Kickstarter: kicking the habit of turning to angel investors

Entrepreneurs raise funds via Kickstarter, and in doing so attract more contributors, who in turn make it an even more appealing platform

Entrepreneurs have tons of ideas for the next great product. And until recently, if an entrepreneur wanted even a modest sum of $10k, she needed to convince her friends and family to chip in. If she wanted $100k, she needed an angel investor. And if she isn’t connected to the right people, finding an angel investor is about as hard as finding an actual angel, as they are bombarded with a constant flow of “brilliant” product ideas. Moreover, even if she found one that liked the idea – this angel investor tended to demand things like “equity”, “liquidation preference” and more. She’s frustrated because she knows there are so many people out there who would believe in her product, if only she had 2 minutes of their time to explain.

Enter Kickstarter.

Kickstarter allows entrepreneurs to raise money from everyday people. Submit the proper forms online, upload your campaign’s video, and voila – you’re raising money. And the best thing? the money pledged comes with practically no strings attached – your contributors get no equity (moreover, it’s in fact unclear whether you even owe them the service/product you offered in exchange for their contribution). With the alternative being and endless search for an investor, that’s a lot of value created.

Kickstarter also creates value to consumers/contributors. With a 5% fee taken for every successful campaign, you can bet Kickstarter will do their best to find the projects you’ll find most appealing (read: you’ll contribute the most to, in expectation). So rather than sifting through the thousands of campaigns happening simultaneously at any given moment, Kickstarter will do it’s best to help you explore only the ones most relevant to you, sparing you the ones for products like “Little Eatz – treats that both you and your dog can eat”. With so much data about the campaign (popularity, category etc.), and about you (e.g., campaigns you’ve contributed to before, and if you’re willing, data pulled from your Facebook account), they’re very likely to do a good job.

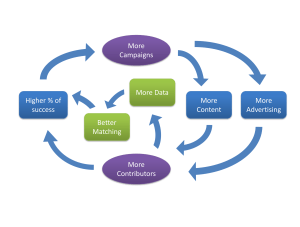

This brings us to every investor’s must-have these days – Network Effects. Contributors bring Campaigns and vice versa. It’s easiest to see how contributors bring campaigners – the more dollars there are on a platform, the better your chances are to succeed, and therefore to upload your campaign to begin with. But also, as mentioned, campaigns bring contributors. With plenty of campaigns to choose from, Kickstarter can keep the contributors entertained for hours browsing the site, and more importantly, to always have a supply of interesting campaigns. Campaigners also help drive more contributors by taking charge of the marketing efforts, blasting their friends’ social media feeds with links to their campaigns. And to top all of this off, with a growing crowd of both campaigns and contributors seeking a match, Kickstarter gets better and better at playing matchmaker.

And as mentioned, Kickstarter doesn’t shy away from capturing some of the value it creates – charging 5% of the money raised in fees. With about half of the fees likely going to cover credit card companies’ fees, Kickstarter is left with a hefty sum given its near-zero marginal cost. With $500M in money pledged (generating $25M in fees) this still doesn’t give it “Unicorn Status”, but relative to the amount of capital invested ($10M), it’s not too bad. And with new geographies constantly added, it is likely to grow even larger.

I think it’s clear that Kickstarter is a winner. However, it’s not too clear who is the loser. Two come to mind: angel investors, and all the companies producing products that compete with the products featured in the campaigns. Ryan Grepper, the creator of “Coolest Cooler” might have had to give up equity to raise the $50k he asked for his venture. Instead, he created a Kickstarter campaign, and raised $13M. Good chance some angel investor never got the chance to tag along for the ride. Maybe one day Coleman, a company that makes outdoor recreation products, will one day discover that Ryan Grepper is eating their lunch. Time will tell.

Interesting post, Asaf, I agree with you that Kickstarter’s value loop is a very powerful one. Thank you RC Strategy for the gift of value loops.

One thing your post made me think of is the impact Kickstarter has on traditional funders of consumer products (VCs, angels, etc.). With the significant traction Kickstarter has, I would expect more power to move to the hands of the entrepreneurs in their negotiations with investors. It will be interesting to look at data and see whether price/equity for consumer products startups has increased since Kickstarter is around. There might also be some sort of synergy between the traditional model and the crowd-funding model in which founders use Kickstarter to demonstrate demand and thus raise VC money more easily.

One concern I have with the Kickstarter value loop lies in value creation you identified for entrepreneurs: “And the best thing? the money pledged comes with practically no strings attached – your contributors get no equity (moreover, it’s in fact unclear whether you even owe them the service/product you offered in exchange for their contribution).” This is potentially very negative for many contributors who are so integral to this feedback loop.

With stories of so many Kickstarter campaigns that never return the promised goods, I could see potential for devaluation of the network. In fact, I’d be very interested to see metrics on the ratio of multi-campaign contributors are and the retention over time…

There is an interesting article from last year on the Verge (see link below) that talks about possible disintermediation of Kickstarter by equity-backed crowd-funding campaigns made possible by changes in investing regulation. Could spell out trouble for Kickstarter.

http://www.theverge.com/2014/3/28/5557120/what-if-oculus-rift-kickstarter-backers-had-gotten-equity

Thanks for the post, Asaf! Very interesting!

I certainly agree with you that platforms like Kickstarter (and Indiegogo) continue to provide a lot of value for entrepreneurs. It allows them to not only raise capital, but in some instances, it also allows them to test their products/services on a somewhat large scale (i.e., some companies provide funders early-access to the products) before going to a mass-produced market.

I also think in some cases you’re right about angels (at least smaller investors) losing out on the chance to invest in these companies. Those with larger sums of money to invest (angels and VCs) can certainly still do so, but with Kickstarter, they are able to better understand a little more as to how “risky” that investment is. Projects that are heavily funded with multiple different users/investors can certainly prove demand, allowing entrepreneurs to possibly raise at higher valuations and investors to bet bigger on those that consumers believe (via their financial support) will succeed.