In a Digital World, PTC is a real winner.

PTC, a leading software company is evolving to be a leader in IoT and AR.

PTC is a global leader in software development that provides technology solutions for other companies to design, build, operate, and service their products in this increasingly connected world. In a bullish market, PTC has outperformed their competitors which has led the in my opinion to be very successful winners.

Initially they began their journey developing computer-aided design (CAD) software. As that market became crowded and commoditized, they shifted their focus on product and service life cycle management. They used their proprietary software to create, manage, and deliver up-to-date service information for their customers. Furthermore, their technology could predict and prevent product failures.

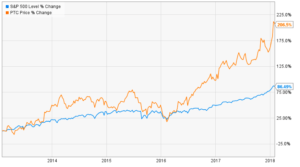

Again technological innovation increased competition and allowed them the opportunity to evolve again. PTC invested heavily in Internet of Things (IoT) and Augmented Reality (AR) to position themselves for future growth. This has significant impact as McKinsey estimates that IoT could have a total potential economic impact of $3.9 trillion to $11.1 trillion a year by 2025. To capitalized on this, over the past five years, PTC has gone on an acquisition spree and the bet has paid off. As shown in the graph, their stock price has increased by over 200% while the S&P 500 has gained roughly 85% over the same period. PTC’s stock price as increased from $23.77 to $72.19 adding almost $5.6 billion to the market capitalization.

An example of an acquisition that has benefitted the company was their 2014 purchase of ThingWorx. ThingWorx provides companies with unparalleled insight and into the status of their equipment. With ThingWorx, a factory plant manager can have real time visibility into performance and issues with any of their equipment. They can drill down to the root cause of problems and then gain insights in how best to address the issue. If it is simply a setting that needs to be changed, the manager is instructed in what to change.

The second area that PTC is heavily invested in is AR. Their suite of AR tools create significant value for their customers. According to their documents, AR brings clarity and efficiency to a broad range of stakeholders. For the servicing equipment, step by step instructions can be provided to mechanics for how to fix problems. This improves service margins, worker safety, response times and first-time fix rates. AR can also be used for training purposes. Rather than investing in capital-intensive mockups, or diverting productive resources for the sake of training, AR can improve retention, understanding and productivity by using interactive, 3D product visualizations in training. Lastly, AR can be used to improve operator efficiency on the manufacturing plant floor. AR can reduce errors and provide guidance for rapid problem detection and resolution. This improves output and lowers costs for PTC’s customers.

While their journey to this point has been very successful, I wonder how sustainable it will be. Many other competitors have started to jump into this space. In a recent talk, GE transportation showed how they are joining the physical and digital worlds to drive service efficiency and analytics. Will PTC be able to stay ahead of the technological curve, or will large companies with deeper pockets make competing in this market unsustainable for PTC?

Sources:

https://www.ptc.com/en/about#_ga=2.252763085.539838488.1517517549-770579608.1517517549

https://ycharts.com/companies/WMT/chart/#/?securities=id:%5ESPX,include:true,,id:AMZN,include:false,,id:TGT,include:false,,id:COST,include:false,,id:PTC,include:true,,id:DHR,include:false&calcs=id:price,include:true,,id:level,include:true&correlations=&zoom=custom&startDate=02%2F01%2F2013&endDate=02%2F01%2F2018&format=indexed&recessions=false&chartView=&chartType=interactive&splitType=single&scaleType=linear&securitylistName=&securitylistSecurityId=&securityGroup=&displayTicker=false&title=¬e=&units=false&source=false&liveData=false"eLegend=true&legendOnChart=true&partner=basic_850&useEstimates=false

https://finance.yahoo.com/quote/PTC?p=PTC

GE Talk:

https://www.youtube.com/watch?time_continue=1&v=UEyv5CVF0g0

https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/the-internet-of-things-the-value-of-digitizing-the-physical-world

Interesting post! I wonder if they are trying to go too broad with their offerings? While I see the intersection between AR and IoT, it seems that having a competitive advantage on offering a platform to both analyze the data coming from the equipment AND providing a training system through an AR platform is a tall order. Furthermore, providing a comprehensive AR solution requires a lot of partnerships and coordination among the hardware providers. Its also interesting how they seem to be taking a similar approach as GE in the case we most recently discussed, but the outcome in stock price is far different.