Cornershop: Disruptive Chilean E-Commerce Grocery

On-demand delivery app Cornershop is rapidly growing in Chile and Mexico through its digital expertise, technology, and capabilities changing the way shoppers buy in Latin American.

Cornershop’s Platfform

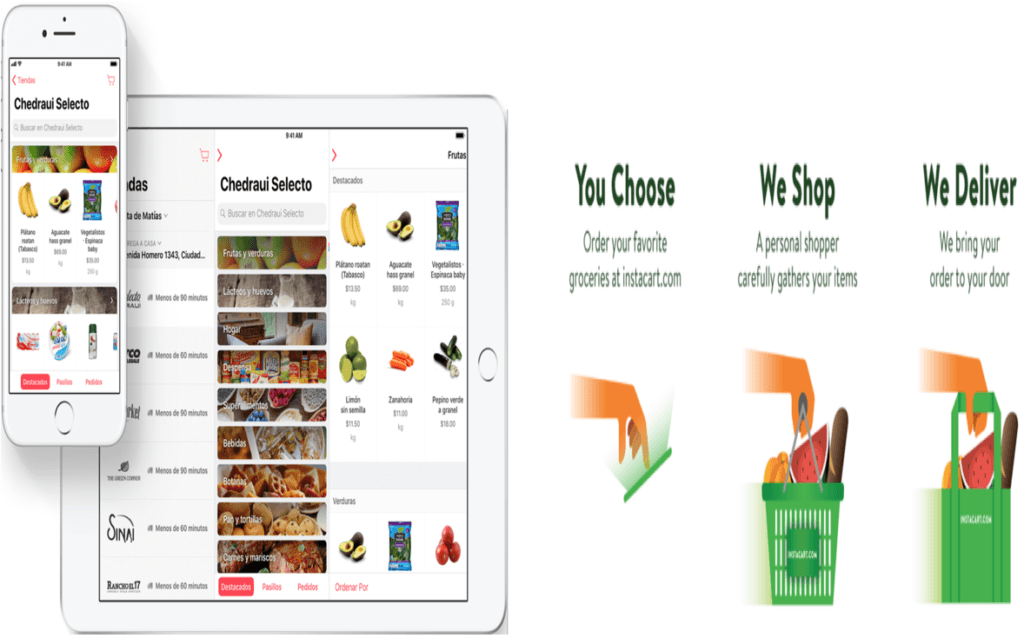

Similar to Instacart, the platform connect customers with personal shoppers in their area to shop and deliver groceries from their favorite stores. Customers through Cornershop’s platform can shop from anywhere in major cities in Chile and Mexico using their computers, iPhones, iPad or Android devices. In adittion, customers can get grocery deliveries from supermarkets, pharmacies and specialty food retailers in less than two hours. Moreover, the platform have a clean interface, is easy to navigate, search pretty seamless, among others, helping customers to shop in Cornershop vs. competitors.

Key Platform Elements

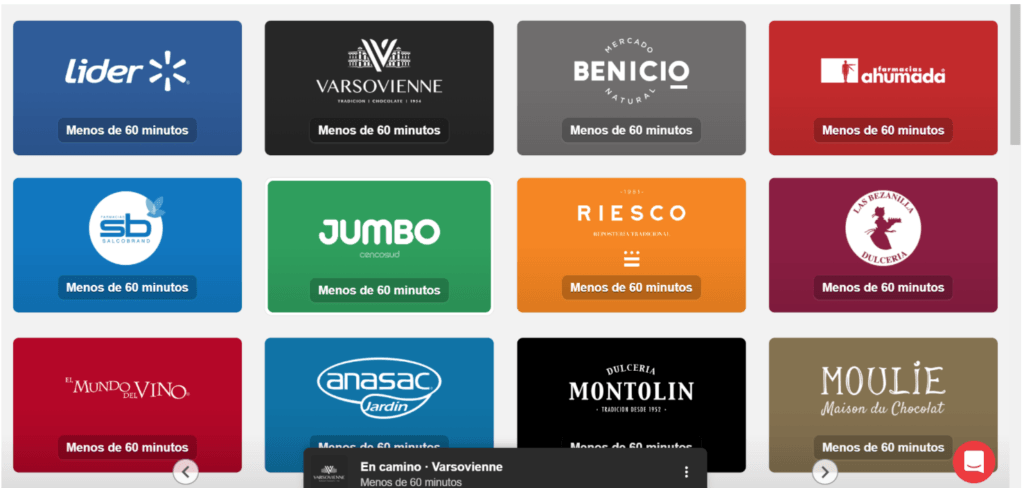

Company partners with big retailers, including Walmart, creating an amazing ecosystem: One shop platform

Cornershop’s customer can buy from big supermarket players, pharmacies, specialized food retailers, among others, in Chile and Mexico increasing the assortments of items in their purchases (one stop-shop). Moreover, Cornershop has established alliance with various supermarkets, including Tottus and Lider-Walmart in Chile, through which the store pays a commission to include its products on the app, reducing the delivery fee for the home delivery service (1). In adittion, the company founded in 2015, was recently acquired by Walmart for $225 million, expecting to increase its ecosystem in the platform. Moreover, according to Judit McKenna,CEO of Walmart International, “We are focused on making life easier for customers and associates by building strong local businesses, powered by Walmart,”(2). On the other hand, Cornershop is eyeing Canada and U.S (after Walmart’s acquisiton) and already has partner with others retailers including Costco Wholesale Corp, Mexican chains Chedraui and La Comer (3).

Cornershop’s platform easy to use

Similar to Instacart, Cornershop site and app are intuitive — you fill your shopping cart, pick the hour you want delivery to occur in, and then the groceries are handed to you at your doorstep. But achieving this simplicity cost effectively at scale requires an enormous investment in engineering and data science (4). However, Cornershop has been able to build the techonology in the platform that makes easy to navigate, search some item, etc. Moreover, An English-language version of the app will roll out within a month as part of preparation for the Canada launch, Undurraga said. (5)

Value Creation of Cornershop

As we mentioned:

- One Shop Platform

- Partners with largest grocery in Chile and Mexico

- Less than two-hours delivery

- Easy to navigate

Not mentioned:

- Food Selection from Shoppers is better than competitors

- Permanent contact between customers-shoppers for any issue

- Better delivery of the purchase

Value Capture Strategy

Cornershop has established alliance with various supermarkets through which the store pays a commission to include its products on the app (This allows them to charge less for the home delivery service to the customers). With the stores that have not signed up for the business exchange, including Jumbo in Chile, Cornershop establishes an increased price for the items (price mark-ups), plus an extra charge for the delivery service to the customers. However, Undurraga, Co-founder of Cornershop, admits that in the long-term “We aspire to charge the same prices as the stores do in all cases, and to partner with all of them,”(6). In adittion, Cornershop generates other revenue through advertising.

(1) Walker Rowe, “Cornershop aims for slice of grocery shopping in Chile and Mexico,” IDG Connect, June 01, 2016 https://www.idgconnect.com/idgconnect/interviews/1001219/cornershop-aims-slice-grocery-shopping-chile-mexico

(2) Sarah Perez, “Walmart to acquire Mexico & Chile-focused grocery delivery service Cornershop for $225 million,” TechCrunch, October, 2018 https://techcrunch.com/2018/09/13/walmart-to-acquire-mexico-chile-focused-grocery-delivery-service-cornershop-for-225m/

(3) (5) Daina Beth Solomon, “Update 1-Walmart’s Latam delivery app Cornershop eyeing Canada and U.S,” CNBC, November 14, 2018, https://www.cnbc.com/2018/11/14/reuters-america-update-1-walmarts-latam-delivery-app-cornershop-eyeing-canada-and-u-s.html

(4) Jeremy Stanley, “Data Science at Instacart,” Medium, February 17, 2016, https://tech.instacart.com/data-science-at-instacart-dabbd2d3f279

(6) Ximena Cassab, “Cornershop: The Revolution of ‘On-Demand’ Groceries,” Portada, May 02, 2016 https://www.portada-online.com/2016/05/02/cornershop-the-revolution-of-on-demand-groceries/

This is really interesting, and does look like a nice app. I’m curious to see how it plays out in the long-term, especially as they push into new markets. It seems like this is such a challenging industry because there are so many factors the platform needs to balance – freshness, scope, very specific delivery windows. I thought it was interesting that stores pay a commission to lower the price of their goods. While I think Cornershop is betting on the fact that stores will want to protect their reputation and keep prices low, I think customers who see a discrepancy between in store and in app prices will attribute all of that difference to Cornershop rather than the store providing the goods.

So unless the stores actually see a drop in performance, I’m not sure whether they’d be willing to pay. Do you see any differences in the Chile/Mexico markets or in Cornershop’s approach that may make this more successful than similar platforms have been in the US?

At least in the US, Instacart is pretty successful with a current valuation over $ 7.6 Billion. Ocado, another online grocery retailer, is valued at $ 2.3 Billion, among others. Thus, I don’t know if I agree with you about “Cornershop’s approach that may make this more successful than similar platforms have been in the US”. I strongly believe that there are a lot of profitable On-Demand E-Commerce groceries in the U.S, specially Instacart, and Cornershop just tried to replicate the same business model in Latin America. Moreover, One of its main Co-Founder, Daniel Undurraga mentioned: “I think Instacart can build a profitable business in the US, as can we down here.” In addition, Daniel Undurraga lived in San Francisco for almost five years and was infatuated with the wide variety of on-demand services available and realized that Latin Americans would enjoy similar services, too. On top of that, nobody else in the region was providing them.

On the other hand, Mexico and Chile are totally different markets starting that Mexico’s population is over 120 million people vs 15 million people in Chile. Moreover, Undurraga mentioned: “Mexico was the most obvious place to start the business, since it is the largest market in Latin America. It is a country that allows you to scale very easily,” explains Undurraga. What’s more, Undurraga and his partners worked for Groupon Mexico, so they know the market well and have a large network that helped them start the business. “We chose Chile because I’m Chilean, and we have our engineering team based there,” he adds. Thus, I think that cause most of the Founders were Chilean, was easy for them to start the business in that region, but they knew that without Mexico it would be impossible for them to scale the business considering the small Chilean market.

Thank you for this article, it was very interesting and always great to read about new technologies around the world.

Being international myself and seeing this happen, I wonder how Cornershop is positioning itself and prepares to react and sustain its market dominance when and if a strong competitor with potentially better supply chain management and scale, such as Amazon, will enter that market as a strong competitor.

Thanks for writing this. I enjoyed reading the passage a lot. Cornershop seems to have a promising future and the problem it is solving is surely a pain for a lot people including me. One concern I have is that since it is acquired by Walmart, it may affect its partnership with other shops who regard Walmart as a competitor.

Thank you for your post.

I am actually mention the Conrnershop acquisition in my post about Rappi. What are your thoughts on how Cornershop will compete with Rappi? Specifically, Rappi introduced Rappi Prime that allows for free delivery.

Hi NR,

Thanks for your comments. Cornershop knew that would be difficult to compete against big players, thus they focus on creating an amazing platform, easy to use, better delivery, etc. Walmart and big players had their own e-commerce platform for delivery but weren’t as good as Cornershop. Those applications were difficult to use, the foods in bad conditions / poor selection, etc.

In addition, 20% of Cornershop revenues came from purchases in Walmart. Thus, Walmart knew the potential of this platform and tried to acquire several times before buying it for $225 million a few months ago. Maybe, Cornershop’s founders knew that Cornershop alone would not be able to compete against Amazon or other big players in the future. (Also the “exits” for them was amazing. Founded in 2015 and after 3 years sold for $225 million! Awesome). In addition, Cornershop was a kind of “inspiration” for new Chilean entrepreneurs trying to create the new “big-endeavor” in our country. Just for your knowledge, Cornershop just replicates in Chile and Mexico the business model of Instacart in the U.S, they didn’t come up with a new “big idea”. Thus, I’m pretty sure that is plenty of room to implement U.S tech in developing countries before the arrival of Uber, Airbnb, etc.

Hi Jose,

Last winter break I went to Chile and I saw some “Rappi-Motorcycles” in the street of Santiago making deliveries. I think that the main difference is that Cornershop focus more in “Supermarket” deliveries while Rappi in “convenience stores”. Try to dig in more about customer segment about each platform, partnership, etc.

See you in class next monday

Hi Wendy,

100% agree with your comment. I’m pretty sure that some partnership, specially with Walmart’s main competitors could be affected after the M&A. However, customers can still buy in Walmart’s competitors through the platform, but they have to pay a delivery fee (Walmart don’t charge delivery fee) plus an increase in prices. Of course that after Walmart’s acquisition, customers have more incentive to buy in Cornershop through Walmart channel. Is the trade-off for Walmart between acquire more customers (through Cornershop platform) and acquire e-commerce expertise (buy the platform vs build the platform) vs. potential Cornershop’s partnership losses.

Thanks for your post Nicolas

Cornershop, as Instacart in the US, is taking advantage of one of the main challenges that traditional groceries players are facing today: What is the right move in E-Commerce? Should we pursue in-house growth of our online channels or should we outsource to thirds parties’ platforms such as Cornershop?

As we all know, Groceries is one of the categories where E-commerce is super underrepresented with penetration rates below 3% in the US and less than 1% in Chile. This make almost impossible to think in profitably in this sector for now; There is no grocery player in the world that is making money in their online business (apart from Ocado in the UK) with this level of online demand. And this is exactly the reason why players like Cornershop appeared and succeed in the market, they don’t face any of the huge fixed cost that running an in-house grocery operation demands (labor, IT systems, shadow stores, logistics) plus they are able to get enough scale on the demand side pooling customers from different companies. From an asset perspective, there is nothing unique or distinctive on Cornershop or Instagram, anyone could replicate the platform that they built…the real challenge for them will be once the online penetration of groceries explode, and grocery chains start developing their own online channels; will be a space for Cornershop in that world? My guess is no.

Hi Nicolas, this is very interesting. It has made me think what their strategy going forward might be now that they have been acquired by such a big company as Walmart. Being part of Walmart gives them a great advantage over competitors because of the financial capital that becomes available to them. At the same time, being owned by Walmart might limit their capacity of expanding their partnerships with other retail chains or living into countries where there is no Walmart. I also wonder if the acquisition has somehow generated more value for users.