CVS Health’s ExtraCare Program: Four Feet of Data Analytics

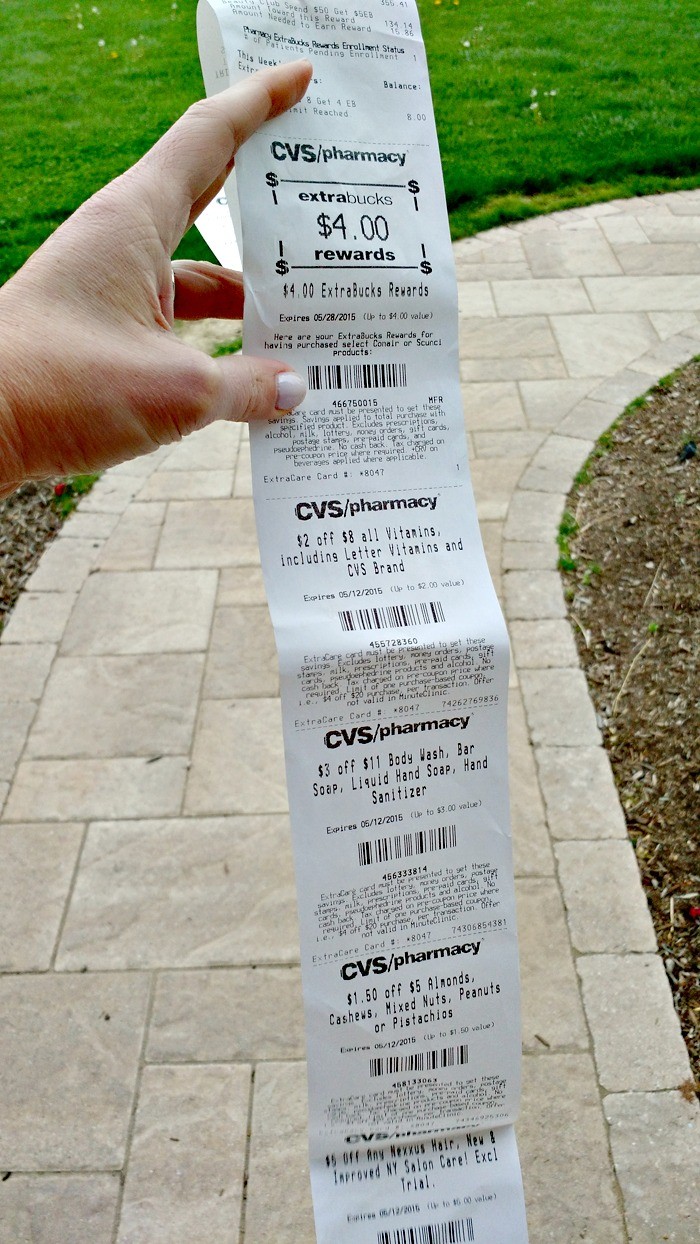

Did you ever wonder why your CVS receipt is four feet long? The answer: a depth of customer data analytics that drives value creation for the CVS customer and value capture for CVS Health

CVS Health’s ExtraCare® loyalty card program leverages advanced data analytics to drive value creation for over 70 Million front store and pharmacy customers. As a former CVS employee, I had the privilege to be able to meet with the directors of the ExtraCare® program to understand how they leverage algorithms to drive value for customers and the company.

CVS Health is a Fortune 10 Company with services ranging from the front store (where you buy shampoo and deodorant), the pharmacy (where you pick up prescription drugs), the Pharmacy Benefits Management arm (which provides prescription services to your employer or insurance company) and MinuteClinic® (where you go to get flu shots). CVS Health generates ~$140 billion in revenue and ~$4.6 billion in net income on an annual basis in its pursuit of helping patients on their path to better health.

ExtraCare® manifests itself as ExtraSavings® coupons that can be redeemed for specific items or categories ($4 off any $10 purchase of Gillette razors!), and Extrabucks®, which is “free” CVS money that customers can use on any purchase ($2 reward (expires in like 4 days!)). Customers can access these coupons online (by printing or “sending” to card), by using the coupons on their four foot long receipts, or by scanning their cards at portals in the store that will print out their customized offers (also four feet long).

Value Creation:

The ExtraCare® programs creates value for front store and pharmacy customers by providing them with customized coupons for relevant products based on past purchases. For example, if you purchase diapers and baby formula, you will likely get a coupon for baby wipes. In this way, customers can receive a discount on products that they are likely to purchase anyway, given their basket of goods. CVS uses various algorithms that leverage the frequency of shopping, the number and category of items in their basket, the volume and price per item, and hundreds of other variables to determine the products that will be offered (they are constantly regressing multiple variable to understand the most predictive ones). Based on subsequent behavior they will determine if a test group, versus a control group, purchased more items or were up-sold on a higher margin CVS brand item. For its email incentives, it runs repeated tests using these algorithms to test various hypotheses (A-B matching tests that will offer similar profile customers a $3 off $15 or a $4 off $20 or $5 off $25 coupon to determine coupon conversion, total basket, and yield).

Value Capture:

Value capture on the ExtraCare® program occurs when CVS is able to determine that, relative to a control group that did not receive an offer, it was able to convert, up-sell/cross-sell, or increase the order size of a given customer. The predictive algorithms generate test groups based around various metrics and customer profiles. Afterwards, the data is analyzed longitudinally, as well as relative to a control, to understand how much value was captured from a given program. However, this is not a static process: as new items are introduced, new stores are opened, and customers deepen in their loyalty, CVS has to constantly analyze the results of the programs to make sure they are capturing a justifiable amount of value. In fact, it recently received some bad press about firing its unprofitable customers (e.g. the ones who use too many coupons).

Operating Model:

The ExtraCare® program provides a depth and richness of data unmatched by any other loyalty program in the U.S. With 16 years of data linked across pharmacy and front store, and over 70 million active members, ExtraCare® knows more about you than you do. In addition, ExtraCare® offered a onetime 20% off coupon if you linked your email to your ExtraCare® card, providing CVS with a vast, and cheap means of marketing directly to consumers. The processes around running, updating and enhancing the algorithms that run the program have become so streamlined and integrated, that ExtraCare® has become a great lever to quickly boost revenue. One risk to this program is the inertia associated with a large company: given its success, it is unlikely that CVS will ever modify the program, potentially missing out on further opportunities to leverage analytics or machine learning to further improve targeting and yield. Yet, given the depth and richness of data in the ExtraCare® program, as well as the low cost of running these algorithms, the program will likely continue to add value to CVS for years to come.

Cool post, thanks for sharing! This reminds me a lot of what Target did to become known for its data analytics program as well. I love the idea of large chains using customer purchasing habits to improve both their sales and the user experience – seems like a win-win.

It’s interesting that CVS was “firing” its unprofitable customers. I would’ve expected that any coupon CVS decides to create would have its parameters set (i.e. discounted price, quantity of items needed) such that CVS could still guarantee itself some minimal margin. Or, in the case that the coupons actually represent a loss and are meant to encourage a larger basket filled with non-discounted items, I would expect the same effect to exist to some degree even if the customer used multiple coupons in one trip (e.g. the customer would come in for 4 items that he has coupons for, and end up buying 10 items total).

Put another way, I’m surprised that CVS couldn’t optimize its algorithm to take into account the behavior of customers who use “too many” coupons. Theoretically, if the algorithm can predict that the user qualifies for coupons A, B, C, D and E, but that the user is also likely to use all 5 coupons at once, then maybe the “optimal” coupon output would be C, D and E only.

Either way, if we extrapolate what data-driven discount generation looks like in the future, maybe we’re heading towards a world where every large merchant has enough data to perfectly understand its consumers, and then can try to adjust prices, discounts, and even what goods are displayed (easy in the case of Amazon) in an attempt to maximize profit from those consumers. The countervailing force would be competition, which would still help keep prices down for consumers. But the counter-countervailing force there is that in a world where data becomes more and more valuable, perhaps consolidation for the sake of aggregating data becomes a more frequent phenomenon.

I’m surprised CVS hasn’t leveraged this data for a more socially beneficial effort versus trying to sell us more things that we don’t need. I know whenever I get one of those 4-foot-long receipts, I start to question myself – maybe I do really need to buy more beauty products?! I’m just not so clear as to how this is enhancing consumers’ lives. You mention that the program offers coupons for things you already buy. This hasn’t happened to me – it’s generally for complementary products that I normally don’t buy, but might consider with a coupon. The pharmacy data would be particularly telling. HIPAA laws would probably prohibit this, but I bet there would be a way to help those on multiple anti-depressants to find more natural ways to handle anxiety and depression. It’s a shame that so many people are living emotionally drug dazes because of Big Pharma.

Another potential opportunity for CVS would be to make using the coupons easier. The algorithms behind the program are incredible, but we are expected to clip and save these coupons for the next time. Seems like a mismatch. I usually forget, and I am super frugal. There should be a way to seamlessly connect the coupons to the rewards card, that way you don’t have to remember to bring the coupon.

I fully agree with the comment above re: unprofitable customers. The fact that they even have any given such level of data analysis suggests to me that this is the number one fix they can do to improve their otherwise impressive data management system. Another thing that comes to mind are lessons from dunnhumby and Tesco. Perhaps CVS could learn how to group their customers into specific categories and further tailor the offering based on those? Or maybe it could learn to predict not only what the customer wants and buys right now, but which category they are likely to move to as their life progresses? In Tesco’s case, they would use massive data to draw dynamic (as opposed to static) conclusions: e.g., a customer just purchased their first set of diapers. That likely means they have a baby. From our database we know what purchases usually follow that first purchase for YEARS to come. How do we leverage this knowledge?