MEDS’ mobile pharmacy boom – can it sustain its market advantage beyond Covid-19?

With only three years in operation, MEDS' 1-hour delivery mobile pharmacy is leading new customer behavior for online shopping during Covid-19. The question is – can it sustain and leverage its market advantage for future growth beyond the outbreak?

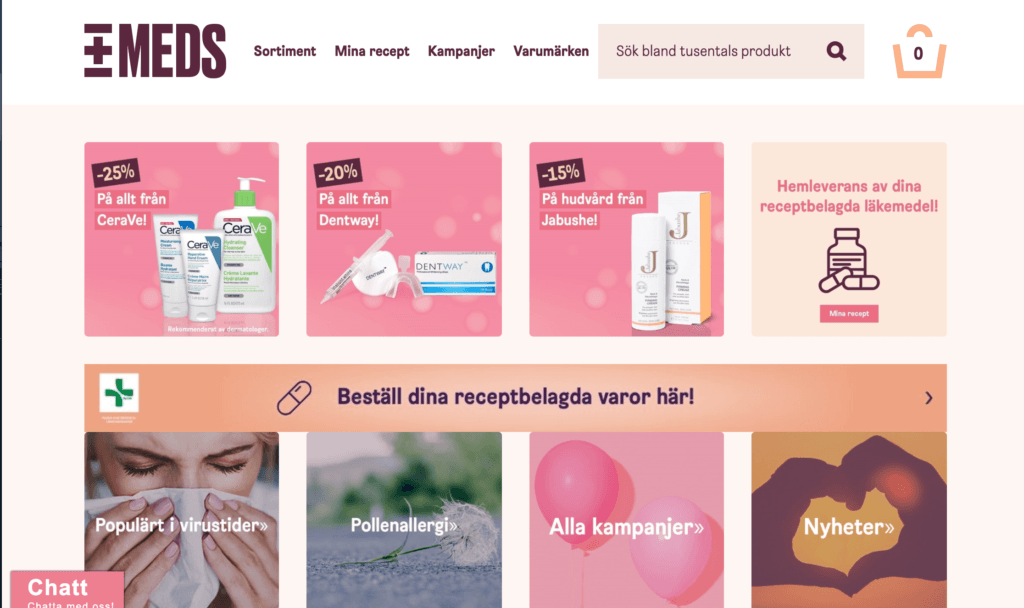

Meds and mobile pharmacies in Sweden

Meds is an online “mobile pharmacy” reseller of over-the-counter and prescription medication as well as beauty and health products, available to consumers -humans and their pets- in Sweden. Moreover, it offers online medical advice via an instant chat with expertise equivalent to that found at a physical offline pharmacy. Meds’ value proposition however is unique among online retailers -in any category- in Sweden in that it offers delivery within a few hours across the country, sometimes in as little as one hour – without shipping fees.

In 2019, mobile pharmacies contributed to only 10% of revenues in the Swedish pharmacy industry – a small percentage for a tech-savvy Nordic population used to online shopping, although a result of the State pharmacy monopoly that permitted private offline actors first in 2009. Offline players were then slow to shift their focus to also include online retailing. Consequently, they were quickly outperformed by Sweden’s first and now largest online only pharmacy, Apotea, when it emerged in 2013. Without resource-intensive physical stores, Apotea was able to offer slightly lower prices for the same products, along with accessible service and efficient home delivery – particularly attractive for customers who are ill and most in need of remedies yet less willing to leave their homes.

Identifying a huge market opportunity for mobile pharmacies to overtake their offline counterparts, Meds was founded in 2017. Similar to Apotea, Meds was able to surpass traditional competitors with low prices and accessible service and immediately gained traction, significantly facilitated by Apotea having paved the way for online pharmaceutical businesses to flourish. Meds however is expecting its yet unmet hourly delivery speed advantage to make them the leading mobile pharmacy in the next five years.

What is the secret sauce to Meds’ success so far?

Meds’ goal is ambitious but not out of reach. The founders early on hired a team with expertise in the online pharmaceutical market, many coming from traditional pharmaceutical competitors, along with young but experienced personnel in various areas, among them a marketing chief officer from Google. It took only 6 months from start to launch of the company, and due to cooperation with several logistical companies they were able to procure storage in central Stockholm which allows for pick-up to delivery every hour – something which its competitors are unable to offer as their storage is placed in the suburbs, most often requiring at least a 1-day delivery. Similar accessibility is offered or planned across the country.

Meds further is a data-driven company, using their in-house built tech system and relying on customer data to continuously perfect accuracy and optimize for media placement and product development to guide creativity. With superior insights of consumer behavior over competitors they claim to be at the forefront of innovation in the industry. Marketing is by far their largest investment and they have successfully promoted themselves as relevant, fun, and approachable with e.g. media collaborations with Sweden’s “sweetheart” singer, contributing to their traction and impressive growth.

How has the outbreak of Covid-19 affected Meds?

Covid-19 has unsurprisingly led to increased demand on protective products such as hand sanitation and protective masks, but also in products such as thermometers and remedies for colds, coughs, and general viruses. The changed customer behavior is due both to an increased prevalence of illness as well as due to the escalating fear of contracting one, not seldom leading to individual stockages of pharmacy products to secure adequate provision if need be.

Although there is no required quarantine implemented in Sweden, mobile pharmacies with home delivery are growing at a significantly higher rate than offline competitors due to government recommendations to stay at home, where Meds’ delivery speed is particularly attractive in a panic-inclined atmosphere. In addition to increasing purchases per customer, the virus has significantly widened Meds’ customer base to individuals who had previously not shopped pharmaceuticals online, not the least elders for whom quarantine is most encouraged and thus who are most in need of home delivery.

As a result of the above, Meds has seen a significant jump in sales of products perceived to be related to the Corona virus since the start of the outbreak, notably with a 2,000% increase in sales over one week in March. However, as Meds has been unprepared for the rapidly boosted demand they are struggling to keep up with orders and have consequently pleaded both to other companies to temporarily lend out personnel and to global suppliers via e.g. Linkedin for additional aid, intending to maximize their relevant purchases to meet present and future customer needs. Yet many suppliers are based in India and China, both of which have implemented restrictions on exports to ensure sufficient internal provision of products, inevitably resulting in stock shortages in Sweden. Luckily for Meds (although not so for the population), its competitors are facing the same struggles with similar stockouts, and as such, Meds’ new and existing customers have little inclination to switch preference to e.g. Apotea.

Is Meds’ rapid growth sustainable?

Demand for pharmaceutical products will naturally gradually decrease as both illness from Covid-19 and the fear of it will decrease. However, consumers over time become increasingly familiar with online shopping and used to the convenience of mobile pharmacies. The longer the virus impacts the population’s tendencies to social distancing and quarantining, the more engrained the new behavior becomes in people’s shopping habits, likely to the extent where they not only appreciate but also expect lower prices and most importantly quick home delivery.

Before the outbreak, industry analysts predicted that customers would increasingly trust and turn to mobile pharmacies such that online shopping in the industry would increase from 10% to 25% in the next three years. However, the recently widened customer base and increased purchase basket for each customer has expediated online pharmacies’ growth likely already above 25%, with Meds and Apotea at the forefront as the two providers have the largest and widest stock of products to meet demand, along with the most convenient delivery and online help. Many customers will likely eventually, at least partially, return to offline pharmacy shopping, resulting in a decreased demand for Meds’ products. Yet almost certainly the virus has still led people to open their eyes to the convenience of mobile pharmacies and strongly contributed to market expansion in the long term.

Opportunities and risks going forward

Covid-19 has provided an exceptional opportunity for Meds to leverage its leading role during the outbreak to grab market share as the industry grows additionally with an already steep trajectory towards increased online shopping. To meet increasing demand with a lean structure, Meds has room to explore AI and automation to handle storage and other operations that have so far been kept relatively manual for flexibility.

Apotea’s presence is clearly a threat to Meds’ growth, particularly as the competitor is already trying to match Meds’ young and approachable brand and is making efforts to catch up on delivery speed. There is also a risk that it, too, becomes increasingly data driven, although Meds will by then have a significant data bank of customer behavior with superior accuracy to guide their strategy. Importantly, Meds’ experienced team has proven key to creating innovative marketing and has an advantage in attracting diverse and qualified talent.

Meds should however look out for new competitors already starting to emerge within existing diversified conglomerates as these have access to deep pockets as well as already established and widespread supplier and delivery channels, particularly important upon expansion into other Nordic (and elsewhere) countries. Meds could also become an attractive opportunity for such larger competitors, potentially opening doors for an attractive acquisition of the company for synergies and accelerated growth.

Sources:

https://digital.di.se/artikel/natapotek-utmanar-med-snabbleveranser-vi-ska-bli-storst-i-sverige

https://www.gp.se/livsstil/konsument/apoteken-tar-fajten-p%C3%A5-n%C3%A4tet-1.4132494

https://www.ehandel.se/Sa-ska-utmanaren-MEDS-bli-Sveriges-storsta-natapotek,12132.html

https://www.resume.se/alla-nyheter/folk-pa-vag/meds-hittar-ny-marknadsdirektor-hos-google/

https://www.dagensanalys.se/2019/07/marika-baltscheffsky-lamnar-google-och-gar-till-meds-se/

https://www.apotea.se/?gclid=EAIaIQobChMI2s7EhJyQ6QIVCMqyCh0EogeXEAAYASAAEgKqUvD_BwE

https://www.breakit.se/artikel/24247/hart-tryck-pa-apotea-lanar-personal-fran-krisande-foretag

It’s so wonderful learning about Meds — I am particularly impressed by its delivery speed!

I agree with you that Meds will need to find a way to keep its early competitive advantage. I wonder how high customer loyalty is and if its speed of delivery alone might be able to serve as a strong enough moat. For pharmacies and delivery companies, the churn rate seems to be particularly important. I wonder if Meds might be able to help patients with chronic conditions refill their medications on a monthly basis. In this way, they will have a stable recurring revenue stream, patients won’t have to deal with the hassles of refilling their medication, and adherence rates will increase!