Friend Not Foe: Starbucks Bets a Latte on Digital

For years, Starbucks has been a lonely example of how a traditional brick-and-mortar retailer can leverage digital innovations, rather than fight them. The company introduced mobile payment systems in 2009 and wireless charging stations in 2015, far before the technologies were commonly used. 2017 is no different. Starbucks continues to bet big on digital by integrating the in-store and digital customer experience and it’s paying off.

Customer Convenience = Starbucks Cash Flow

Starbucks’ primary digital asset is its mobile application. Used by over 12 million customers, the app allows for quick and easy payment, rewards for loyalty, and additional features like store locator and music recommendations.[1] How does Starbucks translate a great app into great economics? Well, for one thing they get your money upfront. Think of all the transactions you make in a day or week – how many of them do you actually pay for before the service has been received? Somehow the convenience, rewards, and predictability of the Starbucks experience allow customers to mentally justify the prepayment proposition. In 2016, Starbucks achieved 38% of its revenue, $6 billion, from pre-paid cards.[1] This favorable working capital line item translates to serious cash flow for the coffee giant. In recent years, the company has achieved an annual net cash benefit of $150 million from prepaid cards, which will only grow as customers join the platform.[2]

More Cash Flow = Better Innovations

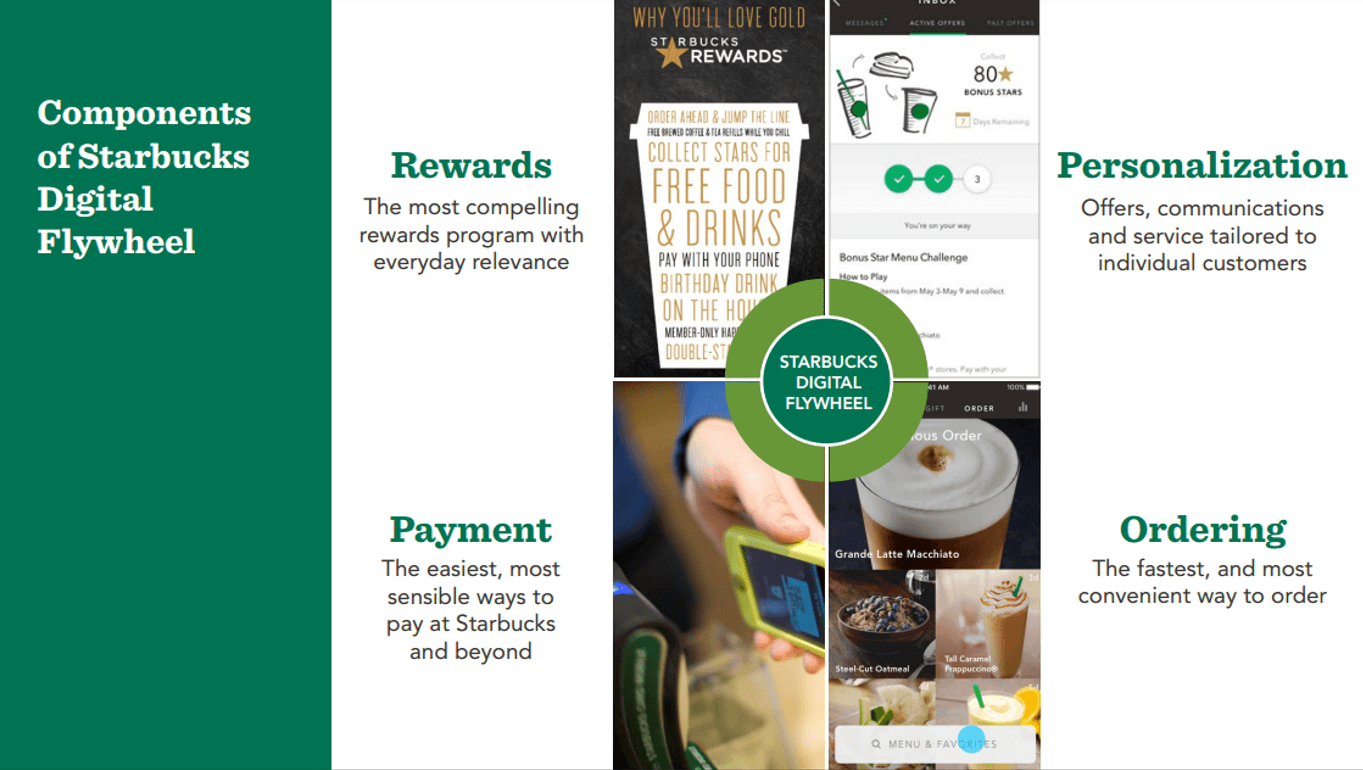

Starbucks, therefore, gains an advantage in reinvesting in what CTO Gerri Martin Flickinger refers to as the “Starbucks digital flywheel,” innovations that continue to enhance the Starbucks experience and facilitate value capture (see slide).[1] This includes game-changing initiatives like the 2015 introduction of Mobile Order and Pay. This new functionality allows customers to conduct the entire purchase process within the app and simply pickup their ready-made drinks in stores of choice. The feature now accounts for ~8% of Starbucks transactions.[1] While there have been some minor operational growing pains in adapting to this immense demand, mobile ordering platforms have proven to increase customer loyalty, purchase frequency, and average ticket sizes.[3][4] Thus, Starbucks is poised to reap the benefits of this innovation in the coming years. In fact, its confidence in the feature was recently manifested in its partnership with Amazon’s Alexa to create a “virtual barista” to facilitate seamless voice ordering. [5]

Better Innovations = More Sales

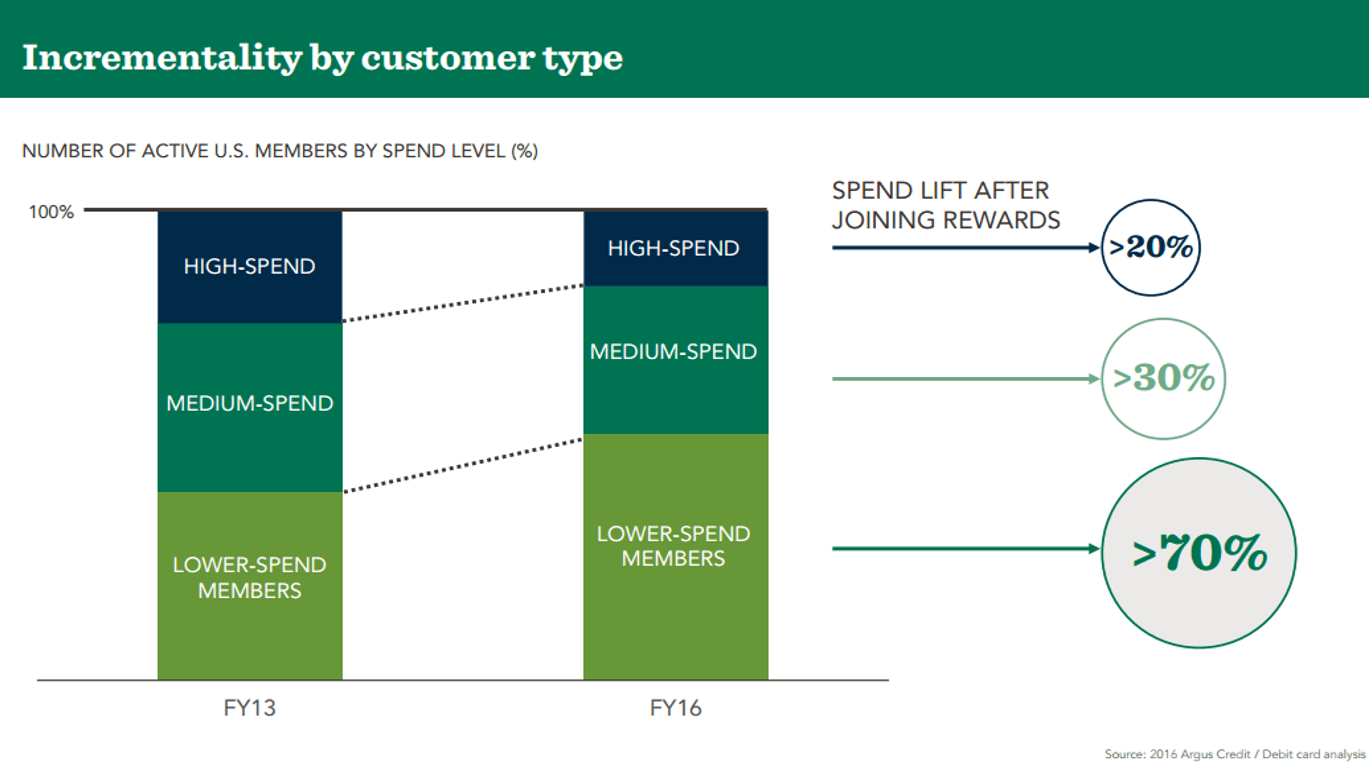

Customer-centric innovations like the above drive regular customers to migrate to the digital platform which further contributes to Starbucks’ bottom line. After joining the rewards program on the Starbucks app, spend has increased by a minimum of 20% across all customer segments (see chart).[1] App users in general are more loyal and reportedly spend three times more than the average Starbucks customer as well.[3] Digital conversion also drives value by facilitating the seamless collection and utilization of data. With 12 million active users, almost 20% of all Starbucks customers and growing, the company can observe customer and store data in real-time and use it to create personalized targeting.[1] In addition to bolstering the Starbucks’ brand, this one-to-one communication has already shown signs of financial success by making marketing spend more efficient and driving increased promotion redemption and related sales.[1]

By crafting an operational and financial model that leverages its digital offering to better serve customers, capture incremental value, and fund future innovations, Starbucks is well-positioned to continue to thrive as the traditional retail model evolves.

Amazing pun. 🙂

🙂 thanks Sonali!

Is Starbucks simply lucky?

I ask this because apparently their products have not been seriously challenged by digital services, like non-F&B retail, taxi hailing, and hotel booking were. Simply speaking, Starbucks sells coffee and other drinks, as well as the environment where people can stick around for a dozen purposes. An e-coffee or e-seating place were not invented, and Google maps did not undercut the value of coffee. They had no threat from the digital economy, anyway. Please correct me if you can, but I can’t get my head around this.

Meanwhile, I do agree they did a good job with the app augmenting their current products.

Thanks Hao! You certainly make a good point that Starbucks benefits from a lack of digital alternatives to its core products. I don’t think this eliminates the fact that Starbucks has built and leveraged mobile assets to continually increase the value proposition to customers to win in the (competitive) restaurant space. With the digital revolution, customers are becoming more impatient and high maintenance as it relates to convenience and personalization. Restaurants who have lagged in utilizing digital to respond to this are facing problems with customers that can drop to the bottom line (for example, see some of the low performers here: https://arc.applause.com/2016/06/22/best-restaurant-apps-2016/). In my view, by making value-add digital innovations, Starbucks is protecting against the risk of defection.