Digital Disruption in the Insurance Industry; Winning by unlocking the Value Chain

For many years digital disruption was an imminent threat for this industry and its legacy players, but never ended up being a reality. Thing has changed dramatically in the last few years and today we are started to recognize who are the winners and losers on this disrupted competitive environment

If someone had asked you ten years ago which industry was going to be the first to be disrupted by digital innovations, many – including me – would have answer the insurance industry. This hypothesis was driven by the fact that if we breakdown the insurance business to its core, is basically an industry built on incomplete information, where insurance companies pools together subjects with apparently similar – but unknow –risks, charging a flat premium that is calculated based on uncertain probabilities to cover the future liabilities originated by that group plus a profit. Then, when we think in digital disruption, as we experience today in many sectors, we think in multiples online applications and live tools that can close, in a smooth way, the information gap between people that need insurance and companies that are willing to provide it. But what we have seen in reality is just the opposite, where the insurance industry and their legacy incumbents remained isolated for many years from the digital disruption wave. Several factors can be mentioned to explain why digital disruption was delayed in this industry including rRegulations (and over regulation!), capital requirements and several entry barriers such as historical data and long contracts.

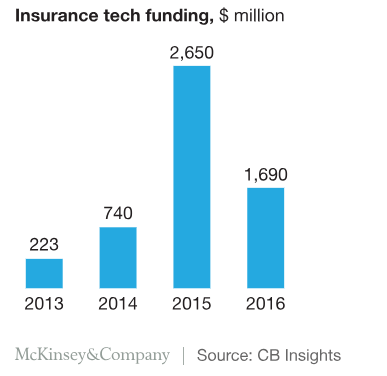

Today we are finally starting to see a credible wave of digital disruption that is changing the dynamic of this industry and is defining a new set of winners and losers. A quick proof that digital disruption finally has arrived at this industry is the amount of money that is going to “insurtechs”, companies that are leveraging technology to compete in the insurance landscape[1].

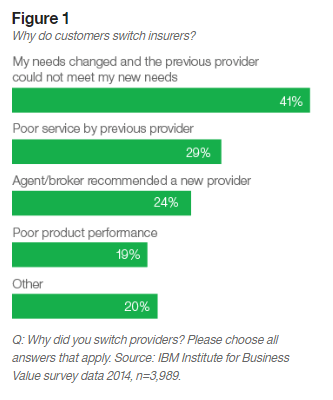

The other side of the same coin is the value that incumbents’ players have lost in the last few years. McKinsey, in the same report, has estimated that “US auto insurers have already lost on average $4.2 billion in underwriting profit a year over the past five, with expenses and losses consistently outweighing premiums” due to digital technology innovations in the industry. Insurance customers today are demanding better services, flexibility and customization, all features that legacy vertically integrated players are having a hard time to offer within their traditional business models that was successful for many decades. There are several studies that shows what is happening to customers in this industry, and how they are demanding new needs, greater flexibility, transparency and tailored offerings. One of the latest IBM reports[2] shows exactly this phenomenon:

In this context, let’s start describing who are the losers of the disruption. As we introduced before, the players are risk at this industry are those legacy companies with high levels of vertical integration competing all over the value chain (product design, marketing, distribution, pricing, claims, customer service). This high operational leverage is what constraint them to adjust their business model quickly enough to meet customer needs now that digital players are offering specific value prepositions for each module of the value chain. Does this mean that all traditional insurance companies are losing in this new disrupted competitive environment? The answer is no. What we are seeing in the market is huge variance in the results, where those legacy players that have failed to decouple their integrated business models and focus on those steps of the value chain where the add more value to consumers are losing a lot. Below[3] we can see the example of two traditional UK insurance players, facing different reality in this era of disruption, based on the actions that they have taken. Being a legacy/traditional player does not mean that you are condemned to be a looser in this digital disrupted era, is all about how flexible you are in adjusting the business model.

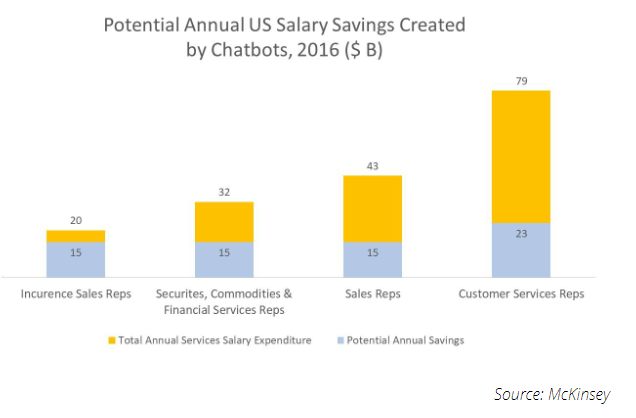

When we talk about losers, there is a significant impact on labor as well. As legacy company start to break down their integrated business model in order to adapt and compete in this new “modularized” environment we see how traditional jobs will be replace by digital tools (ej. Chatbox[4], online platforms, digital premium calculators, etc)

Now let’s move to the winners in this new digital era. As we mentioned before, conceptually the winners in this industry are being those players that are focusing in one step of the value chain and are offering something unique and valuable to customer leveraging some digital capabilities. Key for the winners is to recognize their strengths – where they truly add value to customers – and partner with third parties as required. Let’s review a couple of examples:

- Wrisk: UK based startup founded in 2016 that is focused in the distribution stage of the traditional insurance industry value chain leveraging technology in order to offer a simple and transparent experience to customers, offering nothing different than market products but adjusting premiums based on real information of the customer that is feed into the app. The company boomed last year when BWM announced that the company will be the exclusive insurance partner in the UK, removing from the business all legacy insurance companies. As a winner example of this disruption Wirks was able to identify a clear and specific pain point in the customer journey of buying a new car, bringing to minutes the total time to get a fair premium based on the actual risk of the customer.

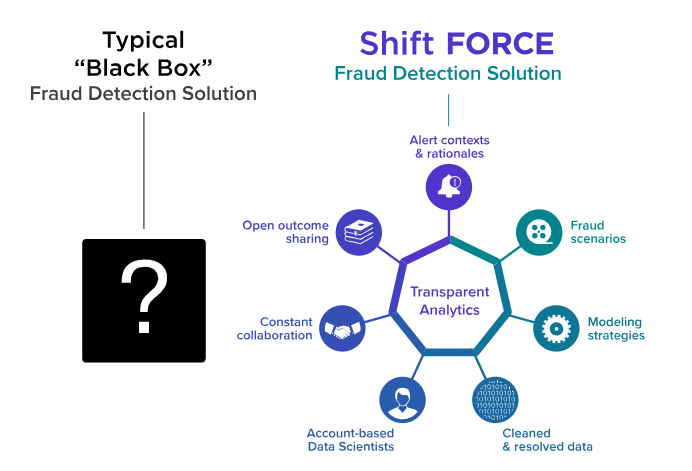

- Shift Technology: French based company founded in 2014 that is focused in leveraging data science to prevent fraud on insurance claims. It not only provides business users with an automatic data-based fraud prevention model (that can be 250% more effective in fraud detection), but also actionable analytics indicating suspicious claims. Offering a Software as a service delivery model, is designed to offer low implementation cost partnership with larger players that are willing to leave behind their traditional models.

[2] Capturing hearts, mind and market share, https://www.ibm.com/industries/insurance/resources/connected-insurers-paper/, accessed on March 1, 2019

[3] Identity Crisis; the insurers moving away from insurance,Financial Times August 7 2018,https://www.ft.com/content/2916c128-918d-11e8-b639-7680cedcc421, accesed on March 1 2019.

[4] Insurance Technology: 11 disruptive Ideas to Transform Traditional Insurance Company with Machine Learnng, APIs, Blockchain and Telematics,https://www.altexsoft.com/blog/finance/insurance-technology-7-disruptive-ideas-to-transform-traditional-insurance-company/, accessed on March 1, 2019

Great article Nicolas. I think a big loser in this industry are the insurance agents. I think the main reason they are being disintermediated even by their own companies is because they have failed to add value to their clients. Insurance agents should be able to provide clear explanations about the different products and be able to make a recommendation based on the clients needs. In many cases the agent is driven by commission to suggest more expensive insurance. In other cases they are no where to be found when the customer needs to make a claim. In the worst cases they have misinformed the client about what their insurance covers.

If digital sales can provide the information necessary to a customer in a way they can easily understand it there will soon be no insurance agents left.

In this sort of tech-enabled insurance framework it is straightforward to imagine how driving data fed back to insurance co’s could dynamically shift the price of premiums based on simple metrics – number of red lights ran, frequency of wearing a seatbelt, etc. – e.g. Wrisk. It is also easy to see applications for insurance fraud in the vein of Shiftforce across industries, such as health insurance claims, for Shift.

Very exciting topic Nicolas, thanks for the post.

I would add that most of the value created from technology-enabled business models in the insurance sector is being driven by MGAs (managing general agents), which generally assume the oversight of marketing, distribution and claim processing. In my view, most of the innovative products you mention leverage the power of AI, ML, IoT and Data Analytics to create value either at customer services, fraud detection, sales optimization, or cross-selling levels (all of them within the MGA’s scope). These novel offerings help reducing costs from attending customers, from potential losses and from customer acquisition; and try to push revenue up, as well. Thus, MGAs are able to keep a larger margin and even share part of the gains with the insurers carrying the risk. Therefore, I think MGAs could end up being the real winners in this case, as opposed to Daniela’s view.

In my opinion, in most cases, big insurance companies are mere observers of these innovations as they only act as the financiers of a system (unless they are vertically integrated into the distribution market, of course), that often makes impossible for MGAs to get funding to take the risk and to vertically integrate backwards.