Letgo: Grabbing Hold of the Classifieds Market and Not Letting Go

Letgo is a second-hand marketplace, connecting buyers and sellers of consumer goods ranging from televisions and clothing to cars and real estate, revolutionizing classifieds listings and innovating on the foundation established by dated offerings like Craigslist and local newspapers — a much-needed platform solution to an ages-old challenge.

What is Letgo?

Letgo is a second-hand marketplace, connecting buyers and sellers of consumer goods ranging from televisions and clothing to cars and real estate, revolutionizing classifieds listings and innovating on the foundation established by dated offerings like Craigslist and local newspapers. While other classifieds offerings specialize in specific goods (such as Autotrader’s car focus or LikeTwice’s apparel concentration) and cross-category platforms fail to facilitate hyper-local transactions (eBay primarily ships goods between users), Letgo enables transactions to take place that would otherwise not occur due to time, resource, logistical, and communication limitations – making this a much-needed platform solution to an ages-old challenge.

Adding Value: A Digitally-Enabled Treasure Hunt

So how does Letgo add value in a market that has been around since the advent of community message boards and newspapers? Simply put, Letgo applies innovations in digital technologies—ranging from machine learning to computer vision and predictive analytics—to assist both sides of the classifieds marketplace, enhancing value generated for both buyers and sellers to improve the overall ecosystem leveraging its platform.

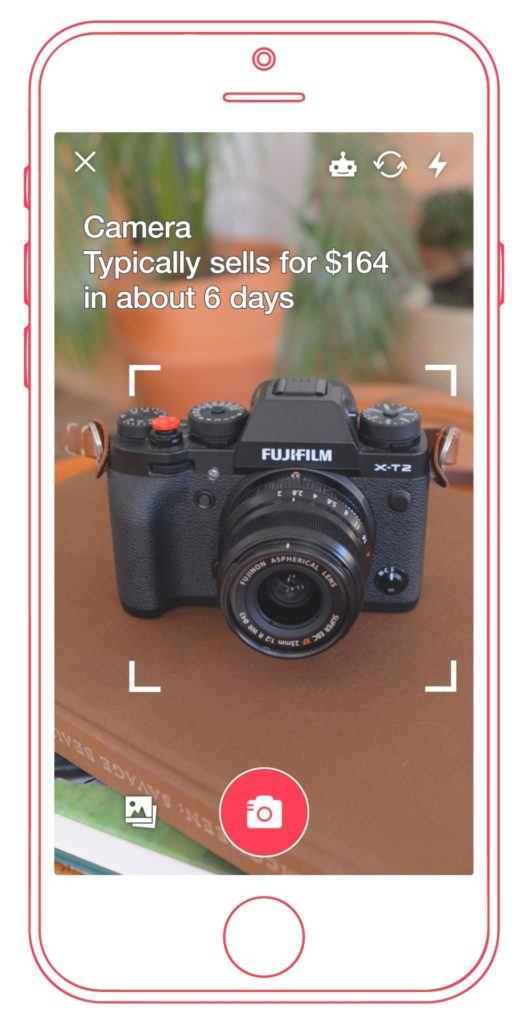

For sellers, posting is quick and easy, taking less than a minute to generate an active listing. Users download the app, take a photo of their item, set a price, and the listing is posted on the local marketplace. This process has been made even simpler with the implementation of Letgo’s auto-listing functionality called “Letgo Reveal” which intelligently interprets photos of an item, categorizes the item into the appropriate listing classification, and sets prices based on its database of listings (subject to seller’s approval). This intelligent pricing aid not only recommends asking prices, but also considers the likelihood of sales at various pricepoints and expected time until sale, giving flexibility to sellers depending on their urgency to move the item and reducing information gaps in marketplaces where sellers have limited experience and retail knowledge.

On the buyer side, Letgo similarly offers unique value compared to existing solutions ranging from seller verification to content curation. Using online accounts to track user profiles, sellers are verified and vetted with ratings and reviews from other buyers while machine learning algorithms screen out fake and inappropriate content. This reduces spam, prioritizes relevant content, and minimizes safety risks to buyers seeking alternatives to the anonymous nature of transactions facilitated by existing platforms.

By serving as a one-stop shop, a database of prices, a filter for content, and a verification screen of users, Letgo offers a superior experience for buyers and sellers, giving it a distinct advantage over competitors across the major use case considerations.

Capturing Value: Investing Today for Gains Tomorrow

Of course, as a company in growth mode, there is a delicate balance between adding value and capturing it. Since its inception, Letgo has remained free for users, sustained primarily through advertisements while investors fuel growth. As a publisher, traffic volume and quality are critical for driving revenues and, with its hyper-local targeting capabilities and intimate knowledge of what users want to buy, Letgo has a distinct advantage in its offerings to marketers.

Letgo has also experimented with monetizing users through sponsored listings. Its most recent introduction, “Bump,” allows sellers to prioritize their listings for 24 hours for a small fee ($1.99 per listing per day in pilot launch). Using its nuanced pricing models and machine learning algorithms, Letgo may be able to further refine this approach to customize “Bump” pricing or offer premium listings for more expensive items such as cars and homes.

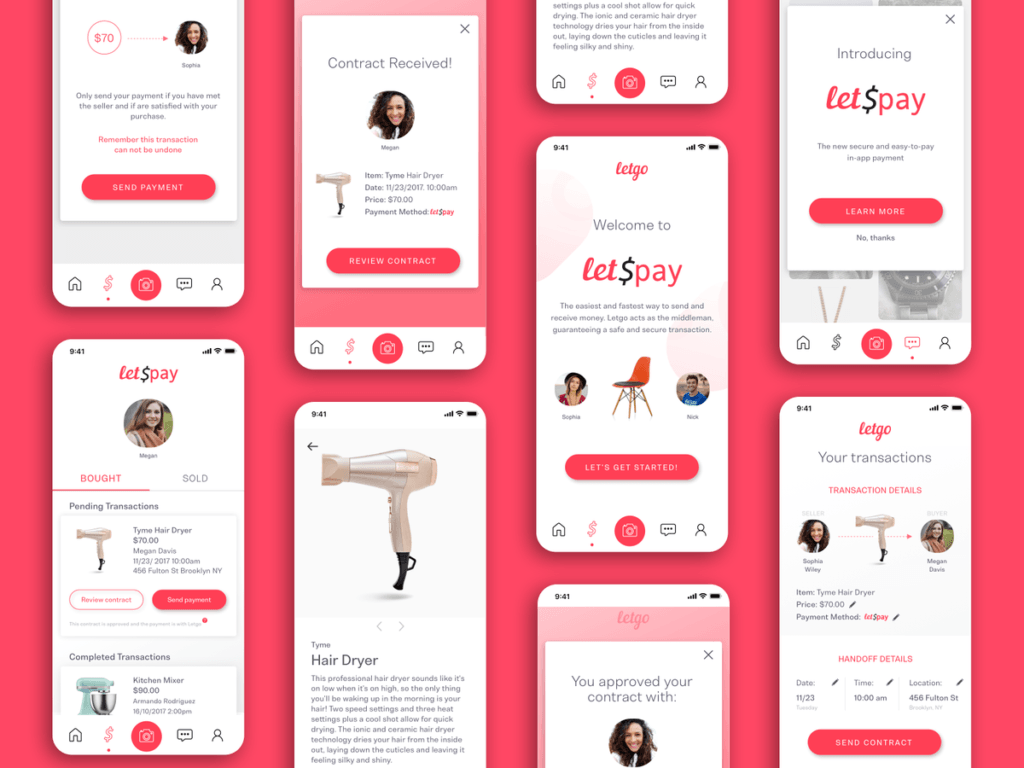

Over time, as the market’s competitive landscape clears and consolidation enables scaled operations across local markets, Letgo’s monetization strategy will similarly evolve. No longer limited exclusively to advertising, Letgo may be able to integrate payments processing services, taking a share of the tens of billions of dollars in transactions completed through the app each year. Gross merchandise value (GMV) was estimated to be over $23 billion in the first six months of 2017 alone. The app continues to grow with over 100 million downloads, 400 million listings, and 6 billion messages sent between users as of mid-2018. With this volume of engagement, selling data about user purchasing behaviors and willingness to pay for various goods with retailers may present another revenue stream in the future.

Throughout these novel monetization strategies, keeping its business model distinct from players like Amazon and eBay will still remain important tenets of the Letgo approach to ensure the company carves out a competitive space in the classifieds market without necessarily overstepping its niche and risking not only competition from large incumbents, but also a diluted value proposition to users who value its localized markets.

Scalability and Sustainability: Looking Ahead and Broadening Horizons

In its rapid growth, Letgo is not alone. Competitors such as OfferUp, Craigslist, Autotrader, eBay Classifieds, and Kajiji are also entering Letgo’s markets with their own offerings and innovations. As a result, Letgo’s growth strategy requires massive upfront investment to capture the audiences in local geographies, leverage scale to enhance the value of offerings, and then transform value creation into value capture over time. As a result, Letgo has leaned heavily on investors, raising at least $975 million over the last five years through five rounds of funding including prominent investors such as NEA, Naspers, Insight Partners, and Accel to continue its rapid growth trajectory.

While attracting users was a significant challenge early in its life, now that this classifieds platform is off the ground, its expansion fuels its own growth. Buyers become sellers, and sellers become buyers, listing and purchasing goods across categories and geographies, enabling viral growth and popularity.

Although multi-homing may take place, sellers are incentivized to list their goods on all platforms to reach more buyers, enabling goods to sell faster or at higher prices. Similarly, buyers are motivated to seek the best offering across platforms, so multi-homing does not necessarily detract from Letgo’s profitability, traffic, or user quality, nor does it lead to a winner-take-all competitive landscape which could drive down margins.

Users are also motivated to continuously check back with Letgo to see if new listings may be relevant to them, leveraging the “treasure hunt” nature of second-hand markets to drive user engagement and increase the velocity of transactions, reinforcing the value-add to users in a flywheel effect.

Furthermore, with geographic expansion, Letgo also benefits from a key advantage that its digital-first model requires minimal refinement for local geographies as users are free to list all goods with minimal manual curation adjustments. As machine learning filters out spam, fraudulent listings, and illegal goods, the algorithm enters new geographies with heuristics already established, enabling increasingly rapid expansion in new markets, further fueling scale advantages and self-sustaining growth.

All considered, Letgo has a strong value proposition that positions it well to continue growing in the coming years, reach sustainable levels of profitability at scale, capture an increasing share of the incremental value it adds to the markets it supports, and establish a favorable competitive position for future success.

References:

https://www.marketwatch.com/story/this-app-makes-it-easier-than-ever-to-sell-your-stuff-2018-07-27

https://www.crunchbase.com/organization/letgo#section-investors

https://fangwallet.com/2018/03/16/how-does-letgo-make-money/

https://aimgroup.com/2016/08/28/letgo-reports-13-2-billion-in-gross-merchandise-value/

https://dribbble.com/shots/8109334-In-App-Payment-Virtual-Contract-Concept-for-LETGO

https://shrugmoney.com/how-does-letgo-make-money/

https://www.wayforth.com/blog/comparing-top-online-marketplaces-2018/