamlined way of paying. Payment options include:

- Mobile Point of Sale: covers the processing of credit and debit cards by reading the chip and allowing users to close transactions

- Digital Wallet: enables members to pay utilities bills, transportation tickets, process QR payments, etc.

- Merchant services: makes checkout and payment process easier by being a registered user and providing contact information

- Prepaid card: it allows customers to use Mercado Pago anywhere, with prepaid and hybrid cards which can also withdraw funds in ATMs

Mercado libre (advertisement)

This tool uses data to promote products and services, as more users are integrated in the platform, more opportunities can be created for targeted advertisement, through product searches, suggested products or banner ads.

What is next for the company

Mercado Libre aims to keep growing in Latin America, now with the introduction of cryptocurrency services. With this new solution, users of the platform will be able to purchase bitcoin and ether using funds from their native wallet solution in Mercado Pago. This new service goes hand in hand with the purpose of the company to keep increasing financial and technological inclusion, giving access to its customers to the crypto world in a simple, educational, and safe way.

Sources:

https://chromeenterprise.google/customers/mercadolibre/

https://www.bigcommerce.com/blog/selling-on-mercado-libre/

https://investor.mercadolibre.com/investor-faqs

https://innovestor.substack.com/p/mercadolibre-deep-dive

https://investor.mercadolibre.com/static-files/5cb0d6df-3fbc-4d87-9cef-f1fca7fea00c

https://investor.mercadolibre.com/static-files/c9c7e0d2-ec16-45b2-bf0b-0630e944c0b7

https://investor.mercadolibre.com/static-files/82ac4b17-e477-4ad3-8d75-a771e2d777bc

https://investor.mercadolibre.com/static-files/5e2df931-e082-49f0-9f55-38309c99b758

Thanks for this interesting post, Paulina! Reading about Mercado Libre, it was hard not to see the parallels to Alibaba in terms of where the businesses started and how it enabled them to expand. In both cases, there was significant pressure to expand scope in order to scale. And likewise, there were synergies on both the supply and demand side. The data flywheel enabled data generated through one service (e.g., payments) to enable another (e.g., credit). And for customers, using one service (e.g., marketplace) made it easier to use another (e.g., payments). It will be interesting to see whether Mercado Libre will expand outside of Latin America, perhaps through partnerships, as Alibaba has done.

Thanks for the post, Paulina! I like the scope growth of Mercado Libre, leveraging data and its loyal customer base to broaden its offering in a synergistic way. As large global marketplaces such as Amazon or Alibaba continue to pursue growth out its core markets (perhaps into Latam next), I believe Mercado Libre needs to focus on continuing to increase value for users on both sides of the platform to create higher switching costs. Mercado Pago and and Mercado Credit are examples of these where the platform is also able to increase its revenues.

Expanding outside Latin America is an option, but I believe these marketplaces benefit hugely from first-mover advantage given the strong network effects, and so I don’t think they should pursue growth in geographies where there are large incumbents already such as North America, Europe or Asia. Instead, I believe they should continue to focus on the digitalization of the Latin American economies and increased penetration of e-commerce.