Devil in data. Monsanto

Agriculture is among businesses that can benefit from big data the most. In theory. The leader in building infrastructure is a controversial but consistent company

Agriculture is an industry that was on the screens since the beginning of the big data era. The variety of variables in plant and animal growing business provides an opportunity to influence biological processes and increase efficiency. That has critical importance in the environment where the arable land area is limited.

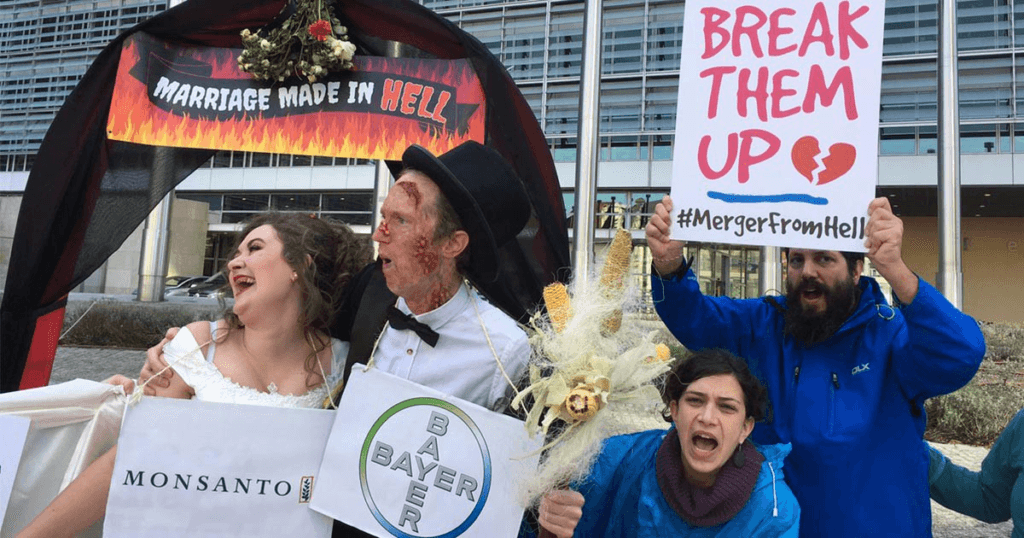

Monsanto historically was a company that pushed the agriculture technological frontier in a controversial and radical way. Recently Monsanto was acquired by Bayer and now the German giant has problems handling past misdeeds of the new subsidiary. This turbulence coincides with the new technological phase in agriculture that big data made possible.

Data sources

There is a number of sources of data that became recently available for industrial use. Overall the strategy of Monsanto is to be a data platform that plug in different partners along the value chain where Monsanto doesn’t have capabilities. For the purpose of the new business, and probably to differentiate the new platform from the negative halo that Monsanto has, a new subsidiary was formed – The Climate Corp.

Equipment sensors. Monsanto historically was a seed and chemical company, so at the current stage, it partners with equipment manufacturers, such as John Deere to get data from the sensors installed on planters, combines, and other equipment.

In-field sensors. In 2015 Monsanto launched what it called “The First In-Field Sensor Network” in cooperation with Veris Technologies, which manufactures and markets soil sensors. The hardware was by default connected to the Monsanto Platform – Climate FieldView.

Drones. In November 2017 The Climate Corporation, a subsidiary of Monsanto – announced a partnership with Deveron UAS Corp., a full-service enterprise drone company with a growing fleet of drones that can each conduct five to eight flights per day. This same year Deveron and Climate completed a successful pilot program in Ontario allowing farmers to visualize Deveron imagery with a Climate FieldView account.

Satellites. One of the most recent partnerships that Climate corp. went into is Airbus Defence and Space. The later will provide high-resolution data from satellites SPOT 6, SPOT 7 and Pleiades, covering both high-resolution images and multispectral bands. Without doubts, the final destination of the data, from a farmer-user standpoint is the Climate Corp. platform Climate FieldView.

Use cases

Now, when companies found themselves in the “digital ag” industry and have this abundance of data, how exactly this data could be used and what types of decisions it can help? Let’s dive into a range of decisions and processes that could be enhanced using data.

Precision planting and seed selection. Each seed has the optimal range of placement depth and interval, optimal soil composition, and optimal humidity. Even more than that there are seed hybrids specifically developed to adjust variations in variables hard-to-control variables. Modern farmers can create a complex seed map that planting equipment can execute with inch precision. Post-tracking can further improve model prediction power.

Timing for planting, watering and fertilizer delivery. Our species since the pre-historic times tried to capture the experience of optimal timing for such things as planting and watering in the form of signs. In 21 century the progress in this field is more limited than in many others, due to the huge number of variables defining the success of a farmer. The modern data and models can address this pain point and make the timing may not be perfect, but better because of the targeted approach. Another factor in consideration is economics, for example, often farmers can sacrifice the optimal schedule of watering to decrease expensive runs of machinery. This is again an area-specific and complex optimization model that an abundance of data and computational power can solve.

Hybrid development. One of the main businesses of Monsanto is the hybrid development and biotechnological enhancement of seeds. In the current state, the experimentation with hybrids and the whole process is limited to Monsanto facilities. With all the data available on the platform Monsanto can turn all the farmers who use both Monsanto Seeds and Climate FieldView platform into the giant experimentation facility. Data about the performance of crops in naturally all possible environments will flow 24/7 to the company data warehouses.

Others. There is a number of other uses, such as early prevention of crop diseases or yield prediction to optimize harvest logistics, but the overall impression is that the list is just started to grow.

Issues

Very promising perspectives of more efficient usage and potentially decreasing the area used for agriculture are tarnished with the number of issues.

The position of the platform owner can potentially give Monsanto ultimate power over both the farmers downstream and partners in the network. The recent history of Monsanto doesn’t give any confidence about ethical considerations in the company decision-making process.

Farmers are concerned that they are deprived of data they upload on the platform. They benefit from the use of this data but how fair is the distribution of this benefit between the parties engaged?

Finally, the new technologies are mainly applied for the most common chemically-intensive hybrids that could amplify the negative consequences of the current structure of modern agriculture, such as the prevalence of corn.

Sources

https://pubsonline.informs.org/do/10.1287/orms.2018.04.08/full/

http://analytics-magazine.org/corporate-profile-data-science-at-monsanto/

https://climate.com/newsroom/empower-farmers-with-reliable-satellite-imagery

https://climate.com/newsroom/climate-to-create-first-in-field-sensor-network/18

https://climate.com/newsroom/climate-to-create-first-in-field-sensor-network/18

As controversial as this company is and the products it produces are, it is a very cool application of big data. Personally, increased usage of technology in growing food seems like an unavoidable trajectory if we are going to continue to feed the world’s growing populations. I also like how they integrate so many different types of data into the Monsanto offering.

Love the title of this article! As you have alluded in the content, Monsanto is widely criticized for its involvement in the Agent Orange chemical production and its monopolistic practices in developing countries. While I agree with Paxton that companies will need to use big data to grow more food, I’m concerned by the ethical implications of growing food in pure output but not in quality. Could big data actually allow Monsanto to maintain its leading position and lead to more future criticism?

I think the Monsanto case shows some of the problems about data analysis in general – it takes the human aspect out of the equation. By only optimizing for the maximum output, Monsanto disregards that food is produced by humans for humans. Monsanto’s approach to data feels like the old idea that companys’ only purpose is to maximize shareholder value, which many agree is an outdated concept. By taking this approach, Monsanto does not only accept the risk that their business activities could overall be harmful for people, but it also creates the perception that the company does not really care about it. The Monsanto acquisition already makes it more difficult for Bayer to attract the best employees. Eventually, the negative perception could also affect customers’ purchase decisions.