Majid Al Futtaim – Innovation in the Face of Threat, Leveraging Synergies across Businesses

MAF Group reacted quickly to the pandemic to support its mall tenants by launching a marketplace to allow them to service their customers online. The company relied on synergies across its businesses to support its swift reaction. Can it keep the momentum going and capture a large share of nascent e-Commerce market in the Middle East and North Africa region?

Majid Al Futtaim (MAF) Overview

MAF is a holding company that has operations across various industries in the Middle East and North Africa (MENA), boasting revenues of $9.6 billion in 2019.1 In particular, the company has an exclusive franchise partnership with Carrefour (Grocery Retailer) in the region. It also operates several malls (e.g. Mall of Emirates) and owns exclusive licensing rights to several fashion brands (e.g. Lululemon, A&F) in the region.2

Exhibit 13

Response to COVID

When the pandemic hit, MAF had to close its malls across the region, impacting many of its businesses. The company needed to react quickly. And so it did. MAF quickly innovated, expanding its digital efforts and leveraging synergies across businesses, to alleviate the impact of the crisis.

Supporting Growing Demand

As part of its digital efforts, MAF had already launched carrefouruae.com six months ago to drive Carrefour online sales in the UAE. After stores were closed in March, Carrefour witnessed an increase in daily online sales of 50%, compared to the same period in February.4 MAF needed to innovate to meet the growing online demand.

As such, MAF quickly converted some of its physical stores into fulfilment centers to meet the growing online demand.5 MAF also reskilled more than 1,000 employees from across its various businesses to support with online order fulfilment, food packaging, etc. This also enabled MAF to provide work opportunities for its mall and leisure staff.6

Launching Online Marketplace

To support its Mall and Fashion businesses, MAF very quickly leveraged the existing carrefouruae.com platform to launch an online marketplace enabling its own brands, mall tenants as well as other businesses in the UAE to reach customers online. To ensure the success of its marketplace, MAF implemented a few initiatives. The company realized the importance of network effects for such a platform, both cross-side and same-side. Hence, it focused on attracting both sides of the market – the seller and the buyer.

To attract buyers, the company leveraged the existing Carrefour platform given that customers were already flocking to the website – around 1,300 average Carrefour daily orders.7 This, in part, helped it solve the chicken-and-egg problem (i.e. tapping into Carrefour’s existing customer base). In addition, customers can use MAF’s existing rewards program, SHARE, to pay when checking out of the marketplace.8 This will enable the company to attract more customers to the platform and increase spending. The rewards program could also reduce customer multi-homing tendencies given that it spans across not only their online purchases, but also their offline purchases across any of MAF’s experiences (e.g. cinemas, ski Dubai).

For the seller side, MAF differentiated itself by providing value-added services including enabling quick sign ups to the platform (3-5 day from sign-up to launch) as well as setting up an account management team to onboard businesses to the marketplace and ensure proper and smooth launch.9 In addition, to support its mall tenants during these difficult times and attract them to the platform, MAF offered tenants commission-free transactions during April as well as 30-days free last mile delivery.10

The online marketplace was launched on April 23, with multiple brands already onboarded.

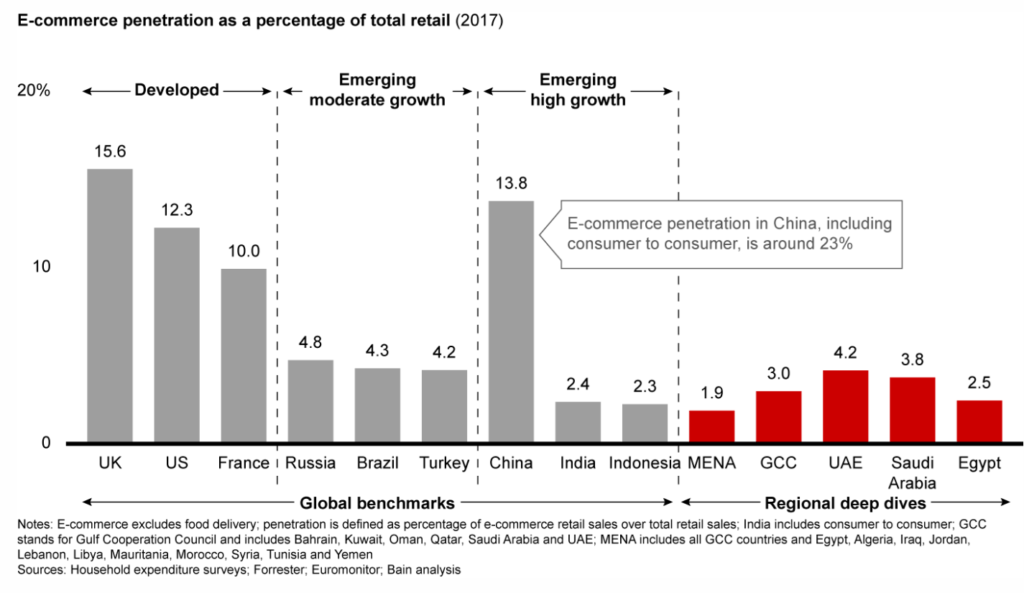

To understand the potential of MAF’s marketplace, it is important to note that the ecommerce industry is still in its early stages in the MENA region.

MENA eCommerce Landscape

The adoption of digital in the MENA region, unlike most other regions, has been driven by consumers. In fact, the mass adoption of smartphones and social media by consumers during the mid-2000s drove businesses to embark on the digital wave.11

As part of this wave, eCommerce has been growing in the region, yet there is still massive room for growth when compared with other regions.

Exhibit 212

There are two key players in the region at the moment: Amazon and Noon.com. Amazon entered the market in 2017 through its acquisition of Souq.com, a Middle Eastern eCommerce company.13 Noon.com, a UAE local startup, was launched in 2017 aiming to “serve, inspire and empower the region” and challenge Amazon in the region.14

Way Forward

Given that the ecommerce industry has exhibited winner-takes-all in most markets such as the US, MAF will need to leverage its existing strengths to gain a large share of the untapped pie in MENA.

In fact, MAF has many strengths and opportunities that it could leverage to its advantage to keep growing the marketplace.

MAF operates 26 shopping malls15 in the region and should focus on developing a full-fledge omni-channel strategy to create a seamless and personalized customer experience across the physical (its edge over the other two competitors) and digital world. It can differentiate itself from competitors and leverage data to its advantage. For example, MAF can differentiate itself by allowing customers to reserve items in the online marketplace to try in store in their malls or enable seamless online shopping and in-store pickups (e.g. through integration of Mall store POS with online marketplace). Another example, MAF could leverage data from both online and offline behavior (e.g. rewards program) to develop a holistic view of its customers. With this data, MAF can identify multiple analytics use cases to help it improve the customer experience as well as improve existing businesses (e.g. operating efficiency) and generate new business offerings.

MAF could also reduce seller multi-homing tendencies by continuing to provide discounts post-COVID or negotiating exclusivity agreements when applicable (e.g. smaller brands). Another way of doing so is by providing a value-add service: data analysis reports based on transactions in their stores and aggregated high-level demand in the region.

MAF should also aim to create a one-stop-shop encompassing all its experiences, without removing any existing websites to reduce customer friction (e.g. voxcinemas.com). This will help raise awareness on the extent of depth and breadth of the rewards program and improve customer experience.

MAF should also leverage its existing geographical footprint to grow geographically, following its existing physical footprint in the region. It can collect the learnings from the UAE market and expand to other regions in the MENA region.

Yet, there are also challenges that MAF needs to address. One of these challenges would be the logistics provider. MAF currently partners with Aramex to support logistics.16 As the company keeps scaling operations, a logistics partnership will be too costly and might not be enough to ensure consistency across geographies, meet growing demand and adhere to SLAs. The company should consider setting up or acquiring (preferred option) logistic providers (e.g. Amazon acquired Wing.ae to support its “Prime-style same-day and next-day deliveries”). 17 Another challenge would be the fulfilment centers and workers. The temporary fixed used now would not be applicable after stores reopen (i.e. staff redeployment and store transformation into fulfillment centers).

Conclusion

MAF reacted quickly to support its Mall tenants in response to COVID. Yet, the company needs to leverage its strengths (e.g. wide portfolio, physical presence, geographical footprint, visionary leadership) and identify opportunities to enable it to capture and retain a large share of the untapped eCommerce market in the MENA region. This will be hard to achieve if MAF does not work on optimizing its supply chain operations for digital (e.g. logistics, fulfilment centers).

Endnotes

1 “Majid Al Futtaim records Dh35b 2019 revenue”, Gulf News, February 2020.

2 Majid Al Futtaim, Majid Al Futtaim, www.majidalfuttaim.com.

3 Executive Leardership, Majid Al Futtaim, www.majidalfuttaim.com/en/who-we-are/executive-leadership.

4 “Majid Al Futtaim Reskills and Redeploys More Than 1,000 Employees”, Majid Al Futtaim Press Release, March 2020.

5 “MAF Retail sees threefold rise in online orders as coronavirus keeps people at home”, The National, April 2020.

6 “Majid Al Futtaim Reskills and Redeploys More Than 1,000 Employees”, Majid Al Futtaim Press Release, March 2020.

7 Ibid.

8 “Majid Al Futtaim Launches Online Marketplace Through Carrefour and Welcomes Shopping Mall Tenants and UAE Businesses”, Majid Al Futtaim, April 2020.

9 Ibid.

10 Ibid.

11 “E-commerce in MENA: Opportunity Beyond the Hype”, Bain, February 2019.

12 Ibid.

13 “Amazon completes its acquisition of Middle Eastern e-commerce firm Souq”, TechCrunch, July 2017.

14 “’noon.com is YOUR company’ Mohamed Alabbar speaks at noon.com’s first seller event in Riyadh”, Zawya, July 2019.

15 Shopping Malls, Majid Al Futtaim, www.majidalfuttaim.com/en/what-we-do/our-industries/shopping-malls.

16 “Majid Al Futtaim Launches Online Marketplace Through Carrefour and Welcomes Shopping Mall Tenants and UAE Businesses”, Majid Al Futtaim, April 2020.

17 “Amazon’s Souq acquires Wing.ae to expand Prime-style same and next-day delivery”, TechCrunch, September 2017.

Great article DA! wow I didn’t know MAF was that innovative. It’s impressive how they managed to quickly introduce an online marketplace to respond to the COVID crisis. You pointed out to the different ways MAF could differentiate itself from competitors and reduce multi-homing tendencies, but I wonder it could respond to its competitor Emaar: another giant that also owns malls, hotels, real estate, and now Noon.com. Emaar is basically following the same strategy MAF is following and already has a jump-start given its recent acquisition of Noon which is leading the e-commerce space alongside Souq. Emaar can even be a bigger one stop shop given its ownership of hotels and residential properties. It will be interesting to see the dynamics between these two. Can there be more than one player in such a small market like the UAE?

Great article DA! Amazing that they have been able to adapt and leverage their strengths so quickly! I am curious to hear how they can incorporate these new found approaches to serving their customers once the social distancing rules ease, and leverage them for the business long term?