DataDog: underdog to cloud monitoring champion

DataDog, a NYC company launched 10 years ago, is now one of the major player that offer tools for companies to monitor their cloud computing activities.

What is DataDog?

DataDog was founded in 2010 in NYC by two French alumni of Ecole Centrale (Paris). These two founders understood that cloud computing was going to be a reference in the following years. They develop a platform to help companies monitor cloud computing. The company went through an IPO in 2019 and was evaluated close to 10 billion of dollars. The company has more than 1.000 employees today and a major R&D center in Paris. Its range of customer includes major firms across different business-like Samsung, AirBnB, Bose or Deloitte. Being a well-funded and trusted company is a compelling evidence that DataDog is a ‘winner’, let’s try to understand why this company is so successful.

Cloud computing market

Trends like Big Data or Data Analytics have made the cloud computing more and more attractive. With cloud technologies companies are able to store and process large amount of data that they would not have been able to do with their own hardware and software infrastructure. Companies like Amazon Web Services, Google Cloud or Microsoft Azure have been developing state of the art technologies for cloud access with huge capabilities. DataDog does not compete directly with these giant providers. This software firm offer complementary tools to help companies handle and optimize these cloud systems. Customers are then able to make efficient decisions on IT operations.

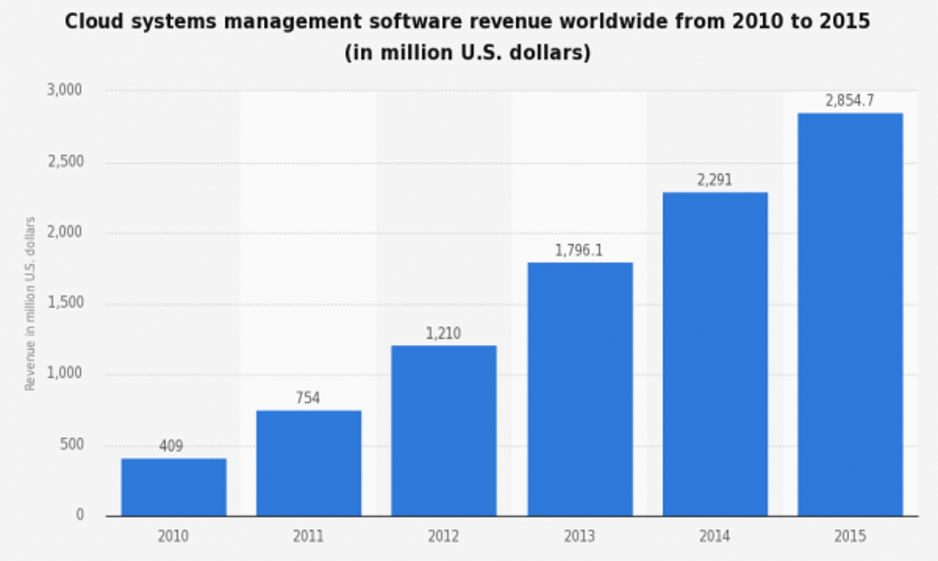

Cloud system software is a fast-growing business as the graph below shows. The worldwide revenue has increased by seven times over five years. Hence Datadog entered this market at a very attractive time, as many conventional companies were eager to shift to cloud computing technologies.

Credit to [1]

Product and competitive differentiation

The first advantage of their product is its flexibility. Their software is like an add-on platform that software engineers can use at any time. It is compatible with most the major software development tools and platforms of cloud providers. Hence developers and engineers are not required to change their computing methods if they want to use DataDog’s tools. Thanks to this approach, DataDog has built a reputation as a vendor that is quick to support emerging technologies.

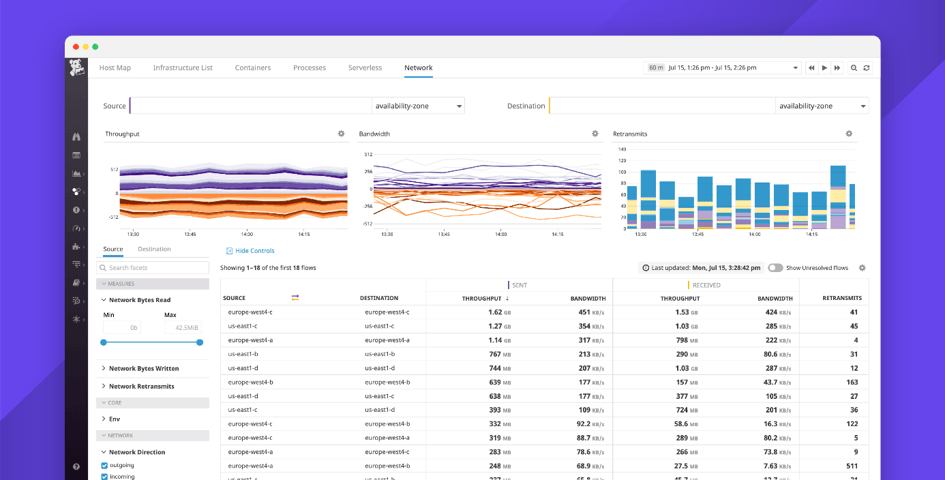

Their second advantage is the variety of monitoring tools that is offered. These tools belong to three main categories: monitoring the infrastructure, monitoring the applications performances (APM) and logging. For the first two categories, the application tracks metrics which could for instance be the cost or the latency of certain part of the computing process. Logging corresponds to recording the different processes, inputs, outputs involved in cloud computing. The customer has access to a dashboard to visualize metrics of the different categories. A different subscription is required for every category.

With this diversity, DataDog can attract customers and make them subscribe for a specific use case. After getting familiar with DataDog’s platform, these customers could be converted to subscribe for other monitoring tools. For customers, it is also convenient to have a unique platform rather than a bunch of them to handle all categories of monitoring.

DataDog Dashboard

What is next?

Because of its broad activity, DataDog is fighting on several fronts and has a large number of competitors. Some of them has chosen to focus on a single front of cloud monitoring (e.g. APM, infrastructure or logging). They have been developing very efficient tools for specific use. DataDog does not necessarily provide all these analytical tools and could lose customers that would need this kind of advanced specificity.

Different questions can be asked on the future strategic paths that DataDog could take:

- Can Datadog compete in these different categories, does it need to focus on one of them which would be more profitable?

- Should Datadog include the advance analytics tools of its competitor in its platform? Therefore, would Datadog have to move vertically on the market to include the tools of different players in their platform? Should DataDog stay on its position and for example acquire some current players?

Sources

[1] https://www.ironpaper.com/webintel/articles/forecasting-the-cloud-computing-market-report/

[2] https://www.datadoghq.com/about/timeline/

[3] https://imgix.datadoghq.com/pdf/451_Reprint_Datadog_26AUG2019.pdf

[4] https://imgix.datadoghq.com/pdf/451_Reprint_Datadog_13AUG2019.pdf

Thank you for sharing. It is interesting to see DataDog capturing the trend of rising cloud computing and developing a complementary package of tools to help companies better handle their cloud systems. It seems like DataDog has competitive advantage against its competitors and therefore it’s important for them to continuously innovate and develop better products in this rapidly-changing environment. The future for DataDog is uncertain and the questions you posed about its strategic directions going forward are very interesting. I think it’s important for them to focus on their core competencies and don’t spread themselves too thin by wanting to do everything at the same time.

Interesting article and thought provoking questions. I like the idea of infrastructure-agnostic platforms like DataDog that sit on top of a company’s existing stack and provide unique value to their customers. One concern is that existing cloud providers are making efforts to build in at least some of this functionality (e.g. Azure Application Insights and Amazon CloudWatch), and may have an advantage due to their relationships with companies that are already heavily invested in a particular infrastructure, or may have more complex purchasing processes. I’m interested to see how DataDog will continue to compete and differentiate itself.