Grab Billion Dollar Opportunity in Southeast Asia

Grab, a major ride-hailing company in Southeast Asia, will be able to capture untapped payment market in the region? How will the ride-hailing platform help Grab building the payment platform?

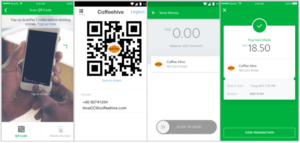

On November 2, 2017, Grab, a major ride-hailing service company in Southeast Asia (SEA), announced that they will add in-store and in-restaurant payment features in GrabPay, a payment function embedded in its ride-hailing App[1]. Similar to Alipay, customers can scan QR code at merchant stores, and complete the payment on Grab Apps. Grab is committed to become the leader in payment platform in SEA. In the latest $2.5 billion funding round, the company announced that the fund will be used to invest in Grabpay as well as its ride-hailing service[2]. Why is Grab trying to expand its payment platform? What are chances for them to be successful in the market? And finally, what will be implications to their ride-hailing business, especially on competition with Uber?

Payment Process at GrabPay

Huge market opportunities

SEA has a huge opportunity in payment space. Grab co-founder Hooi Ling Tan said “the Southeast Asian transport market stands at $25 billion, while the payment market is estimated at $500 billion[3]”. Many of 650 million people in SEA still heavily rely on cash. “Nine in ten in Southeast Asia don’t have a credit card and 75 percent are unbanked[4]”, Tan said. Similar to Alipay, Grab is trying to capture this opportunity by filling out institutional voids, lack of intermediaries in financial transaction in this case, using technology.

Cash based economy in Myanmar

Can Grab be a leader in payment in SEA?

Grab is going to leverage its leadership position of ride-hailing service in the region. Grab has more than 72 million downloads of the app, and operates in 156 cities in eight Southeast Asian countries[5]. Using this channel, Grab will be able to increase end users of the platform quickly, which will create a huge cross-side network effects on merchant side of the platfom. Jason Thompson, Managing Director for GrabPay Southeast Asia said “with our large base of users already conveniently paying for rides, …and merchants who are coming on board, we will begin to see GrabPay available everywhere to everyone[6]”.

However, there are several challenges Grab will face. First, the current Grabpay function in most countries is ‘closed loop’ payment, in which the amount top-upped by customers can be used only for the service offered by Grab (ride-hailing). In order to operate ‘open loop’ payment, in which customers can use the balance for other services such as restaurants, Grab needs to get a separate license from the regulatory body. Unlike Ant Financial, which expanded its service mostly within China, Grab operates eight different countries, therefore it needs to acquire the license from each. So far Grab acquired the license in Singapore and Malaysia, and the approval process is still ongoing in other countries.

Meanwhile the competitor is also trying to capture the payment market. In Indonesia, by far the biggest market in SEA by population, another ride-hailing company Go-Jek has already received a digital payments license from Indonesia’s central bank[7]. Go-Jek also acquired three fintech companies to expand its payment service Go-Pay[8]. Go-Jek CEO Nadiem Makarim said “2018 will be a year for Go-Pay”[9].

With such competition expected, Grab is still likely to become the market leader in payment. As many Chinese consumers and merchants use both Alipay and WeChat Pay, there is a room for multi-homing in this platform. If Grab can build its platform quickly using network effect through the existing ride-hailing customer base, Grab will solidify its position in the market.

Grab recently entered Cambodia, 8th country in the region

Implication for ride-hailing business

Grab’s ride-hailing platform will clearly help building payment platform, but the payment platform will also help Grab further strengthen its ride-hailing platform. Since many customers in SEA still don’t have credit cards, GrabPay will increase the convenience to use the ride-haling service, as Alipay and WeChat Pay became a dominant payment method for Didi. Currently many users are doing multi-homing between Grab and Uber, but they will start using only Grab with its convenience. There are many reports on Uber’s potential sales of its SEA business to Grab[10] – Grab Pay might become the final push to make Uber exit from SEA.

Photo credit

Cover picture: https://www.grab.com/sg/grabpay/

Picture 1: https://www.grab.com/sg/press/others/grab-launches-grabpay-e-wallet-in-hawker-stalls-restaurants-and-shops-in-singapore/

Picture 2: https://dustinmain.com/home/how-to-deal-with-money-in-myanmar-burma

Picture 3: https://www.grab.com/my/

[1] Grab, “Grab launches GrabPay e-wallet in hawker stalls, restaurants and shops in Singapore”, accessed February 25, 2018, https://www.grab.com/sg/press/others/grab-launches-grabpay-e-wallet-in-hawker-stalls-restaurants-and-shops-in-singapore/

[2] Grab, “Grab Announces Didi Chuxing and SoftBank As Lead Investors for Current Round of Financing”, accessed February 25, 2018, https://www.grab.com/sg/press/business/grab-announces-didi-chuxing-softbank-lead-investors-current-round-financing/

[3] “Grab driving to break into e-payment sector”, Vietnam Investment Review, November 23, 2017, http://www.vir.com.vn/grab-driving-to-break-into-e-payment-sector-54090.html

[4] Grab, the Uber rival in Southeast Asia, is now officially also a digital payments company”, Techcrunch, November 1, 2017, https://techcrunch.com/2017/11/01/grab-takes-a-big-step-into-digital-payments/

[5] Grab, “Grab launches in Cambodia with Ministry of Public Works and Transport”, accessed February 25, 2018, https://www.grab.com/sg/press/business/grab-launches-in-cambodia-with-ministry-of-public-businesss-and-transport/

[6] Supra note 1

[7] “Indonesia’s First Billion-Dollar Startup Races to Kill Cash”, Bloomberg, January 10, 2017, https://www.bloomberg.com/news/articles/2017-01-10/indonesia-s-first-billion-dollar-startup-races-to-kill-cash

[8] “Indonesia’s Go-Jek buys fintech startups to boost payments”, Nikkei Asian Review, December 25, 2017, https://asia.nikkei.com/Business/Deals/Indonesia-s-Go-Jek-buys-fintech-startups-to-boost-payments

[9] “Go-Jek CEO Says 2018 Will Be Year for Go-Pay”, Bloomberg, December 6, 2017, https://www.bloomberg.com/news/videos/2017-12-07/Go-Jek-ceo-says-2018-will-be-year-for-go-pay-video

[10] “Uber is preparing to sell Southeast Asia unit to Grab in exchange for stake in company: Sources”, CNBC, February 16, 2018, https://www.cnbc.com/2018/02/16/uber-preparing-to-sell-southeast-asia-unit-to-grab.html

Thanks for this great post, Taka! It was really interesting and especially so after the Ant Financial case we did last week. I had not heard of Grab’s focus of moving into the payments space. I wonder how Ant Financial might react – as it is trying to move into that space as well and to expand globally the reach that it has. You mention in your post that Grab is already functioning in eight different countries so whilst is will need regulatory approval to operate the payments part of its business there, it is already operating in these countries which is likely to help with the regulatory process. It will be fascinating to see how Ant Financial reacts to Grab’s business model expansion!

Thanks, Taka. It sounds like the regulatory issues could be a big hurdle (as they have tended to be in the ride-hailing industry more broadly). I’m very interested to see how Uber responds to this development – I certainly don’t see them just conceding SE Asia as it’s way too big of a region to completely ignore. I also don’t think they will want to enter the payments space given the internal turmoil at the company and their relentless focus on ride-sharing. It’s possible that Uber might try to make anti-competitive regulatory claims against Grab to prevent them from getting squeezed from the market.

Great post, Taka! I heard some days ago that Uber might be considering selling its SEA business to Grab and exit the region altogether, which would be consistent with their last plays in China and Russia. Furthermore, not sure how SoftBank feels about two of their billion-dollar investments competing head-to-head against each other? (https://techcrunch.com/2018/02/22/about-grab-uber/) Maybe Grab’s payment play points towards what we’ve been talking about regarding these kinds of platforms: most of their value is focused on its location (the level of service they offer in each town). Maybe broadening the product scope (venturing into payments) rather than expanding the geographic reach makes more sense, thus Uber should cut their losses and focus on Western markets, while Grab grabs SEA.

Thanks for the post Taka! I was surprised to see a ride-hailing company like Grab try to move into the payment area. But even if Grab can gain traction in mobile payments, I’m not sure they will be able to defend their position when global financial players like Ant Financial compete in SEA.

In Qihoo, we saw how product structure can help determine the success of a company, but can also determine the defensibility of its products. Qihoo used its 360 Safeguard as a natural springboard into software management, PC browser, then search. I don’t see the same strength of product connection between ride-hailing and mobile payments. These products don’t seem like complements, and I imagine a strong player in either product category would be able to take share from Grab. Qihoo also benefited from 360 Safeguard having very low multi-homing, which helped Qihoo secure almost 100% of the market. As we saw in Fasten, there is high multi-homing tendencies with ride-hailing. Having mobile payments when you’re in the restaurant doesn’t prevent you from using a different ride-hail when you’re outside the restaurant.

Time will tell, but I don’t think Grab will be successful with its entry into mobile payments.

Great post Taka! Just like Hans I was also thinking about the issue of limited complementarity between the payments and the ride-hailing products as I read your post. It seems that Grab intends to leverage its already large user base to accelerate the adoption of the payment product. However, there might be some complementarity if they intend to use the same e-wallet for both products because it eliminates the need to build trust with consumers who are already using the ride-hailing app.

Additionally, I wonder how the payments space will be affected by the blockchain. The adoption of cryptocurrencies by the unbanked in emerging economies is on the rise and cryptos are being used for a wide variety of financial transactions. For instance, Bitso is a cryptocurrency exchange platform based in Mexico and almost 30% of users are unbanked using cash to open accounts.

Thank you Taka for the post. It is indeed very interesting to see Grabpay trying to be the Payment platform in SEA. In addition to the difficulty in acquiring the license from each country it tries to operates in, the company will certainly face intense competition in each market. For example, in Thailand, Grabpay will need to compete with Ascend group an Alipay partner which mother company owns the largest convenience store chain in the country.

Great post, Taka! It’s interesting to see how a company move from one platform to other platforms. I would like to push back a little bit on the comments of limited complementarity between ride-hailing and payments. Ride-hailing is an important offline payment scenario and can help kick-start the payment business and educate customers, so it can later expand to larger addressable market. Meanwhile, payment system can improve the customer experience of Grab ride-hailing (I assume Uber is still based on credit card while many people in the SEA are unbanked?). So the two platforms actually reinforce each other.

To Eliza’s earlier comment, I think Alibaba (Ant Financial), will definitely be very interested in investing in Grab, just as what they did with Paytm in India.

Thanks for an interesting read Taka! For most developing countries where credit card is not as prevalent, mobile payment seems an interesting opportunity to fill the gap and replace cash-based payment. But I think who has the power and capability to develop the untapped mobile payment market is under question. In Alipay and Wechat Pay’s case, they each has a very stronger user base developed from social media and e-commerce. In social media, peer to peer transactions are usual so payment method derived from the specific need seems natural. So is e-commerce. I wonder how much paying for transportation accounts for the total transaction need of a person, and how sticky is the habit of using the payment method or app derived from that.

More importantly, the two tech giants both have strong capability to build out offline presence, striking partnerships with merchants and retailers beyond where they started off. You mentioned that Grab could leverage its network effect but only when the other side of the platform, which is merchants, is brought on board can I see the possibility of cross-side effect. And I question the capability of offline execution when Grab is facing eight entirely different countries with different retailer presence and customer preferences.

Thanks for the post. It’s been interesting to watch the competition between Uber and Grab in SE Asia. From my perspective, Grab had an upper hand in being able to tailor it’s business model to the market across a range of dimensions: from accepting cash, partnering with taxi companies rather than fighting them, programs aimed at improving the livelihoods of drivers and their families, as well as GrabPay. While this in and of itself may not be sufficient to drive complete loyalty of the SE Asian rider, GrabPay really stands to increase user engagement.To the extent that Grab can incentivise activity across its riding platform and use of GrabPay in multiple contexts, this move could really position Grab as a preferred partner.