Is Prosper prospering? The potential shift of banking into a platform business

Inherently risky or opportunities for value creation and capturing?

America’s first marketplace lending platform, Prosper has funded $6 billion in personal loans ranging from $2,000 to $35,000 since 2006. It matches lenders and borrowers, eliminating the role of banks as gatekeepers, capital allocators and underwriters. Though a small portion compared to 2015’s estimated personal loan market size of $110 billion (Transunion), Prosper is making a conscious effort to increase the portion of its individual lenders via the launch of Prosper Daily, a personal finance app meant to increase consumer engagement. Hence, Prosper makes an interesting case study of financial services as a platform business.

Value Creation

Prosper creates value for both lenders and borrowers in several ways. For lenders, it provides a high risk, high reward investing alternative. Compared to the historic S&P 500 return of 5%, the average return of 7.86% is a nice boost (as of January 2017 production). Effectively, instead of putting money in one’s also-zero yielding checking account or 1.5% APY Certificate of Deposits (the highest rate you can probably get from a commercial bank), one can skip the banks and lend to the top-tier borrowers for a yield of ~3.5%, gaining an additional 2%. Additionally, starting at $25 investment, Prospers makes high risk high reward investing more accessible to a wider population, a proposition that comes with its own set of benefits and challenges. The reasons Prospers can offer a higher rate of return for lenders are twofold:

- Prosper loans are not FDIC insured, compared to checking accounts (that one “hires” banks to lend out on your behalf). Banks pay a fee to FDIC-insure their deposit base though that fee does not cover the entire cost of the insurance. Guess who else is paying ? 🙂

- Prosper runs its operations online, saving the costs of running and operating physical branches. Banks invest in physical presence upfront in exchange for cheap funding, aka your deposits.

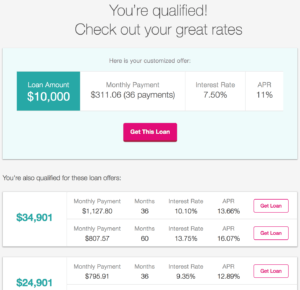

For borrowers, Prospers offers a compelling value propositions, especially for categories such as credit card debt consolidation. Average variable APR ranges from 16%-25% while one can get a Prosper loan for 11% APR. Because Prospers is a marketplace, borrowers can pick from several offers that differ in loan amount, APR, number of months, etc., more expedient than visiting several banks physically to get the same rate (as banks effectively use the same pricing model). At the extreme, borrowers can get good deals from “desperate” investors who price their funding very low to get it deployed, in an eBay auction fashion. Or on the other end, lenders can get extremely good yield if they are willing to take more risk than a typical commercial bank.

Lastly, Prosper services the loans made on its platform, including handling repayments, defaults, forbearance, etc.

Value Capture

Prosper charges borrowers a 1% closing fee of the amount borrowed for AA-D credit grades, and 2% for E-HR (high risk, high reward) credit grades. The minimum closing fee is set at $25. For lenders there is a 0.5% loan servicing fee for AA-A credit grades, and a 1% servicing fee for B-HR credit grades. These fees are deducted from each loan payment as they are received. Together, Prosper captures 1.5%-3% of the loan amount, approximately $90 million to $180 million in fee revenue since 2006.

How will Prosper scale up its platform business?

Prosper, together with Lending Club, has historically tapped into the deeper pockets of institutional investors through wholesale loan sale and the capital market through securitization. In the first one, investors buy a bundle of loans based on their criteria. Prosper removed friction from this process with their API that can plug into a lender or a broker’s systems. In the second one, loans are pooled in tranched special-purpose-vehicles and payment are distributed pro rata to investors, with those holding the top tranche, the lowest yielding and highest rated, getting paid first. The strategy was opportunistic during the low rate environment of the recent financial crisis. However, they will be competing with other asset classes as the economy improves further and the Fed raises rates. Recently, Prosper has invested in improving its retailer investor base, going back to its true marketplace model, as retail investors tend not to be looking out the horizon for better investing opportunities everyday. However, consumer marketing is costly and scalable only to a certain extent because of the product’s inherent risk. Regulation will be a major challenge to imagine virality for this type of business. While a clear cut strategy for scaling remains unknown, Prosper can capitalize on its outsider status to instill a personal and emotional connection with its lenders and borrowers.

Network effects and multi-homing

There is indirect network effect in the model as the more lenders Prosper has, the more borrowers it can attract and rates will get to a natural market equilibrium. Multi-homing exists but not as prevalent as other platform that has higher frequency of use and lower transaction size (such as your $10 uber ride every weekend). Just as individuals tend to have one main bank account and one main credit card, it is hard to imagine a borrower getting loans on both Lending Club and Prosper though it is more feasible for a lenders to do the same.

The Future of Personal Lending as a Platform

Looking at market size and shares alone, it is difficult to imagine a future where marketplace lending platform will outperform traditional banks as middleman of the capital market. On the one hand, it has benefited from consumers’ increasing comfort with online transacting and the modularization in financial services. It is no longer uncommon to have your checking account at Chase, saving account at Capital One 360, an Affirm payment account and a Betterment retirement account. On the other hand, modularization creates opportunities for aggregation of services along another dimension of performance, such as customized financial services (the SoFi model), replacing the convenience metrics that your corner bank has capitalized on. The value proposition for a one-stop shop bank remains strong, the banks of the future may just look very different from those that exist today. Consequently, Prosper would be well-advised to expand its revenue per customer eventually.

The lack of consumer insurance in marketplace lending is another deterrence for growth. However, assume a privately funded insurance service is available, the cost of the insurance may eliminate the excess returns and low rates enjoyed by Prosper lenders and borrower today. Currently the cost of FDIC insurance is born partly by the deposit-holding banks and partly by you and me, the US taxpayers. As expected, there is no free yield, just as there is no free lunch. However, Prosper can make more transparent the risks associated with its loans to the end lenders and borrowers, similar to what they have been doing with institutional investors through monthly loan reports.

Finally, some has argued that data and better underwriting will be the way that marketplace lenders win over traditional banks by pricing more accurately the risk and therefore enhancing customer comfort and appeal of the platform. However, one must not forget that the bank that they have a checking account and a credit card with, through which they incur hundreds of transactions a month, has more data about them (allegedly underutilized) than any marketplace lender that only asks for their employment status and annual salary at signup. Assume that social media data and other types of data enabled by the digital age could be a competitive edge, any models that take them into account are based on common sense and weak in the beginning. All models takes time and failures to improve its accuracy. Therefore, if Prosper consider data their competitive advantage, it needs to strike a dedicate balance between growing meaningfully to feed data into their model and growing too fast and too risky.

Sources:

Prosper – Smart, simple tools for borrowing, saving & earning

https://www.lendingclub.com/info/statistics.action

http://newsroom.transunion.com/transunion-consumer-lending-poised-for-growth-in-2016

https://medium.com/monetary-musings/fintech-businesses-platforms-or-not-92b4e3a84685#.gbne8qihh

Thanks for the post! I’m curious if the organization only connects US borrowers and lenders, or if there are international capital flows. If the platform only serves US-based customers, I’m interested how they’ve enacted those guardrails. In addition, I wonder how the organization thinks about managing it’s relationship with the CFPB (the Consumer Financial Protection Bureau). If the platform serves international borrowers and lenders, I’d be intrigued to understand how they manage in so many different regulatory environments.

thanks Lauren. Prosper is licensed state by state for taking lenders and I believe for the borrowers as well. They do transact through Utah-based Webbank and therefore subject to their regulators . I don’t know if they sell whole loans to foreign-domiciled investors, though if securitization, their SPVs are likely to be domiciled in Cayman or one of those islands and have a diverse investor base.

The WSJ article below states that CFPB is expecting to start supervising Prosper as soon as late 2017. I know that LendingClub and other fintech such as Affirm have set up their own trade group. Fun fact, Max Levchin of Affirm is in the Advisory board for CFPB.

https://www.wsj.com/articles/consumer-finance-watchdog-plans-to-supervise-marketplace-lenders-1461794493

https://prosper.zendesk.com/hc/en-us/articles/210013813-How-is-Prosper-regulated-

Hi…Thanks for this post. Banking is an area of interest for me and it is interesting to read your well explained post on how some of the tricky aspects like lending have been moved to the internet platform. The challenge here is managing the regulatory environment and how that evolves eventually.

Curious what Prosper’s loan success rate will look like once we have enough years of data to look back on — most loans have multi-year terms. Also curious what their marketplace means for equality and inclusion; how do they ensure the algorithms aren’t systematically disicriminating against certain underserved segments to preserve a certain default rate?

Thanks for your comments! They are very insightful. Prosper does share loan performance (at a very high level) in monthly blog post on their website. Not made to be comprehensible to a non-finance person.

https://www.prosper.com/about-us/2017/02/15/prosper-performance-update-january-2017/?bid=74&bname=Investor%20Updates

Yes there are currently lots of talks about digital discrimination. They do ask for borrowers’ zip codes which is sensitive under the Fair Credit Repoting Act as they could be telling of your socioeconomic status. However, do remember that they are also capturing your annual salary. I am sure they are getting around that regulation somehow (zip code is also used to determined if Prosper has license to operate where the borrowers reside)

Really interesting post! Do you think the shift from consumer to institutional was a positive move? I do worry that another LendingClub-style institutional withdrawal could derail the model much faster than if the lenders were retail consumers. Also, any thoughts on working with LendingTree and Mint or others to promote their business to potential borrowers? It does seem that this has helped all of the P2P lenders to acquire more customers at lower cost, but has also created more transparency on pricing which could hurt long term. It will be interesting to see where this industry goes!