Garmin’s navigation to a new business segment: fitness wearables

Garmin’s evolution follows the historical change of technology from hardware-based innovation to the use of software and data for value creation.

Garmin was founded in 1989 as GPS technology company; it was a pioneer for the first GPS units for consumers and during its first 20 years, it became the market leader of GPS products for automotive, marine and aviation industries. However, after the introduction of the iPhone in 2007 and the popularization of smartphones (which includes GPS technology) with free maps navigation apps, the company started to lose relevance in the consumer segment. In the past decade, Garmin invested in developing wearable technology and expand into sports and consumer fitness segment, creating the early versions of activity trackers and sport watches.

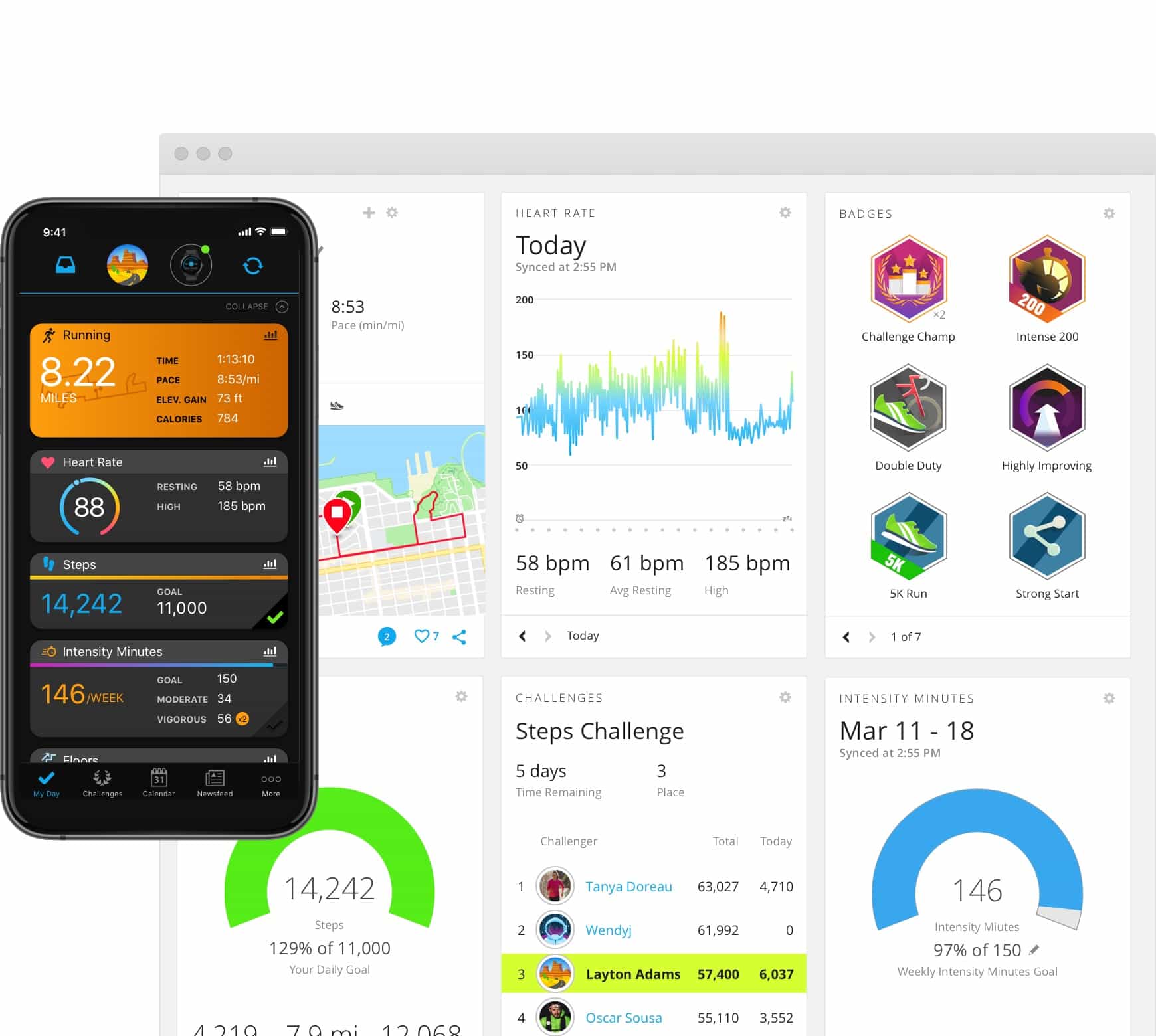

Today, Garmin offers a suite of products that serves the fitness enthusiasts monitoring their daily activity as well as the sports athletes training for a triathlon. Nonetheless, hardware expertise is no longer sufficient, and Garmin had to adopt data analytics as an essential asset to enhance its business. The new value creation for Garmin comes from their app Garmin Connect, which allows the user to track and analyze their data. While the specific type of data depends on the actual device model being used, some of the general fitness stats tracked are steps, speed, heart rate, activity time, calories burned, ascent/descent, location, etc. Using dashboards, graphs and historical tracking, Garmin can nudge users into more active engagement as well as performance improvement, like surpassing a steps goal or reducing race time.

Another example of value created by Garmin using data collected by its devices, Garmin released a Coach feature within their app that provides personalized training suggestions and customized workouts based on the user goals and performance ability. This allows the user to adjust, whether intensity of workout or rest time for recovery, so they can eventually see the intended personal results.

This data platform through “Connect” app, not only allows them to build a community of users with a shared interest in fitness but also gives them insight into their next product development – whether a new feature through the app or a new wearable that addresses a specific target need such as new device for blood pressure monitoring (Garmin Index BPM). While Garmin Connect is currently free to use, it is still unclear how their value capture strategy will adapt as more wearable companies shift their data insights platform behind a paywall or subscription model.

Fitness wearables have become a competitive segment with many different options available today: some by incumbents of the smartphone era such as Apple Watch and Fitbit (recently acquired by Google), but also relatively new entrants like WHOOP and Oura Ring that intend to leverage its digital health capabilities in niche segments. User experience is key to create and capture value in this next phase for wearables, beyond the ability to collect data and create great sensors. Current competitors in the segment like Apple and Google already have the data analytics and software expertise, so Garmin needs to find a way to leverage its cross-platform mobile compatibility for a larger ecosystem (tapping both iOS and Android users), as well as a way to monetize the value creation through data captured by cutting-edge sensors (currently they exclusively monetize the hardware device sales, not the services or insights). They should also further pursue specialization into the segment like its latest devices being FDA-cleared, potentially acquiring some of the smaller players to build a robust health & fitness portfolio. For Garmin, continued investment in its digital transformation and data analytics is critical to find its path to being a leader in fitness wearables.

Sources:

https://www.cnbc.com/2020/10/06/how-garmin-survived-the-iphone-and-started-growing-again.html

I think the potential for Garmin to expand into the health space is quite interesting. They could even consider using their wearables to collect data for other healthcare players, similar to what apple has been doing with their Apple watch or what Google has begun to do with FitBit and Verily.

Garmin is a great company to choose for this blog post! I considered getting a Garmin watch to help track my training runs because it is known for having great tracking / GPS and ability to offer customized training plans based on prior performance. I think that this company will likely expand into other athletic spaces (e.g. swimming) over the next couple year and that the popularity of the brand will grow as the analytical capabilities continue to improve.

Thanks for highlighting Garmin! Fitness data is a really cool application of the concepts we have been talking about in class and it’s interesting to see how Garmin is positioned relative to their rivals (Apple, Fitbit, etc) for the more intense athletic user. And the data that you talk about fits directly into that positioning! Really cool, thank you again!