Fundrise: Private Real Estate Investment For Everyone

Fundrise is a crowdfunding platform democratizing commercial real estate investment for non-accredited investors. Can it compete with the well-established public REIT market for retail investor capital?

Fundrise has become an early success in the real estate crowdfunding marketplace. The platform was founded in 2012 after the Jobs Act eased restrictions on security trading that made private real estate investment accessible beyond high net worth individuals or investment firms.

The platform currently has over 130,000 active investors and has invested over $4 billion in real estate since its founding.[1] The company seeks to capture a slice of the commercial real estate market in the U.S. for its users, which is valued at around $7 trillion.[2] While the company helps unlock new sources of capital and new investment opportunities, it is competing with a growing field of other real estate crowdfunding platforms as well as the long-established public REIT and REIT ETF market. It begs the question, will greater platform scale help the company to compete with the larger REIT market and other platforms by achieving greater risk adjusted returns for its users.

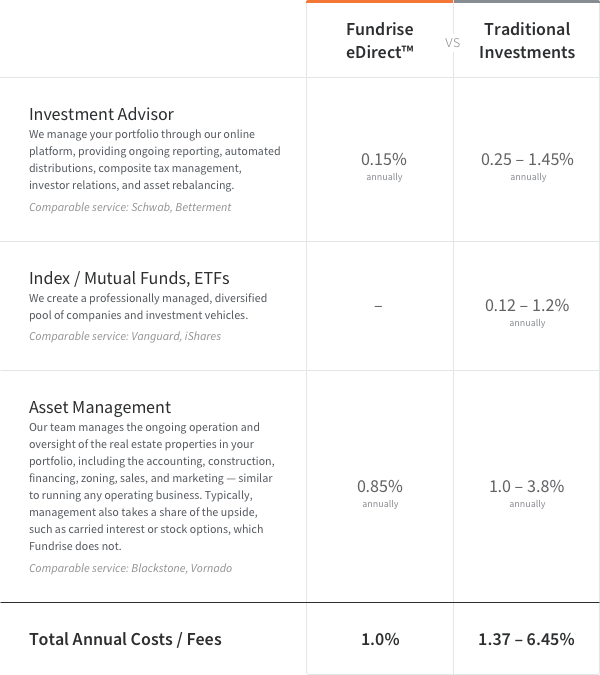

Fundrise can be described as a matching platform and a financial management platform. The company connects accredited and non-accredited investors with private real estate projects. Investors gain access to deals as participants in eREITS or eFunds, while real estate sponsors can raise capital for their projects. In the process, Fundrise collects an annual asset management fee of 0.85% and an advisory fee of 0.15% on all capital invested by its user base.

On the user side, Fundrise captures and creates value in several ways. The main value is in connecting retail investors to portfolio diversification with as little as $500 needed to start. Modern Portfolio Theory has shown that allocations to real estate assets are necessary for maximizing returns for the lowest amount of risk. Individual retail investors will increasingly allocate more retirement savings and investments over to real estate, similar to institutional investment portfolio trends. However, the illiquid nature of private real estate and the long investment horizon of 3-5 years is a deterrent to many investors who prefer the liquidity of public REITs.

Fundrise also creates value by managing the individual investments for users based on targeted risk and goal profiles. The user investments are then allocated to various funds based on the user investment strategy. This dramatically simplifies the investment process for users while allowing users to maintain some control.

Overall, Fundrise argues it can provide greater annualized returns in the long run compared to public REITS. The company does this first by connecting investors to deals with higher returns, and second, by cutting out middlemen. Through a tech-enabled process the company underwrites over 250 investment opportunities each week but less than 1% are approved.[3] The high number of submissions allows the company to select the best deals. The platform targets projects with investment sizes in the low millions, as these projects generally are less competitive and allow for higher returns.

Through cutting out middlemen, users are placed much earlier in the value chain and are much closer to the individual assets with preferred equity or senior debt positions. The reduction in intermediaries cuts out many fees and expenses and eliminates the liquidity premium of the REIT market[4]. The process to start investing takes less than 5 minutes, making it extremely easy for new investors to begin.

Table 1 – Fee Comparison[5]

From the real estate sponsor perspective, the platform also creates significant value. Fundrise is a new avenue for smaller scale developers to raise equity and debt. The platform has created tools to make fundraising more convenient and less time intensive than traditional methods by streamlining investor management for the life of the investment. As the platform grows with greater investment potential from its users, it is likely that sponsors will continue to be attracted to the platform for the ease of this process.

Despite the growth of Fundrise over the past several years, scaling and sustainability of the platform remain a question. It remains to be seen that the Fundrise platform can establish a growing portfolio of projects for users with investment returns that beat other fintech competitors and the established REIT market. The network effects from a growing investor base are also unclear. While the multi-honing of users is low given the long investment time horizons, the multi-honing of sponsors is likely to be high. Sponsors can currently shop their deal around the numerous real estate crowdfunding platforms to see who will meet their needs best.

There is also concern in the ability of the platform to deploy user capital as it grows. Finding adequate deals to keep up with capital expectations may be difficult and is reliant on a robust network of sponsors submitting deals regularly. As more user capital flows into the platform the current small-scale projects strategy may be insufficient to deploy all the capital available. If the platform cannot maintain the competitive advantages that comes with investing in small scale projects as it grows, it may need to target larger projects. However, this will lead them to competing directly with institutional players and potentially losing out on the portfolio diversification that comes with smaller projects.

[1] Kim P, “Fundrise Review: Is It Legit?,” CreditDonkey, Feb 9, 2020, https://www.creditdonkey.com/fundrise-review.html, accessed Feb 2021.

[2] “How Does Real Estate Crowdfunding Work?,” RealEstateInvesting.org,, https://www.realestateinvesting.org/real-estate-crowdfunding/, accessed Feb 2021.

[3] “Fundrise Review – I Invested $1,000 Here’s What Happened,” RealEstateInvesting.org, https://www.realestateinvesting.org/fundrise-review/, accessed Feb 2021.

[4] Claire Rohlfs, “Vanguard vs. Fundrise: Which is the Better Investment Option?,” Fundrise, Dec 2, 2019, https://fundrise.com/education/vanguard-vs-fundrise-which-is-the-better-investment-option#origination-level, accessed Feb 2021.

[5] Claire Rohlfs, “Vanguard vs. Fundrise: Which is the Better Investment Option?,” Fundrise, Dec 2, 2019, https://fundrise.com/education/vanguard-vs-fundrise-which-is-the-better-investment-option#origination-level, accessed Feb 2021.

Fundrise is a fascinating business that is undoubtedly creating value for both sides of its platform. My concern with businesses like this one is that their commodity status prevents them from capturing a commensurate share of the considerable value they create (PeerStreet fell prey to this). It will be interesting to see how they evolve over time.