Etsy: How One ‘Crafty’ Company Carved Out a Niche

Etsy has a current 1.5 billion dollar market capitalization. From its birth in the mid-2000s e-commerce has exploded in almost every product category imaginable. How has Etsy managed to stay afloat among titans like eBay and Amazon?

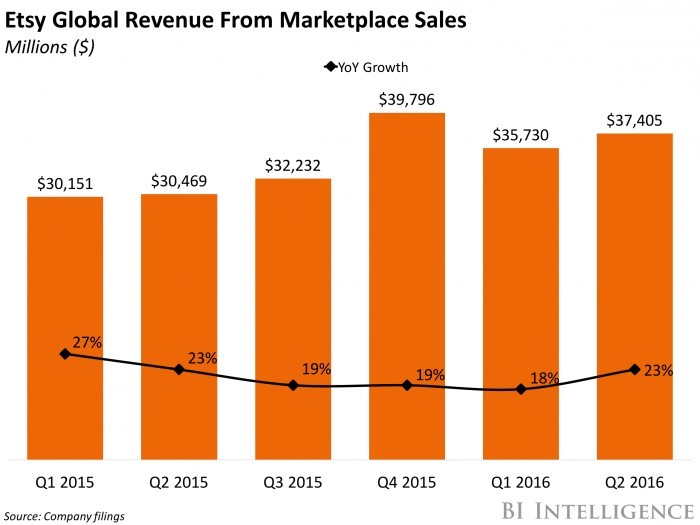

Etsy’s incredible 12-year journey has led them through a successful IPO to a current 1.5 billion dollar market capitalization. Along the way this 2-sided marketplace for handmade, vintage and craft items has faced some serious challenges. These include vendor and consumer backlash for permitting bulk manufacturing resellers onto the platform, accusations of IP violations, as well as a competitive response from Amazon called ‘Handmade.’ [1] Yet, in Q2 2016 year-on-year growth was a healthy 23%+ with annual marketplace revenues topping 37M, active sellers grew by 11% to 1.6M, and a whopping 81% of gross merchandise sales still came from repeat purchases. [2,3]

Humble Beginnings & Scale-up

The road to success began when the founders keenly identified a niche marketplace. In 2005, a general anti-Wall Street sentiment still lingered in the public mindset. Some of that sentiment evolved into a mainstream feminism movement as an outlet to vilify corporate culture. Simultaneous to this was the recent popularization of social networks like LiveJournal and Blogger. Needless to say, their idea was incredibly opportunistic to the macro-economics of the time. [4]

The first move was going door to door at flea markets to engage trend-setting key opinion leaders (KOLs) – artists and craftsmen across a variety of creatives. It just so happened that many of these vendors had no e-commerce presence since they perceived owning an online store as complicated. As Etsy dusted off their hands on the supply-side problem, WOM marketing and blogging did the rest to grow out initial demand. In 2011, organic channels still represented 90% of traffic. They succeeded here by devoting themselves to helping sellers by creating a “Seller Handbook,” developing tools to optimize order processing and customer engagement, and building meaningful social media integrations. [4]

Competitive Dynamics and Multihoming

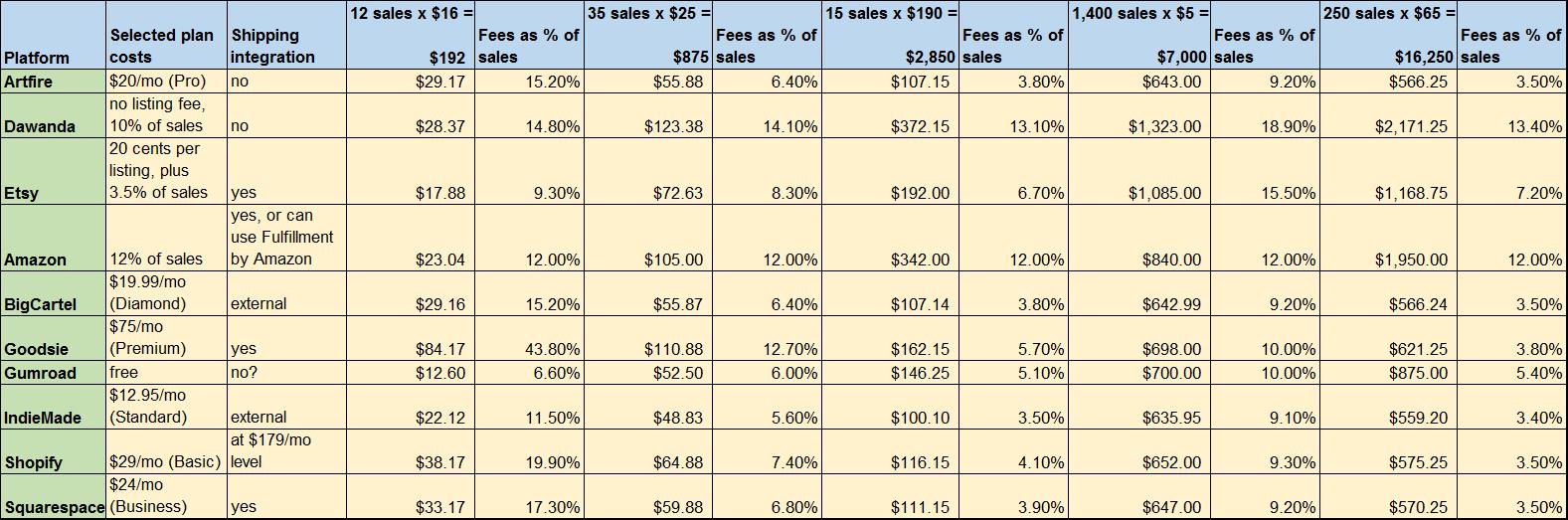

But what about that mega platform eBay which boasted around 117M total listings in 2010 (vs. Etsy’s 6.7M)? It turns out that only 3M listings on eBay were for similar handmade goods. eBay was also unable to offer a great buying-selling experience when community was so core to the product category that Etsy penetrated. Against other competitors, Etsy also priced very favorably. A $0.20 listing fee per item plus a 3.5% commission per sale add up to about a 8-10% historical take rate compared to an industry standard 20-30% rate. [4]

However, once a seller crosses a threshold in terms of items sold, the numbers show that going to Big Cartel or Shopify become cheaper alternatives. Interestingly, this still works out for Etsy. Consumers like Etsy because of its handmade artisanal feel. If a seller gets “too big,” his or her items will inevitably become more mainstream and thus less desirable to the typical Etsy consumer. On the other hand, the smaller the vendor, the more desirable their supplies are to Etsy’s consumers. For a smaller vendor with such low asset turnover and inventory, Etsy (1) has the advantage of an indie-first craft brand name and (2) is the most affordable and usable platform. Lastly, despite the ordinary bad publicity that has been broadcasted over the years, Etsy’s immense traffic and generally positive public reputation have helped it stay afloat.

In Late 2015, Amazon announced its launch of an artisanal exchange called Handmade, which quickly stirred up analyst speculation of Etsy’s future. But despite the numerous advantages that Amazon has including its global user base and specialization in logistics, shipping, and service, Amazon’s Q2 report in 2016 remained silent about Handmade’s performance. Various sources revealed that sellers have been ‘unhappy’ thus far due to low engagement rates. Additionally, Handmade’s 12% take per sale is still higher than Etsy’s – and that doesn’t even include the $40/month that Handmade will start charging its sellers. [2,1]

For an online marketplace to succeed, the ease of use to set up listings is just as important as the end-consumer experience. In this category, Etsy wins as well. On Etsy, multiple images can be uploaded at once and bulk edits can be made with just a few clicks. On the other hand, Amazon’s Handmade only allows serial photo uploads, and if you place your item in the wrong category, the whole post must be deleted and the user needs to start all over. Furthermore, Amazon’s photo requirements are far more stringent than Etsy’s. [1]

In summary, for newcomers Etsy’s first mover advantage is perhaps too colossal and niche to match up against. For bigger marketplaces with deeper pockets, a lack of brand distinction and a build-up of bureaucratic requirements stymies the opportunity to enter.

Sources

[1] http://whileshenaps.com/2015/10/why-handmade-at-amazon-is-etsys-dream-come-true.html

[3] https://www.fool.com/investing/2016/10/11/despite-rising-competition-etsy-inc-is-here-to-sta.aspx

[4] https://growthhackers.com/growth-studies/etsys-crafty-growth-to-ipo-and-a-2-billion-valuation

[5] https://www.wired.com/2015/02/etsy-not-good-for-crafters/

Nice title Felix! On the point of Amazon trying to enter this market – even if Amazon gets to feature and price parity w/Etsy, do you think Handmade would still be a threat? Is Etsy’s core buyer segment is still the “Brooklyn, hipster, anti-large corporation” and if so, would they ever even consider buying from a huge, established player like Amazon given their beliefs? Perhaps Etsy could partner with KOLs in handmade crafts to create a blog to strengthen the unique / curated aspect of their brand.

Hi Chun,

It’s a good question. Although UI and pricing work to Etsy’s favor (at the time of the publications), it is also Etsy’s strong brand established over that years that has given it such stability. Furthermore, I think it would take a while for Homemade to garner enough quality artisanal craftsmen onto their platform to become a threat – Amazon’s brand itself is much less focused on a particular demographic. The number of repeat purchases on Etsy’s platform speaks volumes to their accomplishment in this regard. Lastly, I believe that sellers that might eventually sell on Amazon would have much higher volume sales and inventory. Again, this might play to Etsy’s flavor since their core offering is an inventory of unique non-mainstream items.