Lending Club – a network effect that could change the way we bank.

Lending Club is a peer-to-peer lending online platform where individuals can seek or provide capital to others on the platform. This platform grows as more credit-worthy borrowers and lenders are brought to the platform and poses a serious threat to the incumbents of the traditional banking system.

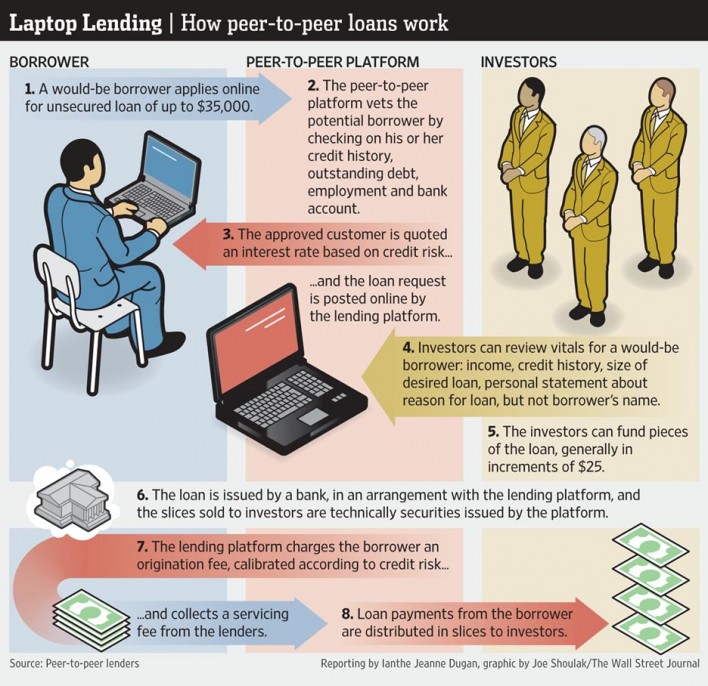

Lending Club is a peer-to-peer lending online platform where individuals can seek or provide capital to others on the platform. The website creates value by directly connecting borrowers and investors and assessing the credit risks of each loan without the large fixed costs of a traditional bank, therefore lowering the cost of the borrowers and raising the returns for investors. Lending Club captures the value by charging both the borrowers and investors a fee based on the loan amount. All loans on the platform are unsecured personal loans in the range of $1,000 to $35,000, with a standard period of three years, or a higher rate five-year period with additional fees. Lending Club makes money by both charging the borrowers an origination fee and investors a service fee.

The borrowers start by creating a listing with details of themselves, such as annual income and credit score, and what type of loan they are looking for. Then, using those details, Lending Club will determine whether that borrower is credit worthy and then assign a credit grade to the requested loan along with interest rates and fees. Borrowers must pay an origination fee based on their credit grade and ranges from 1.1% to 5.0% of the loan amount. Investors search, browse, and select loans that they wish to invest in based on the information provided by the website and at the interest rates assigned by Lending Club; however, investors do have the option in how much they wish to lend, with a minimum of $25 per listing. The rates vary from ~6 % to ~26%. The investors must pay a service fee is 1% on all amounts the borrower pays.

The platform operates and grows based on the model of an indirect network effect, where higher quality borrowers will increase the value for more investors, which in turn will attract more borrowers. The key, therefore, is to ensure that the borrowers are of acceptable quality and credit worthiness. Initially, Lending Club did not use a complex algorithm to analyze the borrowers credit grade; instead, Lending Club had relied on Facebook (LC actually started as an application on Facebook) to allocate lending via established social networks, with the assumption that people within certain social connections will be more willing to lend or pay back their debt. However, this reliance on social networks limited the growth of users and diminished the value of the platform as an online bank by limiting the amount of willing capital to be lent out. In response, LC created a complex algorithm that analyzed borrowers based on dimensions such as credit score, credit history, debt-to-income-ratio, etc. to better predict the risk of the loan. The results proved to be successful: currently the default rate on Lending Club is about 3.4%, giving lenders some assurance as to the reliability of the platform.

Furthermore, with a more robust online lending platform with millions of borrowers and lenders, the Lending Club ecosystem will attract other collaborators, such as financial advisers, to its platform and further increasing its value to all actors involved. For instance, at first investors did not have too much liquidity options after making the loan; they either committed to the three-year or five-year lending period. However, as more and more investors came to the platform, the need to create a secondary market became apparent, so Lending Club entered into a partnership with FOLIOfn Investments, a brokerage and investment company that provided the Lending Club ecosystem a secondary market for its loans, further increasing value creation for its investors with greater liquidity options. As this ecosystem of online banking matures, other advanced financial services, such as investment advisory and wealth management, could be added to the platform, growing the Lending Club network and making it substantial disruptor to the traditional banking model.

Is this a winner take all type of business? What will prevent users (both lenders and borrowers) from multihoming. If the answer is simply “better interest rates” then I could see this being a volatile, low margin business. Can they capture value outside of what is effectively an origination fee? I wonder if better algorithms for assessing credit are truly a sustainable competitive advantage because 1) the incremental improvement in loss ratio from better algorithms will likely diminish rapidly and 2) existing players, like banks, have a lot more data.

I agree with DD1 above – I love the idea of Lending Club, as a way to lower overall fixed costs in the market (by removing brick and mortar), however I’m not yet convinced they can “win”. As Lending Club has become increasingly similar to existing loan providers, I wonder if the market will just become a race to the bottom with price. I’m not sure why I would go to Lending Club over the Chase’s of the world if I saw similar rates available. No stickiness and price wars scare me!

I wonder if someone like Ledge might have a more sustainable position in the long-run – i read an interesting article about them recently. It looks as if they are trying to increase the “stickiness” by piggy-backing on the wildly successful and sticky Venmo. (http://www.forbes.com/sites/timconneally/2015/09/24/ledge-picks-up-where-lending-club-left-off/)

Lending Club is definitely a threat to the big traditional banks, and I believe a lot of them are looking to build their own capabilities with this model. Regulation remains key in this industry, and political lobbying from the incumbents could deter the growth that Lending Club has been able to sustain.