Fundrise – Real Estate investment for everyone?

Fundrise is a private real estate investment platform that allows average individuals with low capital to invest in real estate.

Real estate investors historically have enjoyed an average return around 9%, with less volatility than stocks, through direct investment in real estate properties. Institutional investors have used real estate to diversify their portfolios with significant investment in real estate, on the other hand, average investors with limited capital have had a hard time accessing the real estate club, which limited their investment to one or two properties with no diversification and the higher risk of default. In 2013 the Jumpstart Our Business Startups or “JOBS” Act, passed and real estate crowdfunding became possible, individual accredited investors with over 1 million in assets or making over $200,000 were able to invest directly and diversify their portfolio of real estate for as low as $1,000.

To include non-accredited investors, Fundrise investors do not invest directly in real estate, but they participate through eREITs and eFunds (Launched in 2017). Unlike regular publicly traded REITs it is less liquid and not effected by open markets and it has a significantly smaller market, however, investors in eREITs get to avoid some of the typical REIT fees like 1% annual asset management fees. The portfolios are located across the US with a focus on income generating properties and long-term appreciation strategy. The platform invests in commercial real estate properties specifically in deals that are small for public REITs but big enough to generate an adequate return for investors. With over 17,000 investors, Fundrise managed to invest $300 million in commercial real estate deals, and in 2017, they earned 11.4% total return on investment and paid +$16 million in dividends.

Value Creation/Capture:

Fundrise allowed non-accredited investors to get involved in commercial real estate investments which differentiated the platform from other competitors while giving investors all the benefits of online investment platforms including online convenience and accessibility, diversification, and consistent cash flow for a fee of 0.85%. Also, it adds value on the development side, as it fills the gap of funding for smaller real estate projects which are traditionally hard to finance.

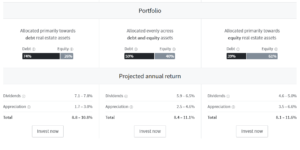

The platform gives investors 3 options to choose from depending on their risk appetite and investment strategy, all options range from moderate to long-term investment:

1- Supplemental Income: Moderate-term investment while providing highest dividend and lower appreciation.

2- Balanced Investing: More diversified portfolio, moderate to long-term investment and average dividends.

3- Long-Term Growth: Longest -term investment horizon and highest return option through appreciation.

Risk and Competition

Although Fundrise was one of the first real estate crowdfunding, the market is very crowded with other platforms that provide different services and valuable investment options. Unlike other platforms like PeerStreet which only provide collateralized senior debt positions, Fundrise invests in projects as Equity, preferred equity, and mezzanine debt and occasionally Senior debt, which expose investors to a higher risk in case of default. In addition to that the competition with more liquid and established publicly traded REITs.

As the real estate cycle reaches its eighth year with historically low-interest rate and cap rates, the skepticism regarding crowdfunding platforms increases, crowdfunding platforms may not have the capital or the expertise to survive a recession exposing +$2.5 billion of real estate investment to default risk.

Sources:

https://fundrise.com/

https://investorjunkie.com/44326/fundrise-review/

https://www.forbes.com/sites/samanthasharf/2017/06/15/home-sweet-investment-fundrise-introduces-new-way-for-millennials-to-endow-their-future-houses/#5f457f9f779b

Fundrise Reports 2017 Performance. Total Return for the Year Stands at 11.44%

Fundrise Drops Minimum Investment to $500 in New Starter Portfolio Offering

https://wallethacks.com/realtyshares-review-crowdfunding-real-estate-investing-platform/

Thank you for the great post! Real estate crowdfunding definitely seems to fill some of the market needs, such as helping to finance smaller real estate and allowing people increased access to a new asset type. However, I do worry that Fundrise is requiring a very low minimum, such as $500-$1,000, because that threshold will impact what type of investors the platform will attract. If the investors don’t fully understand the risks, a few bad returns can bring detrimental word of mouth for the platform.

I totally agree, and the criticism on some of these platforms is happening already because of a few unsuccessful deals. However whats helping Fundrise is that its diversified over 30+ deals so they balance the risk if a couple deals went bust, unlike other platforms were investors can put 5K or 10K in direct investment and if the deal default they lost the whole investment. I think its risky either way and they haven’t been exposed to a real test yet and survived a market crash or a rescission.