Burger King: Leveraging data to guide decisions and enrich the customer experience

While most cases at HBS treat Burger King as McDonald's eternal rival, there's a new reason why the competition has increased in the 21st century. By turning details about customer transactions, preferences, and purchasing patterns into actionable insights, Burger King drives business decisions with the power of data analytics. Is McDonald's simply going to rest on its laurels, or will it use a trojan horse strategy to stay ahead?

If you ever asked a stranger which product defines America’s #1 food export in the world, there’s an inescapable chance that they will mention a hamburger. But, like any commoditized product, the need to stay ahead and maintain a competitive advantage through traditional methods like price discounts or new product offerings has failed to inspire disruptive innovation. For most of its history, Burger King has trailed McDonald’s in terms of its number of retail locations, international reach, and total market share which stands at 5% versus McDonald’s dominating 19% [1]. With this problem in mind, Burger King’s new leadership has turned to data analytics to empower its marketing, sales, and operations strategy and the results are promising. Did you ever think that your Whooper might be powered by big data, or perhaps that Burger King’s decision to partner with Impossible Burger to offer a meatless Whooper was influenced by big data insights? This is precisely part of Burger King’s new secret formula[2].

Let’s delve deeper to understand exactly how Burger Kings unlocks this value and learn about its future plans to potentialize the offering through data.

I. Data Assets, Digitized Solutions & Processes and Value Created

With over 11 million daily sales at its retail locations, the vast amount of data available to Burger King is a diamond in the rough[3]. From the supply chain operations to source its ingredients, maintain assortment and merchandising, to the cooking processes at each retail location, the amount of data available at each step of the hamburger journey may even be incalculable. Yet, given our current computing limitations, the value of big data remains even if we analyze a portion of its magnitude, and even Google knows well that simply having infinite computational power does not guarantee that humans will make decisions with the data outputs[4].

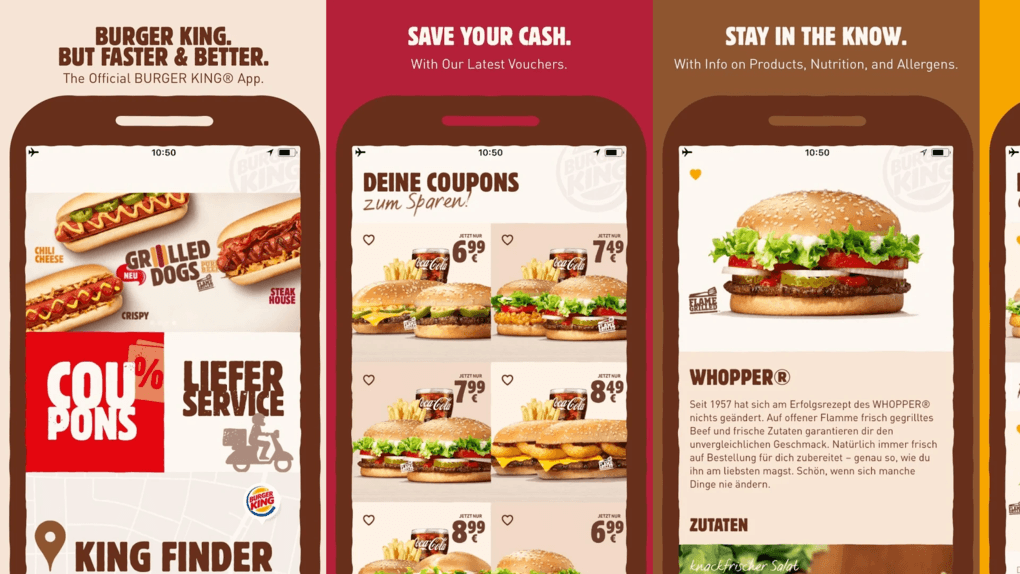

Using this logic, Burger King first leveraged its capabilities as a retailer to enhance the customer experience it provides through a modernized website, mobile apps and digital experiences at its retail locations[5]. Launched in 2014, the Burger King App offered a BK location tracker, tailored personalized coupons and special promotions to enrich the monotonous nature of buying a burger, and added engaging video content to delight its users. Aside from that, Burger King deftly requested location sharing from its users to use the app, and encouraged users to provide direct feedback, which gave it access to new dimensions of user data:

As a Burger King spokesperson explained “This new scalable mobile app will improve the guest experience by eventually allowing guests to receive desirable and specific offers as well as access to a digital wallet, which they can use to make payment. The application also provides the Burger King brand and its franchisees with rich data about in-restaurant buying habits, which it will use to improve the guest experience.”[6].

One of the results of this data-driven approach was the increased implementation of an omnichannel strategy to connect the physical retail locations with its digital app offerings. Based on common user feedback, Burger King’s expansion of self-service kiosks to global locations and the revamp of its online digital wallet, the BK Crown Card, allowed the company to make strategic decisions that have impacted the shopping experience.

Overall, aside from the vast amounts of user data capture, the value created through these innovations improved customer retention and greatly enhanced the customer journey. In terms of metrics, 90 days after the rollout of its app offerings Burger King saw a 34% increased in redemption offers that turned into foot traffic, and recorded a remarkable 85% completion rate in the online surveys processed through the Burger King App[7].

II. Investments to Unleash the Power of Data

The earlier anecdote showed Burger King’s first venture into big data, but that was the world of early data analytics in 2014. In the last two years, Burger King has emphasized its previous strategy by incorporating more powerful capabilities in its marketing campaigns to drive consumer engagement. In 2018, Burger King’s marketing team led by Fernando Machado launched a stunt campaign from December 12 until December 14 called the “Whooper Detour”. Customers had to download the upgraded Burger King app and get within 600 feet of a McDonald’s restaurant to activate the offer. Leveraging Google Map’s features, the app also navigated the user away from the McDonald’s location toward the nearest Burger King to pick up their food within one hour of placing the order online. The returns of this investment were impressive, by driving an estimated 1.5 million downloads of the new Burger King App and providing an ROI ratio of 37:1, which placed the Burger King app as the most downloaded Apple App Store for several days in a row [8].

Not to be outdone by the recent wave of AI-talk in business schools, in late 2018 and early 2019 Burger King launched a series of funny commercials on Youtube powered by algorithms and engaging voice-overs [9]. In an attempt to showcase the limitations of AI applications, which Mashable called “beautiful disasters”, the ads promote a chicken sandwhich that “tastes like bird”, repeatedly mispronounce Burger King’s name as “Burglar King”, and even take a jab at BK’s own slogan “Have it your way” by mispronouncing it as “Have it Uruguay”. While the commercials drove significant viewership on Youtube, actual AI technologists viewed the attempts as a half-hearted tactic to gain market awareness. But, after the sound of the laughs is over, will Burger King truly embrace more complex data analytics to empower its ongoing strategy?

III. Opportunities & Challenges Ahead

As the old adage says, “Don’t wake up the bear, for it will eat you”, and McDonald’s fierce strategic response should make Burger King reconsider its naive applications of AI technologies. Earlier this year, McDonald’s announced its $300 million offer to acquire Dynamic Yield, a startup based in Israel that provided retailers “algorithmically driven decision logic technology”. In terms of applications, McDonald’s plans to use the technology to innovate its drive-thru experience. At a recent pilot program in Miami, McDonald’s launched a series of dynamic display ads powered by machine-learning algorithms that would greet the consumer by his/her first name and offer products depending on prior customer visits, flavor preferences, and even weather patterns. Through this powerful use, this technology would parallel Amazon’s recommendation engine by nudging users about what other customers bought as well, thus increasing the switching costs of moving to another brand.

Compared to Burger King’s modest same-store growth of 0.8% and lower net income, in 2018 McDonald’s tallied nearly $6 billion of net income and ended the year with a free cash flow of $4.2 billion. This means that as McDonald’s continues its focus towards a sumo strategy, Burger King is limited to maintaining its current strategic position and perhaps applying a judo-strategy by investing in cross-brand campaigns, and obtaining internal resources from 3G Group, the Brazilian private equity group that also controls Popeye’s and Tim Horton’s under the RBI umbrella.

In sum, when you combine the potential to understand Amazon’s competitive advantage and a healthy financial outlook, McDonald’s entrance in the data analytics space poses a direct and imminent threat to Burger King’s future profitability. While data analytics used to be equal to launching new apps and raising user awareness on Facebook and Youtube, the future of AI applications shows us that it must be taken seriously and that mockery may drive temporary laughs but not create a true competitive advantage.

Works Cited:

[1]https://www.nasdaq.com/articles/mcdonalds-vs-burger-king-closer-look-two-burger-giants-2017-09-20

[3]https://www.statista.com/statistics/230961/people-who-visited-burger-king-usa/

[4] https://www.cnbc.com/2019/10/23/google-quantum-computing-supremacy-claim-disputed-by-ibm.html

[6]https://pimcore.com/en/customers/fast-food-chain-rules-website-and-mobile-apps-engagements_c668

[7]https://mobilebridge.com/customer/burger-king-improved-engagement-400-percent/

[8]https://www.mobilemarketer.com/news/burger-kings-whopper-detour-generated-15m-app-downloads/548203/

[9]https://mashable.com/article/burger-king-ai-ads-beautiful-disaster/

Great article! I agree that making apps, websites and raising awareness on social media does not really amount to data in and of itself. These digital properties could a source of data, but one still needs to know what to look for, how to capture it, and finally, how to read it and how to use it. It sounds like BK has done this well so far, using the metrics from their surveys and apps to inform decisions about self-service kiosks and promotions. I also agree that it will be difficult to keep up when your competitor is spending over 300 million on R&D.

Thanks for writing on this! Interestingly, I wrote about this exact trend, but from the perspective of McDonald’s. One of the most difficult aspects of shifting to consumer preferences in real-time is being able to manage inventory in various stores. McDonald’s seems to be ahead of the curve in this aspect, particularly due to its partnership with Dynamic Yield. However, what Burger King is doing with regards to using its app to engage with its customers is compelling. By creating multiple touchpoints with customers through gameification, the company can hopefully convert some of these users into lifetime customers.

Such an interesting article! I can’t help but associate it to the movie about the rise of the McDonald franchise called The Founder and think of how this business has been through tremendous change. In the first 3rd of the movie, the focus is on the problem of making sure the service offered in subsequent restaurants is as good as the original place and you see how much effort is put into monitoring and managing all the workers, but now, with the app, inspection has become a lot easier since the surveillance work is past to the customers who rate their own experience…

I believe that both companies, BK and McDonald’s, are a perfect fit for the use of big data. Both companies have a very mature and established business model, supply chain, product selection, pricing, etc. That means that improvements are rather incremental, and creativity in business decisions or radical innovations are not needed. It is very unlikely that either of the companies will drastically change their menu in the near future or use other cooking processes. I expect that both companies will further engage in a war of resources, in terms of marketing expenses, but also big data analysis. In this market segment, customers are very price sensitive. Any cent that the companies could save by leveraging their large amounts of data could be used to lower the prices of their products and put further pressure on each other.