Faire: Empowering the Shop Local Movement

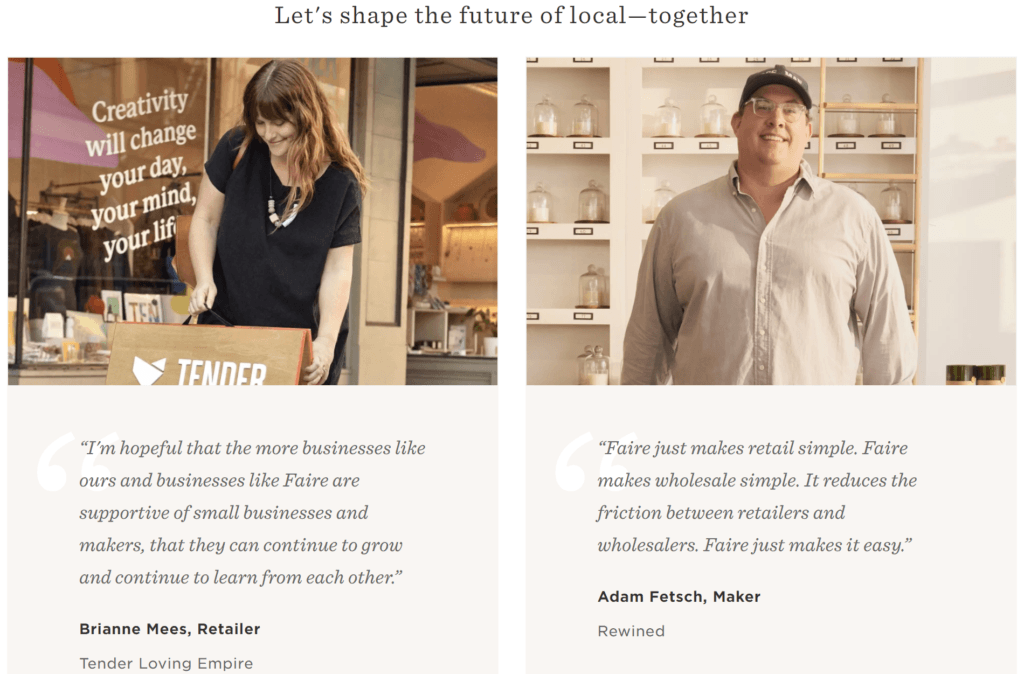

Faire is an online marketplace connecting small independent retailers with artisans (makers) to bolster the Shop Local movement and build local economies.

How does Faire create value?

Faire connects two fragmented groups to enable transactions that weren’t already occurring. Traditionally, small retailers would find sellers by attending tradeshows or searching online for specific items. They would negotiate terms and keep track of inventory, payments, and re-orders for each individual seller.

Traditionally, makers would find buyers through agents, tradeshows, or individual outreach. This is both time consuming and costly, leaving less time to actually work on their craft.

Enter Faire. Faire helps reduce those costly and time consuming search costs that both sides face so that retailers and makers can focus on their core business. For retailers, Faire offers a site where they can not only search for what they are interested in but also discover new finds based on Faire’s personalization algorithm.

- Faire delivers a one-stop-shop experience by centralizing buying and payment for all of the makers they shop from on the platform.

- Faire offers straightforward, no-negotiation terms. Payment terms are Net 60 (ie. pay after 60 days).

- Faire funds returns on first-time purchases with makers. The founders believe that lack of returns is a key barrier for small retailers purchasing and by de-risking this process, they will enable more transactions.

For makers, Faire offers a platform to reach thousands of potential customers without the monetary costs of tradeshows and agents, or time costs of outreach and upkeep of administrative tasks.

- Faire allows makers to have a direct fulfillment relationship with retailers, eliminating the need for costly booths at tradeshows or working through an agent.

- Faire does marketing on behalf of makers but nudging buyers to restock, or alerting them to new SKUs from makers they’ve purchased from previously.

- Faire centralizes invoicing and guarantees payment with two options: (1) next day less 3% payment processing fee, and (2) Net 30 for the full amount.

- Faire does not have listing or membership fees; onboarding is quick and easy.

How does Faire capture value?

Faire captures values through the following commission on makers: 25% for new retailers, 15% on reordering retailers, or 0% for new-to-platform retailers that the maker invites to Faire.

The greatest risk to a platform like this is disintermediation. Faire has taken steps to help stop this issue by creating value within payments and invoicing to incentivize both parties to stay on the platform. Off the platform, retailers would lose the advantages of a one-stop-shop and makers would lose guaranteed payment. Additionally the commission structure helps monetize the first interaction disproportionately so that in the chance disintermediation does occur, Faire still recoups some value through the matching process.

Is this model scalable and sustainable?

Faire turned 3 years old in January and as of October 2019 had 50K local retailers, 7K makers, and 15M products sold. Makers now hail from 39 countries and the platform expanded to include Canadian retailers.

The platform exhibits strong cross-side network effects: each additional maker adds value to the buyers through selection and price competitiveness while each additional buyer adds value to the makers by being a potential customer. Faire has created a sticky platform by instituting infrastructure to deliver a one-stop-shop experience, and a referral funnel by which makers can onboard existing retailer relationships to the platform. Additionally, since both sides of the marketplace are highly fragmented, it would be difficult, at this point, for a competitor to replicate the network effects and compete with the incumbent. Large e-commerce players do not pose a threat because the most similar platform Etsy, tried B2B and shut down the platform after realizing their consumer-scale makers were different from the wholesale-scale makers they needed. Amazon is also not a threat because Faire’s retailers are looking for products you cannot find on Amazon; they even have a badge and filter on their site for this.

On the surface, Faire’s commission model and tactics to fight disintermediation lend itself to have a sustainable business model. As the business grows, so too will the percentage revenues from commission. They do not hold any inventory, and manage a fully third party business. Digging deeper, the big red flag on long term sustainability lies in their payment terms. In order to maintain Net 60 for incoming payments and Net 30 for outgoing payments, Faire will need to maintain a high volume of transactions and keep enough cash on the balance sheet to backup the payment guarantee for makers.

Sources:

- https://news.crunchbase.com/news/online-marketplace-faire-ups-local-retail-game-with-150m-series-d-bags-1b-valuation/

- https://www.faire.com/

- https://www.luckybreakconsulting.com/review-of-faire-the-wholesale-marketplace-platform/

- https://www.luckybreakconsulting.com/an-interview-with-max-rhodes-ceo-of-faire/

I think the points you raised about Faire’s sustainability are really interesting especially with the payment terms. I am curious to see their ability to maneuver the current environment and a recession. On one hand, large gatherings, including trade shows, being canceled and may lead to small businesses and makers turning to Faire out of necessity driving both sides of the platform. On the other, recessions typically hit small businesses the hardest which will be challenging to makers, retailers and Faire.