Lemonade – Renters and Home Insurance For Urban Dwellers

Build on the combination of technology and behavioral economics, Lemonade is an innovative insurance company hoping to "transform insurance from a necessary evil into a social good."

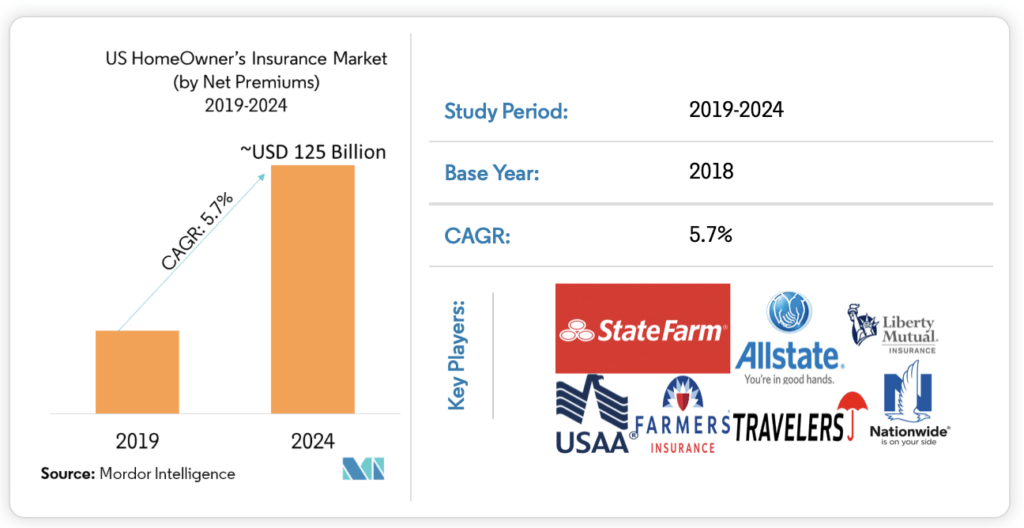

By 2024, market size of home owners insurance in the US is predicted to reach $125 bn [1]. With extremely low scores of customer satisfaction [2], little technical and business model innovation, and projected continual expansion in size, US insurance industry provides untapped opportunity for innovative disruption. This opportunity was recognized by Daniel Schreiber and Shai Wininger, experienced entrepreneurs, who founded Lemonade in 2015.

Lemonade is a “homeowners and renters insurance [provider] powered by AI and behavioral economics, and driven by social good” [3]. There are four characteristics that make it stand out from traditional insurance providers.

- Business Model: Unlike traditional insurance companies who make money off of claims, Lemonade charges customer a flat fee of 25% of a customers premium and devotes the remaining 75% to claims and reinsurance.

- Social Good: Innovative business model not only increases customer trust – the company has nothing to gain by holding up clients’ claims – but also lays foundation for Lemonade’s ability to follow through on its mission of providing social good. Upon registering, Lemonade asks its customers to specify a charitable cause they care about. This information becomes key in their annual “Giveback.” During the Giveback, Lemonade donates unclaimed premiums to support charity of the client’s choosing.

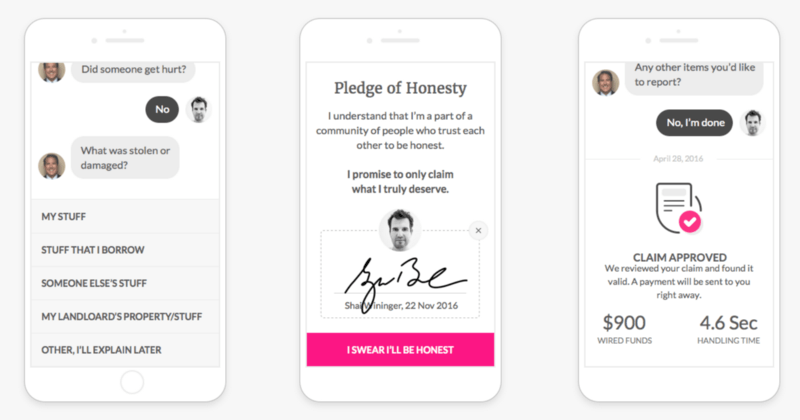

- Behavioral Economics: Instead of relying on management consultants advice, Lemonade partnered with academic researcher – Duke’s Dan Ariely, professor of psychology and behavioral economics, to eliminate fraud. For example, instead of relying on paperwork, Lemonade asks its users to speak in-front of a camera to file claim to foster honesty.

- Technology: Lemonade replaces human brokers and bureaucratic paperwork traditionally associated with purchase of insurance policy. Instead, the company uses Artificial Intelligence chatbots – “AI Jim” who evaluates insurer’s claims by running freud-detection algorithms and preforms an assessment of the claim against policy – and machine learning, which allows for a calculation of each user’s personalized rate.

Lemonade’s unique proposition for solving customers’ pain-point seems to work. Last year, which was only the second of company’s full cycle of operations, Lemonade registered nearly half a million users and revenue of $57 million [4]. The New York based firm now operates in over twenty states and plans to expand to cover whole of US and few European nations. [4]. Given that Lemonade is still relatively small in comparison to the multiple billion dollar industry of home and renter insurance, it is difficult to specify any one firm that looses out because of Lemonade’s entrance into the industry. However, I do think that innovation driven by Lemonade is likely to propose adaptation challenges to incumbent insurance providers like State Farm or Liberty Mutual. In the specific case of insurance, adaptation to new digitized mode of providing insurance – via mobile application rather than face to face meetings – provided a challenge to traditional firms because it completely turns around their way of conducting business. Instead of persuasive sales man, the companies should invest in AI based digital assistants. Moreover, one of the reason that Lemonade gained so many users so fast is its ability to position itself as an easy, fast, and transparent alternative to the distrusted and sluggish incumbent firms. Having a damaging reputation of everything wrong associated with insurance, it almost seems like traditional players would have to form spin off companies under different names to capture user interest. Important group of losers are also insurance professionals, who today work as agents. With technological expertise, and ever improving algorithms Lemonade successfully sidestepped necessity for human insurance agents to be involved in the process.

[1] https://www.mordorintelligence.com/industry-reports/us-homeowners-insurance-market

[2] https://www.ey.com/Publication/vwLUAssets/ey-2014-global-customer-insurance-survey/$FILE/ey-global-customer-insurance-survey.pdf

[3] https://www.linkedin.com/company/lemonade-inc-/

[4] https://www.lemonade.com

Interesting article! I am curious about how the company handles insurance fraud beyond the “Pledge of honesty”. I could picture loopholes where people would fake a theft and trick the A.I. into covering some items that never existed (by gathering expensive items’receipts from their friends for example).

Is Lemonade a non-profit company? How does it make money if it is paying all unused claims to charity? I would be curios to know more about their financial strategy.